The US Memorial Day weekend is set up to become a very interesting time for investors. The EU voting is complete and the change in EU leadership may move the markets a bit. China appears to be playing a waiting game – attempting to hold the US/Trump at bay until after the 2020 US elections. This week is certain to be very interesting for traders/investors.

The European stocks moved higher in trading on Monday as the relief from the EU election event and support for auto shares pushed the markets higher. The transition in the EU over the next few months will solidify into a political and social agenda. The EU leadership must acknowledge these future objectives of all parties in order to maintain some level of calm. It is evident that many EU nations are relatively satisfied with the current leadership while others are transitioning into more centrist leadership. The next 4+ years will be full of further transition in the EU.

China is another global issue that is relatively unsettled. We’ve been doing some research with regards to China and the potential future political and economic pathways that may become evident in the near-term future. Our biggest concern is that China has been inflating their economic levels for decades and the true scope of the Chinese economy may be much weaker than everyone expects. If our suspicions are correct and China has been inflating economic levels for many years, then the transition to a consumer/services-driven economy may be dramatically over-inflated and the US/China trade issues could be biting much harder than the Chinese want to admit.

The “Sell in May and go away” market saying may become absolute truth in 2019. Our expectations are still suggesting that an attempt at new market highs may take place before August 2019, but the current market rotation (lower) is setting up a very strong potential for further downside price action at the moment. Our proprietary Fibonacci price modeling system is suggesting the $7294 level in the NQ is key support. Below this level, the NQ could break much lower and potentially target $6850 or lower.

The YM is setting up a similar price pattern with resistance near 25,840. We believe this resistance will push prices lower as we move further into early June. The potential for some type of surprise economic data or Fed/Global market move after this weekend is somewhat higher than expected. There is a lot of shifting taking place throughout the globe and we believe this turbulence will reflect in the US market soon enough.

As of right now, our expectations are that a brief upside price rally will take place over the next 4~7+ days before a continued downside price trend may become evident. Pay attention to the news cycles for key elements that could drive the US stock market lower. We will continue to update you with regards to our proprietary research and expectations. The next 7+ days will likely be nothing but sideways price rotation within a Pennant/Flag formation.

Read our research to understand how this setup coincides with the GOLD price setup and why it is important to understand why July 2019 is so important. Please take a minute to review these recent research posts that focus more on the US Dollar and Gold, and also the July turning point for US Stocks.

4 DAYS LEFT TO GET YOUR FREE SILVER ROUNDS WITH SUBSCRIPTION!

We continue to see money flow into the safe-haven assets like the Utility sector, bonds, and most importantly precious metals. I anticipated this and our XLU utilities ETF taken with members for 4.4% already, and our VIX ETF trade we closed for a 25% last week.

For May I am going to give away and ship out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. You can upgrade to this longer-term subscription or if you are new, join one of these two plans listed below, and you will receive:

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Chris Vermeulen

After an incredible 7+week rally in Bitcoin, from $3700 to above $8000, the current price action is setting up for what may become an extended Pennant/Flag formation with quite a bit of sideways trading ahead.

Our researchers believe the past 7+ weeks rally in Bitcoin was prompted by a shift away from risk in Asia/China and into more suitable protection assets. Cryptos appear to be the easy choice for many as this rally coincided with the April 3rd through 6th US/China trade talks in Washington, DC (https://www.scmp.com/economy/china-economy/article/3004961/us-says-theres-still-significant-work-be-done-trade-talks). It appears that many investors were preparing for a difficult deadline after the March 1st deadline for a deal was pushed back. These early April trade talks may have been interpreted as a “do or die” effort from both sides. Again, shortly after the May 1st US/China trade talks in Beijing, Bitcoin began another rally from the $5200 level all the way up to the $8000 level.

Our contacts, although we admit they are fairly limited in total quantity, have stated the sentiment from locals in China are very pessimistic on the US and President Trump. A few of our contacts have recently stated they have been laid off or terminated from their jobs and, as we understand, locals have already started to react in a protectionist mode. This happens when economies contract quickly. Consumers attempt to protect their wealth and assets by moving any capital they have into something more efficient than their local markets – thus Cryptos.

This Weekly Bitcoin chart highlights areas that we believe our current support and resistance levels. The $8000~8100 level goes all the way back to the February 2018 low. This is a critical level for trading as it became a massive price support level back in 2018 – and eventually became critical resistance in July 2018. Additional resistance is found near $9900.

This Daily Bitcoin chart highlights what we believe are the current Key Highs and Key Lows that will tell us if the next phase will be a continued rally or a breakdown in price. The Key Low near $7480 must hold for any further upside price advance. If $7480 is broken, we would expect the next Key Low price to be targeted (near $6200). Otherwise, if another rally breaks out and price rallies above the Key High, then we could see an upside target range between $9200 to $9700 very quickly.

You can see from our BLUE CHANNEL levels on the lower indicator that we believe a Pennant/Flag formation may be setting up in Bitcoin right now. This type of price rotation is not uncommon after a big move like we’ve seen already and it could be a fairly wide price rotation as this sideways Pennant/Flag pattern continues. The current range between Key Highs and Key Lows is about $2000 – lots of room for trading/traders.

The key to understanding this move is the protectionist thinking of the people of China. They are very likely attempting to move their capital into something that is not Chinese Yuan based and away from traditional holdings (Gold, Real Estate, Jewelry or other assets). Eventually, we will likely see Gold/Silver follow the rally in Cryptos if fear continues to hit the markets. Cryptos, although, appear to have executed the first leg of the “fear trade” originating from the breakdown in the US/China trade negotiations.

An additional word of warning should be that any resolution to the US/China trade talks over the next 60+ days could remove any long term support for this upside move in Cryptos. Pay attention to the news cycles and what is happening in China, the EU and the rest of the world. As fast as it went up, it could easily break down as news hits.

Lots of great price action unfold to take advantage of. Subscribers just closed out a 24% winner and another 3.46% as the markets prepare for a new move. If you want my trade signals and alerts be sure to check out my Wealth Trading Newsletter.

Chris Vermeulen

www.TheTechnicalTraders.com

In our continued effort to help skilled traders/investors understand the future risks associated with geopolitical market turmoil, the EU Elections next week and the continued US/China trade war, this Part III of our Sector Rotation article will highlight certain sectors that we believe may continue to perform over the next 12 to 24+ months and help traders/investors survive any extended price volatility/rotation over that same time. Read Part I, and Part II.

Currently, the US stock market has weathered a bit of a jolt in terms of price rotation. After many stock indexes reached new all-time highs, the news of Iran Oil Sanctions, US/China trade talks failing and the political turmoil in DC as an incredible 2020 US Presidential election cycle heats up, investors are watching the markets for any signs of strength or weakness. Meanwhile, the US Dollar continues to strengthen against other global currencies in an incredible show of “King Dollar” strength and dominance. All of this plays into one of our favorite narratives that we started discussing over 30 months ago – the Global Capital Shift.

For those of you who remember our many articles about this global market phenomenon and the root causes of it, we’ll try to keep the following example/explanation of it fairly short. For those of you that are new to our research, please allow us to try to explain the Capital Shift event and why it is important to understand.

The Capital Shift started after the 2008-09 global credit market collapse. The US and many other nations created an easy money policy that was designed to spark investment and recovery across the globe. This easy money, at first, supported failing companies and governments in order to maintain social order and structure. After that process was completed, this capital went to work investing in under-valued global markets and assets. As prices continued to rise and the easy money policies became rooted into the social structure, the hunt for greater returns rotated throughout the planet – diving into undervalued markets and opportunities, often with no regard for risk.

After 2014, things began to change in the US and throughout the planet. The US entered a period of extended sideways trading that caused many investors to reconsider the “buy the dip” mentality. In 2014-15, China initiated “capital controls” in an effort to prevent outflows of capital from a newly rich population and corporate structure. Just before 2014, the Emerging Markets went through a period of pricing collapse which was associated with over-inflated expectations and $100+ oil. All of that started changing in 2014~2016 as Oil prices collapsed – taking with it the expectations and promises of many Emerging Market investors and speculators.

This shifting of capital in search of “returns with a moderate degree of risk” is what we are calling the “Capital Shift Event”. It is still taking place and it is our opinion that the US stock market will become the central focus of global capital investment over the next 4+ years. We believe the strength of the US Dollar and the strength of the US Stock Market/US Economy will drive future capital investment into US and other US Associated major markets in an attempt to avoid risks associated with the foreign market and currency market valuations. In other words, when the crap starts flying across the globe, cash will rush into the US and other safe-haven investments to protect real value.

Currently, the potential for another price decline in Crude Oil is rather strong with our research expecting a move back below $55 ppb over the next 4+ months. We believe a further economic contraction across the globe with a very strong potential for increased price volatility will drive Oil prices back below $55 with a very strong potential for prices to settle near $46~48 before the downward trend is completed.

The potential for some type of price contraction over the next 12+ months will be related to how the global and localized economic concerns play out over the next 24+ months. Yet, investors can prepare for these extended price rotations now by becoming aware of weakening price trends and the potential that certain sectors will likely be hit harder than others. For example, the most recent price weakness in the US stock market appears to be focused in certain sectors:

Technology, Semiconductors, Scientific Instruments, Financials, Asset Management, Property Management, Banking (Generally all over the US), Consumer Goods – Electronics, Airlines, Mail Order Services, Industrial Goods, Aerospace/Defense, Farming and Farming Supply, Medical Laboratories, Medical Appliances, Oil & Gas and others. This type of market contraction is fairly common in an early stage Commodity and Industrial economic slowdown.

The sectors that are improving over the past week are : Healthcare, Electric Utilities, Diversified Utilities, Gas Utilities, Consumer Personal Products, Consumer Confectioners, Cigarettes, Entertainment, Beverages and Soft Drinks, Meat Products, Specialty Eateries, REITS (almost all types), Credit Services, Telecom and Telecom/Communication Services.

All of these are protectionist rallies based on the US/China trade war and the market rotation away from Technology/manufacturing growth and into more consumer protectionist spending mode – where the consumer and larger firms focus on core items while expecting a mild recession within the economy. All of this is very common at this time within the US Presidential Election cycle. In fact, our researchers have shown that nearly 80% of the time when a major US presidential election is taking place, the US stock markets will decline within the 24 months prior to the election date.

The Monthly S&P heat map is not much different. It is still showing weakness where we expect and strength in sectors that have been somewhat dormant over the past 4+ years. The key to success for skilled traders is to be able to play this future price rotation very effectively as the different sectors continue to rotate headed into the 2020 US Presidential Elections and with all of the external foreign market factors taking place.

It is quite likely that the US Dollar will continue to push high, possibly well above $102, before finding any real resistance. It is very likely that most of the US stock market will fair quite well over the next 24+ months – yet we do expect some extended price rotation over this time and we believe Technology, Financials, Real estate, and Industrial/Consumer related stock sectors could take a hit over the next 16 to 24 months. These rotations are, again, common for this type of US Presidential Election cycle. Skilled traders are already aware of this cycle and have begun to prepare for this event to unfold. The unknowns of the current global market is China and the EU at present.

And with that last US Dollar chart, there you have it. Our three-part article about how the Global Capital Shift is about to intensify and continue to drive a US Sector rotation that many traders have failed to consider. The EU elections, the US/China trade wars, and the US Presidential Election event are all big factors in what we believe will drive in an increased level of uncertainty over the next 16~24 months. Additionally, we are very concerned that China is very close to experiencing what we are calling a “broken backbone” over the next 12+ months. We believe the pricing pressures in combination with a slowing economy and a consumer move into a protectionist stance could create a waterfall event in China/Asia.

Our advice for traders is to protect open long positions and to prepare for 16 to 36 months of “repositioning” of the global markets. The US elections are certain to drive an incredible range of future expectations throughout the world. Combine that with the EU elections, the BREXIT effort and the continued repositioning of US/China/Foreign market relations and we are setting up for a big shock-wave event in the near future.

Follow our research. We’ve already mapped out the next 24 to 36 months of market price activity with our proprietary price modeling tools. We believe we know what will happen over the next 24 to 36 months, we are just waiting for the price to confirm our analysis. Visit www.TheTechnicalTraders.com to learn more.

Chris Vermeulen

Technical Traders Ltd.

Chris Vermeulen. Founder of The Technical Traders joins me to share his thoughts on the recent flow of money into safe haven assets. During the selloff, yesterday in US markets money moved into bonds, gold, and back into the USD. We discuss just how long this run could last and which sectors Chris is the most bullish on.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 3 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 3 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

Over the past 6+ months, we’ve been covering the price rotations in precious metals very closely. We’ve issued a number of amazing calls regarding Gold and Silver over the past few months. Two of the biggest calls we’ve made were the late 2018 research post that suggested Gold would rally to above $1300, then stall. The other amazing call was our research team’s suggestion that April 21~24 would see Gold setup an Ultimate Base, or what we were calling a “Momentum Base”, near $1250 to $1275.

We issued both of these markets calls many months in advance of these dates/price levels targeting these moves. In both cases, we issued these market calls well over 60 days prior to the move actually taking place. The accuracy of these calls can be attributed to our proprietary price modeling solutions as well as the skill and techniques of our research team. Don’t mind us while we take a few seconds to take credit for some truly amazing precious metals calls over the past 6+ months.

This Weekly Gold chart highlights just about everything we have been suggesting would happen over the past 12+ months. The rally in Gold from below $1200 to almost $1350 setup an upside price leg that we believe is still just beginning. The rotation lower, after the February 2019 highs, setup the Momentum Base near April 24 – RIGHT ON TARGET. Now, the upside price advance that we’ve been predicting should launch Gold well above the $1400 price level appears to be setting up.

Our Adaptive Dynamic Learning price modeling system, as well as our Adaptive Fibonacci Price modeling system, have been key elements to unlocking these early calls. You can read more about our earlier Gold and Silver calls by reading this article: https://www.thetechnicaltraders.com/adl-predictions-for-price-of-gold/

The next leg higher for Gold will see a price peak near $1450 before another brief sideways/stalling pattern sets up. After that, our research suggests a rally will quickly drive Gold prices above $1550 (or much higher).

As we’ve been suggesting, Silver will likely lag behind Gold by about 20+ days. We believe Silver is going to see an incredible upside price move – even bigger than Gold in percentage terms. Our belief is that Silver will be trading above $26 to $28 per ounce – almost DOUBLE the recent low price level, when Gold will be trading just above $2000 per ounce. The reason for this is the relationship between the Gold/Silver/US Dollar pricing levels – called the Gold/Silver Ratio. The chart is below

When the ratio is above 0.80, we consider this to be a “Moderate Peak” zone for Gold. Where the price of Gold (per ounce) represents more than 80 ounces of Silver. The ratio of the price of Gold to the price of Silver is a fairly common measure to determine when Silver is very undervalued compared to Gold. When the ratio typically falls above 0.80, then the price of Silver is very cheap compared to the price of Gold. When this ration move above 0.90, these levels are Extreme Peaks in the disparity of pricing between Gold and Silver. These are the areas where both Gold and Silver rally back to restore a ratio level closer to 0.60 or 0.65 (or lower).

This would indicate that the price of Silver will rally much faster than the price of Gold and in order for this ratio to move back to the 0.06 level, Silver would have to rally at a rate of 1.35:1 or 1.45:1 compared to Gold.

Custom Index – chart by TradingView

Custom Index – chart by TradingView

This Weekly Silver chart highlights the levels we are watching for the upside breakout in Silver to begin – $15.40 or higher and we believe the upside price move in Silver till accelerate well above $18 per ounce very quickly. Again, the move in Silver will likely lag behind Gold by at least 20+ days. So now if the time to buy Silver in physical form (or any form) as we prepare for this move. Once it starts, we can promise you that the rally will be impressive and quick.

Watch how Gold and Oil react over the next few weeks as Fear re-enters the global markets. Our belief is that Oil will fall while Gold initiates the first leg higher, towards $1400 to $1450 before stalling. Once this happens, we can be certain a new upside price advance is beginning in Gold and this could be a fairly strong indicator that the markets are weakening and there is increased global fear.

This is proving to be an incredible trading year for traders who follow our trade alerts newsletter.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 4 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 4 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

In PART I of this report we talked about and showed you the charts of the Hang Seng and DAX index charts and what is likely to unfold. In today’s report here we touch on the US markets. As we’ve suggested within our earlier research posts this year, US election cycles tend to prompt massive price rotations when the election cycles are intense. For example, the 2000 election of George W. Bush prompted a very mild price rotation in 1999~2000. This was likely because the transition from Clinton to Bush II was not overly contentious. The 2008 election of Barrack Obama was a moderately contested election cycle and happened at the time of the biggest credit market collapse in modern history – thus, the markets were well on their way lower 12+ months before the elections. The 2012 election cycle showed moderate price rotation as it was a highly contested election event in the US. The 2015-16 election event was highly contested as well and the price rotation near this time appears longer and deeper than the 2012 event.

Now, in 2020, we have one of the biggest, most highly contested US election cycles in recent history unfolding and we have already begun to see a price range /rotation over the past 12+ months that suggests we could see even bigger price rotation. If we add into this mix the US/China trade issues, global market concerns, US political rhetoric, and other issues, we have a recipe for A BIG MOVE setting up.

Our analysis still suggests that we are poised for an attempt at fresh new all-time highs before any massive price rotation takes place (near the upper trend line). Yet, we believe the downside price rotation is an eventual component of the next 16+ months of the US election cycle and the future price advance that should take place in the near future. In other words, we believe the markets are setting up for a bigger shake-out throughout this election cycle/trade issue event that will prompt lower prices before the end of 2019. We do believe the markets will settle and resume an upward trend bias after this downside price rotation – yet we don’t know exactly when that will happen.

To the best of our ability to predict the future, we can state this at the moment. It appears the end of 2019 will be filled with large price rotation – likely to the downside as trade issues and election/political issues cause a “shock-wave” in the markets. We believe early 2020 will see a relief rally that may setup a bigger price move throughout the remainder of 2020. Right now, traders need to be prepared for an incredible increase in volatility and price rotation. It is very likely that we will see a VIX level above 40 at some point before the end of 2019. This is a time for skilled traders to get in, get profits and get out. Position trading over the next 12+ months will be very difficult.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is exactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 5 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 5 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

This is a delayed video sample of what I share with members to my Wealth Trading Newsletter each and every morning

before the market opens. Learn, Be Alerted, and Profit!

It is becoming evident that the US/Chinese trade issues are going to become a point of contention for the markets going forward. We’ve been review as much news as possible in an attempt to build a consensus for the future of the US markets and global markets. As of last week, it appears any potential trade deal with China has reset back to square one. The news we are reading suggests that China wants to reset their commitments with the US, remove all tariffs and wants the US to commit to buying certain levels of Chinese goods in the future. Additionally, China has yet to commit to stopping the IP/Technology theft from US companies – which is a very big contention for the US.

This suggests the past 6+ months of trade talks have completely broken down and that this trade issue will likely become a market driver over the next 12+ months. The global markets had anticipated a deal to be reached by the end of March 2019. At that time, Trump announced that he was extending talks with China without installing any new tariffs. The intent was to show commitment with China to reach a deal at that time – quickly.

It appears that China had different plans – the intention to delay and ignore US requests. It is very likely that China has worked to secure some type of “plan B” type of scenario over the past 6+ months and they may feel they are negotiating from a position of power at this time. Our assumption is that both the US and China feel their interests are best served by holding their cards close to their chests while pushing the other side to breakdown through prolonged negotiations.

Our observations are that an economic shift is continuing to take place throughout the globe that may see these US/China trade issues become the forefront issue over the next 12 to 24 months – possibly lasting well past the November 2020 US Presidential election cycle. It seems obvious that China is digging in for a prolonged negotiation process while attempting to hold off another round of tariffs from the US. Additionally, China is dealing with an internal process of trying to shift away from “shadow banking” to eliminate the risks associated with unreported corporate and private debt issues.

The limited, yet still valid, resources we have from within China are suggesting that layoffs are very common right now and that companies are not hiring as they were just a few months ago. One of our friends/sources suggested the company he worked for has been laying off employees for over 30 days now and he just found out he was laid-off last week. He works in the financial field.

We believe the long term complications resulting from a prolonged US/China trade war may create a foundational shift within the global markets over the next 16 to 24+ months headed into the November 2020 US Elections. We’ve already authored articles about how the prior 24 months headed into major US elections tend to be filled with price rotation while an initial downside price move is common within about 16+ months of a major US election event. This year may turn out to prompt an even bigger price rotation.

US Stock Market volatility just spiked to levels well above 20 – levels not seen since October/November 2018, when the markets fell nearly 20% before the end of 2018. The potential for increased price volatility over the next 12+ months seems rather high with all of the foreign positioning and expectations that are milling around. It seems like the next 16+ months could be filled with incredibly high volatility, price rotation and opportunity for skilled traders.

Our primary concern is that the continued trade war between the US and China spills over into other global markets as a constricted price range based trading environment. Most of the rest of the world is still trying to spark some increased levels of economic growth after the 2008-09 market crisis. The current market environment does not settle well for investor confidence, growth, and future success. The combination of a highly contested US Presidential election, US/China trade issues, a struggling general foreign market, currency fluctuations attempting to mitigate capital risks and other issues, it seems the global stock markets are poised for a very big increase in volatility and price rotation over the next 2 years or so.

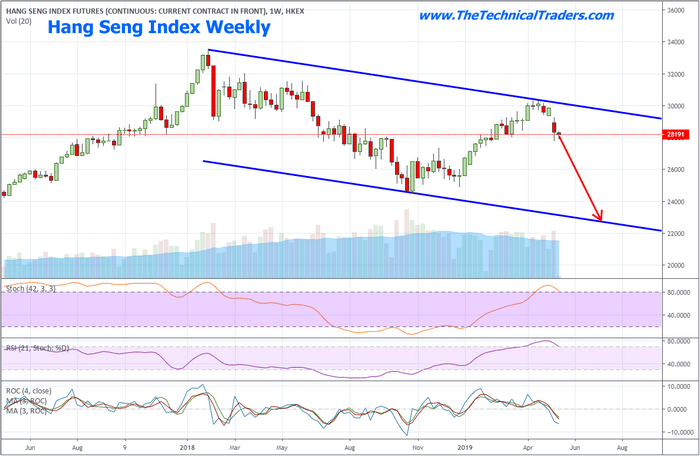

Our first focus is on the Hang Seng Index. This Weekly chart shows just how dramatic the current price rotation has been over the past few weeks and how a defined price channel could be setting up in the HSI to prompt a much larger downside objective. Should continue trade issues persist and should China, through the course of negotiating with the US, expose any element of risk perceived by the rest of the world, the potential for further price contraction is very real. China is walking a very fine line right now as Trump is pushing issues (trade issues and IP/Technology issues) to the forefront of the trade negotiations. In our opinion, the very last thing China wants is their dirty laundry, shady deals and political leadership strewn across the global news cycles over the next 24+ months.

The DAX Weekly Index is showing a similar price pattern. A very clear upper price trend channel which translates into a very clear downside price objective is price continues lower. Although the DAX is not related directly to the US/China trade negotiations, the global markets are far more interconnected now than ever before. Any rotation lower in China will likely result in a moderate price decrease in many of the major global market indexes.

As we’ve suggested within our earlier research posts, US election cycles tend to prompt massive price rotations when the election cycles are intense. In our next post PART II of this report, we talk about what happened in the past election cycles reviewing the monthly charts and weekly SP500 index charts which are very telling in what could be about to happen next for the stock market from an investors standpoint.

For active swing traders, you are going to love our daily trading analysis. On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is excactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only three days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 7 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 13 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen

Stay tuned for PART II next!

Today, the US increased tariffs on $200B of Chinese goods as the US/China trade deal breaks down. China has vowed to retaliate for the move. The past week has seen the global markets shocked by two items: Iran sanctions and US/China trade breakdown. The markets had been expecting a US/China trade deal to be reached and optimism was quite high – hence the rally in the Chinese stock market and the rally in the US stock market. What next?

Well, we believe this news, as well as future news that will likely hit the markets over the next 3+ months, will continue to prompt the Shake-Out we have been warning about. Depending on how severe these news events are, the rotation in the markets could be quite severe as well.

Our recent analysis suggests that recent lows in the US stock market may be near-term support and that the US stock market may attempt to form a bottom near these lows. Our research shows the Transportation Index is leading this move. We believe the ORANGE Moving Average level, as well as the RED and GREY Fibonacci projection points, will act as a temporary price floor this week and next. The YM could move lower by 100 to 200 points today, retesting these low levels, before recovering near the end of the day.

Gold is showing signs of a potential upside price leg in the early stages, just as we had been suggesting. Our April 21~24 momentum base call from months ago appears to be incredibly accurate. At this point, we are just waiting for the upside price swing to begin. When it starts, the momentum behind this upside move will increase as it will catch the attention of many gold traders and solidify the “fear” aspect of this move.

Silver is still lagging behind Gold – as usual. We continue to believe the real opportunity for a great trade lies in Silver. The potential for a $22 o ~$28 upside price swing on a market breakdown or fear play is still very solid. Headed into the 2020 US election cycle and with all the uncertainty in the global markets, we believe this is the “sleeper trade” of the next 16+ months. When Gold begins to breakout to the upside, Silver should follow about 20 days later.

These new US trade tariffs puts pressure on China to come to the table and develop and honest deal. This is not the old way of slow negotiations with no real consequences. For China, the lack of access to the US market could be devastating in both the short and long run. Skilled traders should not be overly optimistic throughout this weekend. Protect your longs and prepare for more news over the next few weeks. This is the type of market that will make or break many traders.

UNIQUE OPPORTUNITY ONLY IN MAY

On May 1st we talked about the old saying goes, “Sell in May and Go Away!” and that is excactly what is happening now right on queue. In fact, we closed out our SDS position on Thursday for a quick 3.9% profit and our other new trade started Thursday is up 18% already.

Second, my birthday is only a few days away and I think its time I open the doors for a once a year opportunity for everyone to get a gift that could have some considerable value in the future.

Right now I am going to give away and shipping out silver rounds to anyone who buys a 1-year, or 2-year subscription to my Wealth Trading Newsletter. I only have 11 left as they are going fast so be sure to upgrade your membership to a longer-term subscription or if you are new, join one of these two plans, and you will receive:

1-Year Subscription Gets One 1oz Silver Round FREE

(Could be worth hundreds of dollars)

2-Year Subscription Gets TWO 1oz Silver Rounds FREE

(Could be worth a lot in the future)

I only have 13 more silver rounds I’m giving away

so upgrade or join now before its too late!

SUBSCRIBE TO MY TRADE ALERTS AND GET YOUR FREE SILVER ROUNDS!

Happy May Everyone!

Chris Vermeulen