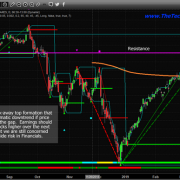

TLT Trade of the Year and What Is Next!

We just closed out our TLT position, which opened up 20.07% from our entry price, amazing. Who said bonds are dull and boring? haha

Only three times since 2008 have I seen bonds rally more than 20% from a new swing trade entry. Each time the move was short-lived, and the price collapsed after it within a few weeks. My goal is not to try and time tops and bottoms for the best entry and exit level. That is a gambler/losing strategy. Sure it pays big if you luck out and nail the timing, but they are few and far between, and the losses from trying will eat up any previous gain.

What I do is follow the price using my proven technical trading experience and tools, which I have acquired since 1997 and then apply position management to limit risk. I then use my trading systems for statistical analysis, so I know the odds for trade are favorable to win and also to pinpoint profit taking levels just like today’s TLT position closure.

Sure, TLT could pop and rally another 5-10%, but its highly unlikely, and it’s fear/volatility driven, so any spike higher from here is likely to drop straight back down shortly after. We got the low-risk easy money portion of the trade, and we are back in cash while everyone today is freaking out and losing money and piling into bonds because of fear, which is likely a top for the price of bonds for a while.

The bottom line, we avoided the stock market crash. We will not be trading inverse ETFs on the stock market until we enter a bear market. Until then, we avoid market corrections by moving to cash, then into bonds just like we have done with TLT. The SP500 is down 14% from the high a few weeks ago, and our TLT bond position is up 20% as of today.

We also made some good money on GDXJ for those who follow our trading strategy and position management. The last couple of weeks has been a tremendous learning experience, in my opinion. The recent price action amplifies how critical position management is (targets, stops) are for our long term trading success. No one knows where the price will ultimately move to or reverse, but through the use of technical analysis and our trading systems, we can consistently pull money out of the market each year.

Yes, we will have small losing trades from time to time like SSO, and UNG but when we do take a loss, they don’t cause much damage to our overall account because of our position sizing and stop levels. I was once told by my trading mentor in 2001 that you should be proud of yourself for taking a loss.

Taking a loss (closing a losing trade) means you are following rules, managing risk, and that you can accept your timing for the trade was wrong. That has stuck with me and pops into my head every time I have to bite the bullet and close out a losing trade.

The stock market is down 9.5% for the year as of today, our account is positive and making money, not many can say that right now. The Power of Technical Analysis!

Remember, successful trading is not about having a bunch of positions you have open, and thinking you always need to own something. It’s about limiting/avoided risk when the odds are unfavorable, and getting back into the market when they do become favorable. Cash is a position and sometimes its the best and only position to be in like right now.

Thanks, everyone, for the kind and uplifting emails, it really is amazing to navigate the market like this with all of you.

HAPPY MEMBERS MAKING MONEY!

Hi Chris, Many thanks for your sterling work. The beauty of your work is that you cover all asset classes to identify setups. One key lesson we learnt is to trust the bond market more than the equities market when the trend between the two asset classes diverges.

Regards, Yusuf

Hi Chris,

I just wanted to send a quick note to tell you how impressed I am with your service and your trading system. I’ve followed/subscribed to several folks over the past several years and have never seen anything like what you provide. Your timely and accurate technical analysis of the major markets is incredible and perfectly aligns with my preferred swing trading approach. My favorite part of the day is watching (and learning from) your morning videos. And to know that my account is steadily increasing in the face of utter market panic is invaluable.

Thanks so much for all you do!

Ryan M.

If you want to become part of an exquisite trading newsletter where you can learn to reach the charts, spot trades, profit targets, stops, and be force-fed winning trades like this TLT trade, and our GDXJ trade then join my Wealth Building Trading Newsletter Today!

Click Here: https://www.thetechnicaltraders.com/#pricing

Chris Vermeulen

Chief Market Strategist

Technical Traders Ltd.