Markets Are Setting Up A Shake-Out – Be Prepared

Now that the April 21 ~ 24 Gold “momentum base” prediction that we’ve been discussing for the past 4+ months has past and appears to be accurate, we think it is time to start warning of increased market volatility and the potential for a market “shake-out” to happen. Last week was a key component to our future price predictions and market projections. We believed our proprietary price modeling systems were accurate and had latched onto a key component of the markets – the “momentum base” call in Gold for April 21 ~ 24 of this year. Remember, this original research post was made in September 2018 – over 7 months ago. We kept refining our research over the past 4+ months and warned, repeatedly, that this base in Gold would likely prompt a market shake-out over the next 30~60+ days.

The moves in the major markets, over the past few weeks, have been very telling. With the SPY and NASDAQ pushing to new all-time highs, strong earnings (overall) and the global markets setting up for another shoe to drop (at some point in the future), it leaves many questions for skilled traders. What’s going to happen next and what should we expect from price?

Well, we have a few simple answers for you regarding the next few weeks expectations as well as some bigger future predictions.

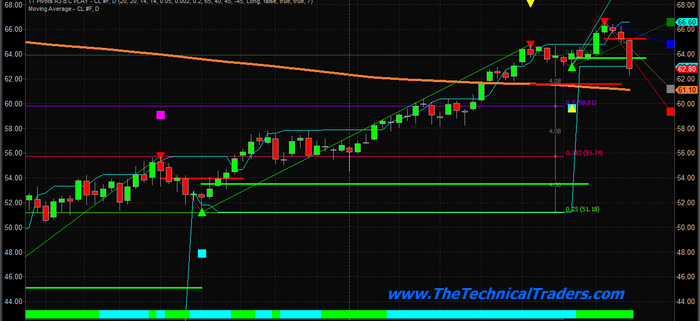

First, Crude Oil rotated dramatically lower on Friday. This was a big downward price rotation considering the Trump/Iran deal stance early on in the week. A disruption in the supply of Oil is often a driver of bigger market swings. I learned a long time ago to watch Gold and Oil all the time. These are often the leading commodities that reflect fear/greed in the markets and potential global unrest.

With Crude Oil slipping below a key Fibonacci trigger level (at $65.25) and another key Fibonacci trigger level sitting at $61.60, it seems rather obvious that Oil may slip back below $60 on deeper price rotation over the next few weeks which could lead to a bigger “shake-out” in the markets. We recently posted an article about how Oil could rotate lower and retest the sub $55 level (https://www.thetechnicaltraders.com/oil-may-be-setup-for-a-move-back-50/ ). At this point, a breakdown of oil prices below the $61.60 level would indicate the very strong potential for further downside price.

Precious metals have setup our momentum base/bottom on the dates we predicted over 4+ months ago (April 21 ~24). It is incredible that our ADL price modeling system can be so accurate so far into the future. Our proprietary price modeling systems provide us with an incredible advantage over most other research firms. The ADL and Fibonacci price modeling systems are predicting an upside price advance of at least 12% to 20% over the next few weeks. Read one of our original research posts here: https://www.thetechnicaltraders.com/45-days-until-a-multi-year-breakout-for-precious-metals/

The upside price potential in precious metals should not be overlooked. Additionally, the implication that some other global market malaise could unfold between now and the end of 2019 to drive precious metals prices even higher is fairly strong. We’ve been warning that Europe, China, and even the US markets could come under some pricing pressure or increased volatility as the US markets establish new price highs. It makes sense that traders would be preparing for another deep price rotation as prices near previous peak levels.

The Transportation Index rotated downward near the end of the week quite hard. Thursday, April 25, saw the Transportation Index fall over -250 pts (over -2.25%) after briefly breaching a key resistance level near $11,050. As we’ve been suggesting, the Transportation Index typically leads the markets by a few week/months and we follow it as a means of understanding future trends, risks and price rotations. Right now, the Transportation Index is suggesting increase price rotation and price volatility is likely to “shake-out” the markets for a while.

Lastly, the YM (Dow Futures), is setting up in a very narrow price channel below the recent all-time high established in early October 2018 (at $26,966). This decreased price volatility suggests that the US major indexes are setting up for a price breakout move. Congesting price channels suggest that price is stuck within a defined price range/channel and the ultimate breakout move will likely be a big breakout move to one side or the other. We have our suspicion as to which direction the move will likely be and we’ll share it with you now. Our longer-term analysis suggests that price will continue to push higher while attempting new all-time price highs. Our expectations that price volatility will increase throughout the rest of 2019 suggest we could see some very big price swings over the next 7+ months. But for right now, we believe this YM price channel will result in a brief upside price breakout that will push the YM price to new all-time highs (briefly) before retracing to form another extended sideways price channel near $27,000. Stocks, in general, are doing well as all our positions rallied last week with one stock jumping over 11% in one session.

Below, we have included a Daily YM chart that highlights this current price channel in MAGENTA. Pay very close attention to this channel as we near the eventual price breakout that will end this congestion. Weakness may prompt a “false breakout” to the downside, suckering in shorts, before a continued upside rally pushes prices over the $27,000 market, then stalling to set up the next Pennant/Flag formation. We’ve seen this type of price action many times in the past. Any downside “false breakdown” would prompt a big increase in volatility. This aligns with our broader market analysis. The push to the upside to establishing new all-time highs also aligns with our broader market analysis. Thus, we expect a pretty big series of price events to unfold over the next 2~5+ weeks.

If you like our research and want to learn how we can help you find and execute great trades, please visit www.TheTechnicalTraders.com. Get ready for the next big moves and learn how our team of skilled researchers and traders can help you stay ahead of these market moves.

Chris Vermeulen

www.TheTechnicalTraders.com