Trading Analysis The General Public Does Not Look At

Yesterday I pointing out how any weakness would most likely get bought back up into the close ahead of Obama speaking and we did get that. I also figured today the market would hold up or close positive also (post Obama) so the general public thinks and feels good about the USA and the financial markets.

Watch the Video Version of this report: http://www.thetechnicaltraders.com/ETF-trading-videos/TTTJ25/TTTJ25.html

Well today the market just happened to gap above yesterday’s key resistance level ans we all know that once we are above resistance be becomes support. After the gap up this morning the SP500 pulled back to this new support level which happens to be Friday’s, Mondays and Yesterdays high then it bounced, actually rallied up on solid volume almost like someone was making a point that this market is going up today and not to mess with it…

Personally I don’t get worked up over market manipulation because of two reasons:

1. There is Nothing you can do about it

2. If you see it and understand the idea behind it, then you can make really good money day trading it.

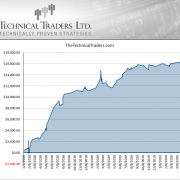

Chart of SP500 10 minute chart

As for our dollar position I still like the trade but I will admit that its really starting to drag out (wear us out of the position so we give up on it). Keep in mind that waiting for a trade to breakout and hopefully go in your direction is part of the excitement of trading… The suspense sure keeps are emotion flying high, which is why it is important to only trade position sizes which you can stomach during volatile times. Also the reason we scaled in at first key support and added more on the deeper pullback.

Posted below and in the member’s area is the chart:

Gold and silver have bounced a little and are trading back at resistance where they were in my pre-market video this morning.

Now, take a look at the different indexes below and you will see how the dow of only 30 stocks shows bullishness, while the key indexes for trend and strength are under performing…

As I mentioned a few weeks back, actually just before Christmas.. I figured the market would start to top out the second half of January. It looks as though that is unfolding but remember topping is a process and it become VERY difficult to trade and time and this is why I am taking my time here…Tops and bottoms are designed to suck traders into the wrong side one final time just before price reverses.

On another note it looks like metals are losing some ground here and may go lower… I’m figuring the dollar should bottom in the next couple days at most. Again tops and bottoms are a process and they always take much longer than we anticipate. If the market does not shake you out, it will wear you out..

You can get my trading videos, analysis and trade alerts by subscribing to my newsletter: http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen