Sweet Spot for Gold Stock Investors

There is no question that precious metals along with gold and silver mining stocks are clearly out of favor with investors. Most of these stocks are 50, 70, even 85% since the 2011 top. It has been a painful ride to the bottom for those who invest with the buy, hold and hope strategy.

The good news is that I see light at the end of the tunnel, meaning gold, silver and miners are showing serious signs of bottoming. While the fundamentals have been bullish on metals for years which is a positive, we also know that fundamentals don’t really play into immediate price action of any specific asset when it comes to trying to time a market.

But the level of M&A (mergers and acquisitions in sector) along with technical analysis are now showing signs that intelligent gold and silver investors are accumulating specific companies and exploration properties at rock bottom prices in anticipation of the next bull market in silver and the price of gold.

At this stage of the game the shotgun approach for owning mining stocks will not work well. If you want the best bang for your buck you need to get specific companies which have true potential of making money.

The Sweet Spots:

Savvy investors have been flocking to two types of mining stocks recently accumulating positions in anticipation of some big events.

These two business opportunity types are:

1. Exploration companies with proven properties containing a sizable amount of valuable resources.

2. Mines starting production.

What do both of these types of stocks have in common that make them attractive?

They both are one event away from generating big value to its shareholders. This proven resource rich properties will either be acquired by a larger firm. This type of event can provide returns of up to 10x ROI on the share price in a blink of an eye in some cases.

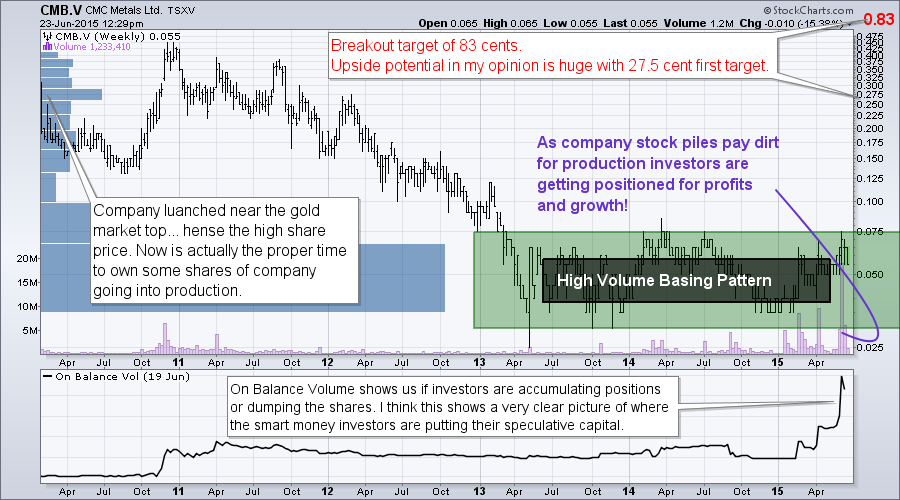

Or these resource rich exploration stocks decide to go into production for themselves and provide potentially even more value long term for its shareholders much like what CMC Metals Corp. (TSX.V: CMB) is doing.

I’m not going to reinvent the wheel here in talking about what CMC Metals Corp. does and the stage that it’s at.

Read this exciting report by: RockStone – Click Here

See My Live Analysis of Chart: https://stockcharts.com/public/1992897/tenpp/2

Concluding Thoughts:

It has been years since I have been excited about precious metals and mining stocks. Subscribers of my trading newsletter know we have avoided owning gold and silver stocks since late 2011.

While I still believe metals and miners will struggle as a sector. It is clear that there are some amazing opportunities available for those who know what to look for, and have the guts to step forward when most investors are stepping back.

The markets go in cycles also known as of expansion and contraction in price and sentiment. Assets classes which are most out of favor eventually become the next market darling. But before that can happen the asset class/sector must be completely out of favor and hated by most… which gold miners are.

Recently I met with the president of the company in Toronto to learn more about its financials, management and project. I now personally own share of CMC Metals Corp. with an average price of 6 cents and I plan to hold these shares for a long time until I think the next gold bull market is almost over.

Get My Next Sweet Spot Silver Miner Stock Pick: www.GoldAndOilGuy.com

Chris Vermeulen

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by CMC Metals Corp. In addition, the author owns shares of CMC Metals Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.