Ray Dalio Suggests USA Is Entering A Period Of Decline And New World Order

We find it interesting how researchers attempt to compare history, sometimes ancient history, to the applicable functions of today’s world and to attempt to translate the decline of empires in the past to what is happening in today’s world. Ray Dalio appears to be suggesting the rise of the Chinese economy and economic capabilities is going to threaten to unseat the US as a world super-power.

Within Ray Dalio’s article, he suggests the following which seems to sum up his cycle theory:

“In brief, after the creation of a new set of rules establishes the new world order, there is typically a peaceful and prosperous period. As people get used to this they increasingly bet on the prosperity continuing, and they increasingly borrow money to do that, which eventually leads to a bubble.

As the prosperity increases the wealth gap grows. Eventually the debt bubble bursts, which leads to the printing of money and credit and increased internal conflict, which leads to some sort of wealth redistribution revolution that can be peaceful or violent. Typically at that time late in the cycle the leading empire that won the last economic and geopolitical war is less powerful relative to rival powers that prospered during the prosperous period, and with the bad economic conditions and the disagreements between powers there is typically some kind of war. Out of these debt, economic, domestic, and world-order breakdowns that take the forms of revolutions and wars come new winners and losers. Then the winners get together to create the new domestic and world orders.”

Our own research team has completed quite a bit of research into cycles and super-cycles and, although we agree with Mr. Dalio that past Empires have collapsed and been replaced with more efficient and emerging soon to be a new world leader. Yet, in every instance in the past, the world has been transitioning from a rather disconnected economic structure where ancient empires, or rather the last gasps of ancient empires and wealth, have become threatened, gone to war, and declined.

WWI initiated with the assassination of Archduke Franz Ferdinand in Sarajevo on June 28, 1914. Nearly a month later, the great powers of Europe were aligned into two coalitions: the Triple Entente – consisting of France, Russia, and Britain – and the Triple Alliance of Germany, Austria-Hungary, and Italy. Thus, the lines were drawn between ancient European empires that led to the beginning of a new structure of world empires.

Throughout history, the biggest world empires are structured, grow into superpowers, and begin to decline. Most of these last well over 200 to 250+ years.

The Ottoman Empire started in the early 1300s and ended in the early 1600s because of a war with Persia – more than 300 years.

The Arab Empire, Mohammed, started in 632 and ended in 1258 – more than 600 years.

The Roman Empire began in 753 BC and ended in 23BC – over 700 years.

Chinese Qing Dynasty started in 1644 and ended in 1911 – over 250 years.

Chinese Ming Dynasty started in 1368 and ended in 1644 – almost 300 years.

America’s strength as a nation started to build in the late 1800s/early 1900s. Our rise to a world power came at a great expense in the 1930s and 1940s – fighting Hitler and the Japanese while saving most of Europe and SE Asia in the process. Then, we managed to rebuild most of these areas over a very short period of time.

Additionally, the idea that the current world would allow a nation like China to become a world-power – threatening world-order, capitalism, democracy, and current global geopolitical order seem alien to our researchers. There is one thing Mr. Dalio seems to ignore in his theories – the world has a choice in the matter – just like we did when Adolf Hitler threatened western Europe and with Hideki Tojo threatened the US and most of SE Asia. We have a choice in how we address the rise of China and how we protect our freedoms, rights, and futures from any threat China may present.

Currently, the world is moving away from a China-friendly relationship after the COVID-19 virus event has wreaked havoc across the globe. China’s rise over the past 25+ years has mostly been on the success of selling China as a cheap manufacturing center for the US and other stronger economies. The process of growing China has been to take advantage of the relationships they’ve built with foreign business/banking. This is all starting to come to a sudden halt which may put extreme pressures on China’s banking and credit systems over the next 20+ years.

Before we continue, be sure to opt-in to our free market trend signals

before closing this page, so you don’t miss our next special report!

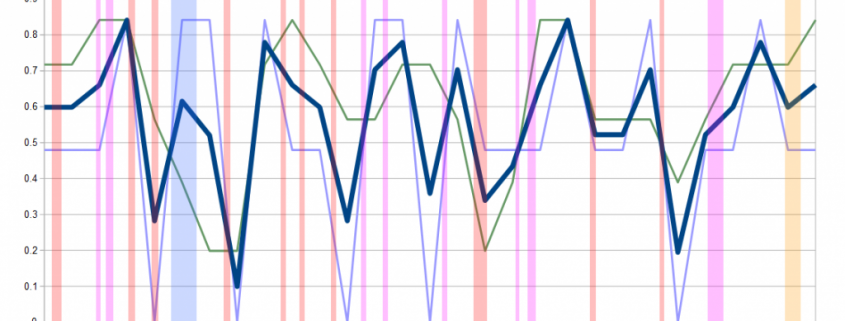

Our research team put together this chart to highlight the past 100+ years of cycle/super-cycle trends. When you review this chart, pay attention to the deep collapse of the heavy blue line from 1923 through 1939 – the span of the Great Depression. We’ve highlighted the area of the Great Depression in BLUE. We’ve also highlighted recessions in RED and MAGENTA. Red areas being recessions in cycle areas where the cycles are trending lower and Magenta are where recessions happened in upward trending cycles. Near the end, we’ve highlighted an area in YELLOW where we believe a new recession will emerge.

Now, as we align these cycle trends with price, we start to see a bigger picture emerge. This SPY Weekly Log chart illustrates how our cycle analysis aligns with price trends quite well over the past 45+ years. Our cycle research goes forward over 600 years and we can identify where and when price trends will likely set up, breakdown, or breakout as a result of our extensive cycle research.

Mr. Dalio’s comments, while somewhat valid in general scope, don’t necessarily translate into real-world processes. With the amount of wealth and new global alliances, inter-connected economies and the recent push attempt to right the many wrongs of the past 30+ years, the world appears to be much more aligned towards restoring some proper order and developing a real future where nations are held accountable and central banks may be forced to adopt a more conservative capital process in the near future.

Without giving away too many details, our cycles are point to a very important cycle event that will take place in the near future. Many people are completely unaware of when and how this event will take place. In fact, many analysts are simply guessing as to what may happen over the next 20+ years whereas we’ve actually mapped out 500+ years of detailed price cycles for the global markets.

If you want to gain insight into the markets next big move or learn how our researchers attempt to stay ahead of the biggest market trends, then you owe it to yourself to visit www.TheTechnicalTraders.com to learn how we help our members create success and find great opportunities.

We can promise you one thing right now – the global markets are going to continue to be very interesting for technical traders over the next 10 to 20+ years. You don’t want to miss the opportunities that are setting up in the global markets and we strongly believe everything you are reading about cycles from others is superficial in structure and content.

As a technical analyst and trader since 1997, I have been through a few bull/bear market cycles in stocks and commodities. I believe I have a good pulse on the market and timing key turning points for investing and short-term swing traders. 2020 is going to be an incredible year for skilled traders. Don’t miss all the incredible moves and trade setups.

I hope you found this informative, and if you would like to get a pre-market video every day before the opening bell, along with my trade alerts. These simple to follow ETF swing trades have our trading accounts sitting at new high water marks yet again this week, not many traders can say that this year. Visit my Active ETF Trading Newsletter.

If you have any type of retirement account and are looking for signals when to own equities, bonds, or cash, be sure to become a member of my Long-Term Investing Signals which we issued a new signal for subscribers.

Ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

Chief Market Strategies

Founder of Technical Traders Ltd.