With global equities taking the plunge, bond market turmoil, talk of negative interest rates and a bullish COT Silver Report, the future for Gold and precious metals just keeps getting brighter.

Add to that the threat of Mexican tariffs and the push for a Gold-backed currency in Malaysia and you have the makings of an exciting Weekly Wrap Up.

Eric cheers on the Raptors, chimes in on Gold and answers some of your questions this week on the Sprott Money Weekly Wrap Up.

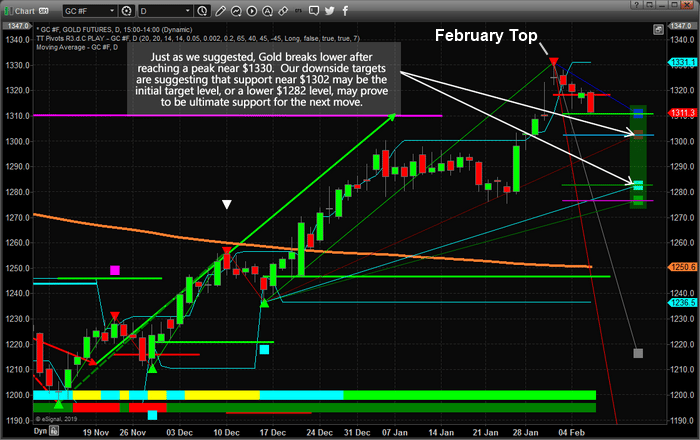

We’ve been trying to alert all of our followers of the setup in precious metals for well over 6 months. Here is our research post from February 6, 2019 (nearly 4 months ago) that highlights our prediction of an April 21~24 momentum base and our earlier calls predicting a move above $1300, then a stall and move lower towards the base in April, then the next leg higher.

We could not have been clearer in our analysis and we predicted the bottom and rally in gold in Oct, called the top and closed our GDXJ miners position near the in February, and called for gold to bottom this April/May over 7 months in advance.

SEE GOLD PREDICTION CHART FROM OCTOBER 2018

Predicted the rally, then the correction which brings us to today

See Blog Post

P.S. If you wanna see our Proprietary Trading Tools – Click Here

I have been pouring over the longer term charts as we’ve started to see Oil and Gold move in directions that would indicate increased fear throughout the global markets while a contraction in economic activity/oil prices appears to be setting up for another big move. The objective is to attempt to identify longer-term volatility expectations and price targets. To accomplish this task, we use our Adaptive Fibonacci predictive modeling utility on 3 Week charts because they provide a unique look at price activity and are a bit more reactive to shorter-term price activity than Monthly price bars.

We found some very interesting components by reviewing these charts of the ES, NQ, YM, and CL. We believe we are setting up a 2~4+ week sideways price rotation in the US stock market as price attempts to consolidate within this range before a broader breakout/breakdown move could happen. Just as we predicted many months ago, the July 2019 price peak we suggested could form appears to be setting up with a sideways pennant/flag formation as investors digest the economic and global trade war news data.

Eventually, the price will make a move in an attempt to break this sideways price channel and our predictive modeling solutions can help us to understand how these price setups will playing out. Let’s get into the charts and research.

As we start to pull apart the data from these charts, we urge you to pay attention to two things – the range of the current Bullish & Bearish Fibonacci Price Trigger levels and current price rotations of price peaks and troughs over the past 40 to 60 bars. It is very important to understand and attempt to use the “new price high” and “new price low” Fibonacci price theory that we keep talking about in our articles.

This first chart is the ES 3-Week chart highlighting the range between the Fibonacci Bullish and Bearish Price Trigger Levels (highlighted in light-CYAN). It is important to understand why the current bearish price trigger level is so far below current price levels. The Adaptive Fibonacci modeling system adjusts trigger levels based on recent price activity and price volatility to attempt to identify when the price is congesting in a sideways price trend or trending upward or downward. When price congests in a sideways form, the Adaptive Fibonacci modeling tool identifies this and determines that price would need to move to new levels in order to qualify for a new bullish or bearish price trigger. In this case, it is suggesting that price would need to fall below $2014 before this 3-Week chart would qualify the move as a “new bearish trend”.

That is a big move from current levels. It totals more than -750 points – a -27.5% price decline.

Currently, as long as the ES price stays above the $2633 level, the Fibonacci predictive modeling system is still suggesting the Bullish trend is intact and should continue.

This NQ 3-Week chart is setup in a similar manner to the ES chart. Although the Fibonacci volatility range on the NQ chart is much more narrow than the ES chart, the Fibonacci modeling system is still suggesting that the current trend is still Bullish and the key levels for the triggers are $6792 for the Bearish Trigger level and $6556 for the Bullish Trigger level.

Because of the narrow volatility range and because the Bearish trigger level is above the Bullish trigger level, we believe a price rotation where the price stays above $6800 is very likely over the next few weeks. Obviously, should price break below the Bearish Trigger level, then we would begin to become concerned that a broader downside trend is being established and start to look at the Fibonacci downside price targets (near $5815 & $3900). Until that happens, expect sideways price rotation with a 250 to 500 point range on average (about 2x the Fibonacci volatility range).

The YM is really the key to understanding just how the markets are going to play out over the next few weeks and months. The extremely large Fibonacci volatility range on the YM chart highlights the potential for the wild sideways price rotation that we are expecting over the next few weeks and months. Remember, our analysis from many months ago suggests a price peak will likely form in July/August 2019 and prompt a broader downside price move after this peak completes. Our expectation that a current sideways price channel is setting up leads us to believe the apex of this sideways price channel may result in a very brief price rally (pushing prices back towards recent highs) before rolling over and starting a new downside price move to coincide with our July/Aug 2019 predictions.

One way or another, it appears the DOW/YM will be leading the way in terms of price volatility and rotation. The wide range between the Bullish and Bearish Fibonacci Price Trigger Levels is suggesting that price volatility is increasing and that the YM would have to move to levels above $29,750 or to levels below $18,875 before establishing any new price trends. The past Fibonacci trigger levels help us to understand key price levels as this future move takes place.

Past Fibonacci Trigger Price levels are $26,025 for a Bearish Price Trigger level and $24,770 for a Bullish Price Trigger Level. This means if the price is below $26,025 – we should expect a bearish price trend to continue and if the price is above $24,770 – we should expect a bullish price trend to continue. Yet, price is current BETWEEN both of these levels, so what should we expect right now? When the price is in between these levels, like now, we typically look for the last price rotation (peak or valley) and for the last level that was crossed (in this case the $26,025 Bearish level) and would conclude:

The trend is currently Bearish and the $26,025 level is key to maintaining this bearish price direction. Should price move back above this level and close above this Bearish Price Trigger Level, then we would consider the trend “moderately bullish” while we wait for a new Price Trigger Level Breach to setup.

Lastly, Crude Oil. We’ve been writing to all of our followers that we felt Oil was setting up for a price rotation many weeks ago. We warned that the $65 price level may be the end of the move and that the $55 to $50 levels are the likely downside targets. The volatility range is somewhat narrow and the last Trigger Level that was breached was the Bearish Trigger Level near $68.75. Therefore, we believe the recent downside price move, below the $60 Bullish Trigger level, results in a new Bearish price trend with immediate targets near or below $50. Ultimately, the $42.40 level may be the longer term downside price target – which would coincide with a broader commodities slowdown and global economic activity contraction.

So here is what you need to know to go into this weekend and for the next 4+ weeks.

Expect the US stock market to trade in a moderately volatile sideways price channel for the next 4+ weeks.

Expect the end of this price channel to result in a “false rally” move that may push prices towards recent highs before faltering and rotating back to the downside.

Expect this END of the sideways price channel to happen sometime near mid-July or early August 2019.

Expect Gold and Oil to continue to react as “fear measures” over the next few weeks/months as global traders reposition their assets throughout this rotation.

Expect a bigger price move near late July through September~October 2019 as this volatility move really begins to take root with equities.

Follow our research and learn how we can help you stay well ahead of these price moves. We’ve just highlighted what is likely to happen over the next 30 to 60 days in this research post. Want to know how we are going to trade these moves? Join our other members to see how we create success and keep our members ahead of these big moves. Also, if you wanted me to ship you free silver rounds with a subscription to this Wealth Trading Newsletter you better join today as this offer expires June 1st.

Chris Vermeulen

www.TheTechnicalTraders.com