Massive Chinese debt and why they are on a gold buying binge!

China’s debt is a staggering $24 trillion with 247% of annual GDP as of last year, which is, in fact, an increase of an astounding 465%, within a decade. The total borrowing, by both the financial and non-financial sectors, was only 78% of the GDP in 2007 and has since increased to 309% of GDP, according to economists at Nomura Holdings Inc., led by Yang Zhao and Wendy Chen.

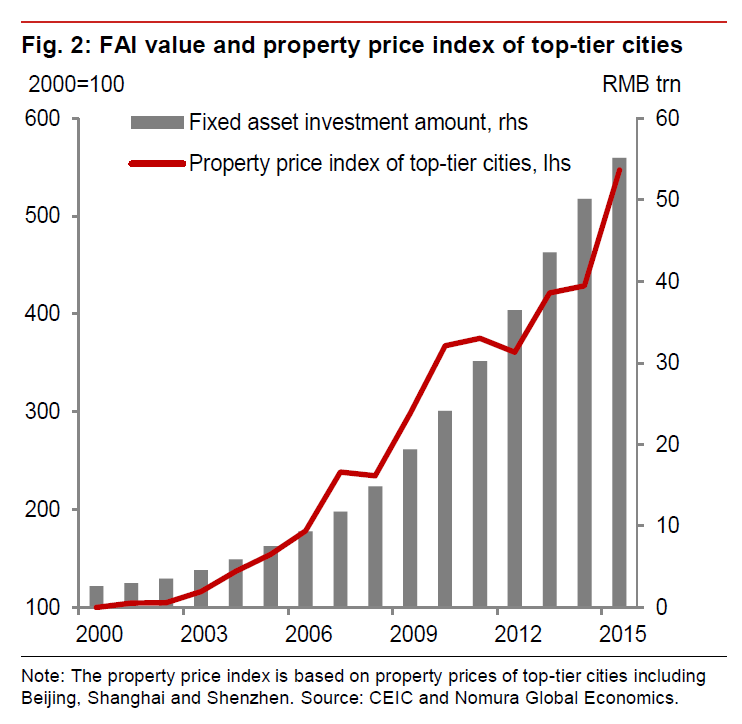

Although some naysayers believe that the leverage in China is still far below that of what the U.S. was in 2007 previous to the financial crisis. However, they neglected to note that the property sector has increased by 4.5 times, between 2000 and 2015, within the top-tier cities. Experience suggests that such a rise is both ‘unsustainable’ and ‘bubbly’. A sharp drop in the property prices will increase the leverage to astounding levels thereby threatening their economy.

Huge fiscal deficit challenge:

The IMF has forecasted that China will have a moderate budget deficit of 3%, which sounds very comfortable. The IMF has merely considered the governments’ debt so as to arrive at said figure, which accounts for less than 20% of public spending. The local governments and municipalities in China account for over 80% of public spending.

When the total figures are considered, the balloons to 10%, according to the IMF, whereas, Goldman Sachs believes that number is much higher being that of 15%. These numbers are far worse than the U.S.’s were directly before the financial crisis of 2008. Learn more here: fiscal deficit

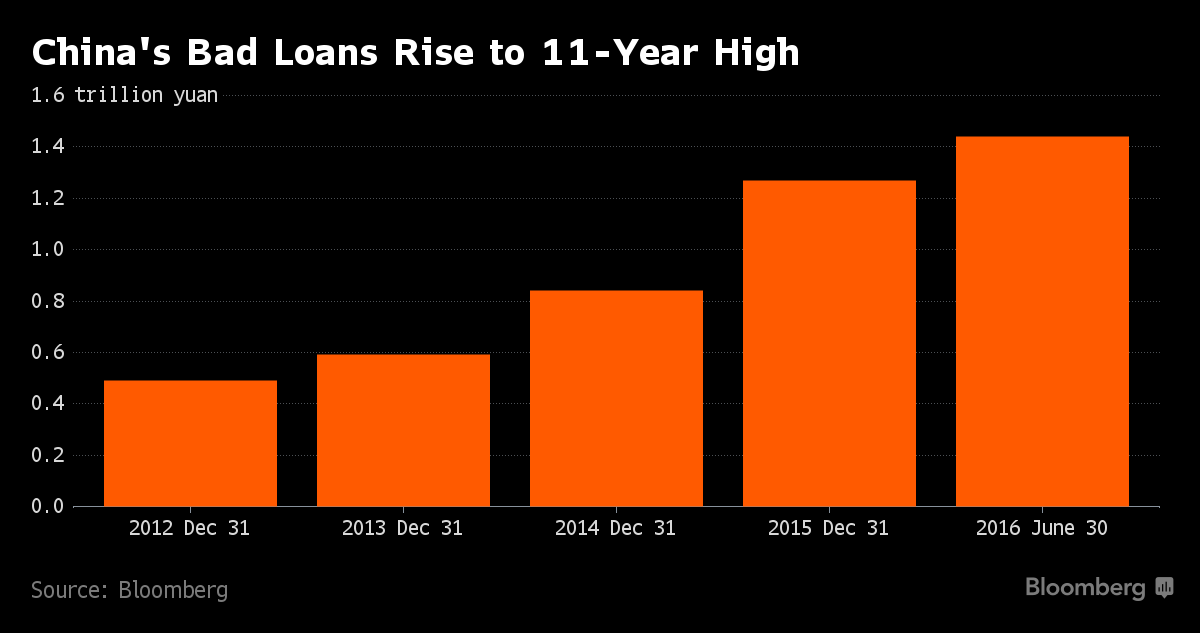

Most state-owned companies are taking on more debt in order to pay off their earlier debt. Bad loans soar as shown in the chart below. The government has not allowed any major firms to become bankrupt in order to keep their job numbers propped up. If the start to let companies fail unemployment numbers could skyrocket!

Growth is struggling:

With growth struggling, and in order to merely reach those of the beaten down estimates of the Chinese government, it appears highly unlikely that China will be able to manage their debt ‘overhang’.

In light of the forthcoming five-year congress of the communist party, the government will not want to push through unpopular reforms, although, they are indeed necessary. The Chinese debt binge has reached such a vast amount that the experts now believe that in order to raise the GDP by $1.00, China must take a credit of $4.00 which is most certainly a sign of an impending crash that will have both global repercussions and further consequences!

Major investors who have raised concerns about China:

Legendary investor, George Soros finds an “eerie resemblance” between the U.S., prior to the financial crisis, and the current Chinese situation. “It’s similarly fueled by credit growth and an eventually unsustainable extension of credit,” Soros told the Asia Society in New York in April, reports Bloomberg.

Similarly, BlackRock Chief Executive Officer Laurence Fink has also raised concerns about the Chinese debt.

The famous short seller Jim Chanos is short on China while stating that it “is the gift that keeps on giving on the short side,” reported CNBC, in May of 2016.

China shifting from dollars to gold!

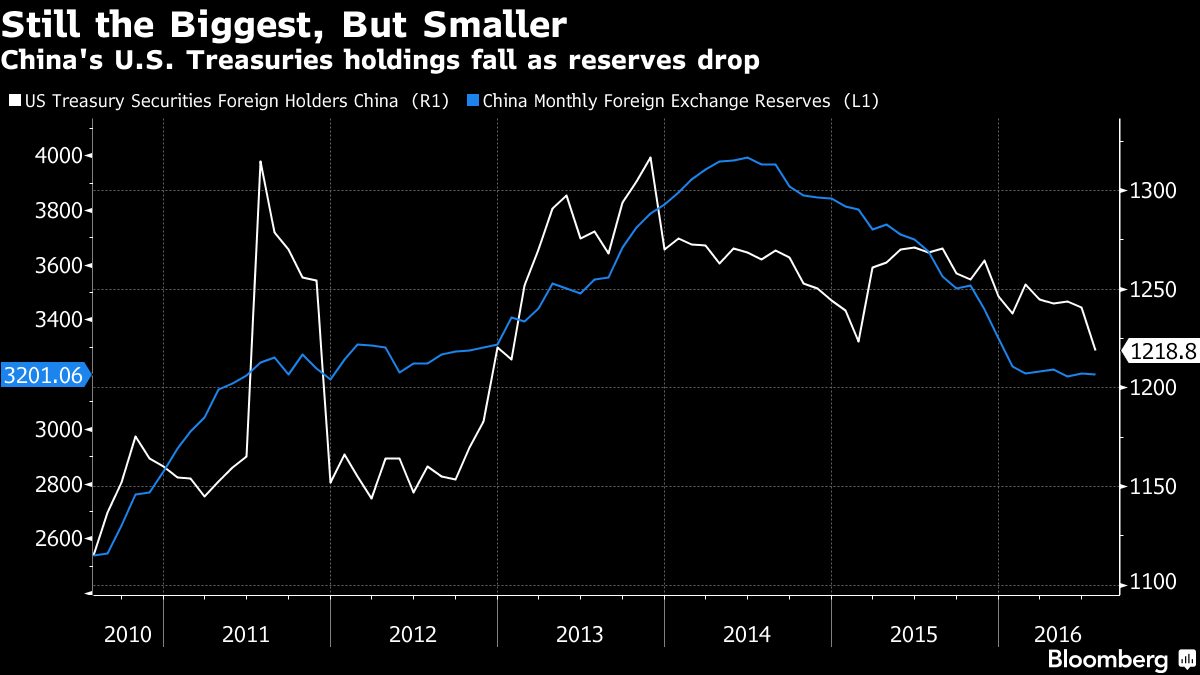

China is gradually reducing its’ holding in the U.S. treasuries. In July, it held $1.22 trillion of US bonds, notes and bills, which represents a drop of $22 billion since June of 2016. This is the largest drop, in three years, according to U.S. Treasury Department data which was released on Friday, September 16th, 2016.

There are many who believe that China’s mammoth holdings of US treasuries will restrict it from ‘dumping’ them. However, Bocom strategist Hao Hong said, “The gold reserve on the China balance sheet has almost doubled since 2009. By holding gold, and moving away from a US-dollar centric system, we actually require less U.S. dollars,” reports Zero Hedge.

China’s gold holdings, which was a paltry 395.01 tons, in the second quarter of 2000, has now risen sharply to 1,828 tons, according to the World Gold Council.

With the Chinese Yuan set to enter as the fifth currency in the International Monetary Fund’s SDR (Special Drawing Right) on October 1st, 2016, the Chinese are propping up the gold backed Yuan as a fierce competitor to the U.S. dollar!

“The recently-opened Shanghai Gold Exchange differs greatly from the London Gold Exchange in one fundamental area: In Shanghai, buyers take physical delivery of gold whereas London deals in paper-based gold futures contracts. In Shanghai, ‘what you buy is what you get’ whereas in the West, gold is a virtualized commodity,” Tom McGregor, Commentator and Editor at CNTV (China Network Television), told Sputnik.

Conclusion:

Similar to that of other developed nations, the Chinese debt has also reached ‘bubbly’ proportions. However, the Chinese are leaning towards gold, in a big way, as witnessed in their latest holdings. They know that, during the next crisis, those nations with a large gold backing will not only survive, but will become prosperous, as well!

China is most certainly going to increase their gold reserves even further, in the future. Imagine if only a portion of their U.S. treasury holdings are shifted to gold, the yellow metal will go parabolic. Therefore, keep an eye on gold and be well prepared to buy it when we reach that last dip, before the ‘bull run’.

Want to know where gold, silver and mining stocks are within their bull/bear market cycles? Or do you want to know when and how to take full advantage of these next major moves?

Follow me at www.TheGoldAndOilGuy.com

Chris Vermeulen