The Pomo Push Saved the Uptrend Again!

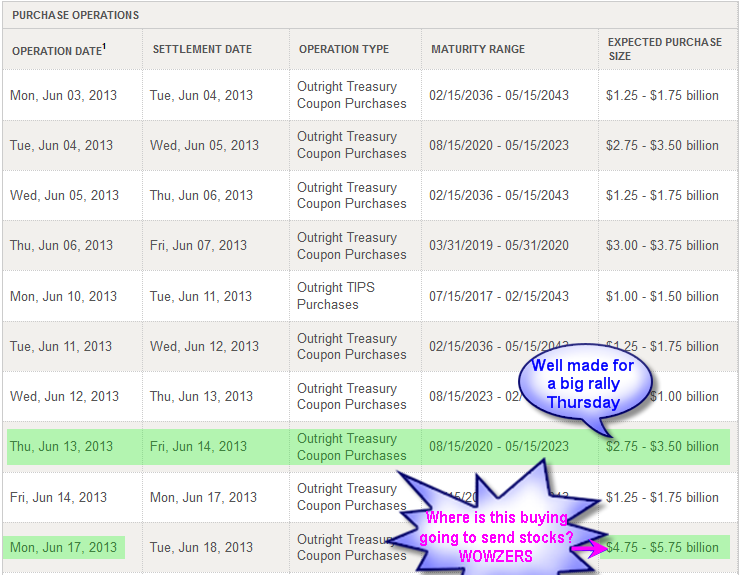

I have previously written Fed/POMO and I have to do mention it again. Yesterday morning I mentioned that if this trend is to remain up big money needs to be stepping into the market to lift stocks and save the trend. Luckily for the market and Ben Bernanke, there was a huge POMO day scheduled for yesterday where the Fed could buy up to $3,500,000,000 of securities.

That massive QE buying pressure (POMO – Permanent Open Market Operations) I’m sure helped lift the market. Look at my simple yet effective technical traders analysis chart of SP500 Futures below.

The Fed’s massive securities purchases likely helped to trigger a strong short-covering push into the closing bell. Remember, the prior day the indices had been hammered as short sellers drove the markets lower. When the shorts are forced to cover their positions, they do so by buying. When strong enough, this produces strong waves of buying.

Remember not to be bias in your outlook on the market, but follow the trend, money and momentum and you should be on the correct side of the market more times than not.

Chris Vermeulen

www.TheGoldAndOilGuy.com