The FED is Exporting Quantitative Easing!

The emergence of the “BLICS”, not BRICS, nations, has been a new proxy entity designed solely for exporting QE!

This undisclosed systemic risk is being spread to secondary nations without the benefit of any investor/trader knowledge through…

Exclusive Precious Metals Report & Free Trading Magazine

The newest issue of TradersWorld magazine just came out which has some great articles in it. They wanted me to contribute some trading insight which I have. You can get this exclusive insight article on page 40: Metals & Miners Set To …

The Next Technical Price Targets for Gold & Silver

I have pointed out earlier, gold is forming a possible short-term top. It is on the verge of completing a bearish ‘Head and Shoulder’ pattern. The pattern is confirmed if gold closes below $1220/oz. The downside pattern target for this setup…

Is silver a better bet than gold in the near future?

Last week, the beginning of April 18th, 2016, silver was on fire, rising sharply and forcing ‘Wall Street’ to take note of its move, though, many investors believe that gold and silver are one and the same, one can hold either in your portfolio…

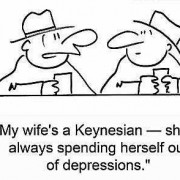

Did “Keynesian Economic Theory” fail in the post-crisis years of 2008?

The ‘Great Recession’ of 2008 was brought about by reckless lending. The aftermath left the credit market in an extreme tight squeeze whereby corporations were frightened and hesitant to spend. Cost cutting led to massive layoffs leaving…

Gold and Silver are on the Cusp of a Massive Rally!

Gold and silver have more or less confirmed they have bottomed and are ready for a multi-year rally. Their trend has not fully ‘reversed’ to the upside yet but the market breadth and internals for the precious metals sector are very bullish.…