How To Take Advantage of Price Momentum – Must Read

Most traders just don’t have the time to track the market on an intraday basis. Crazy thing is I found a way that takes advantage of the intraday price action ever needing to look at a single intraday chart. Now we can swing trade using the daily charts but get the added performance of watching the intraday chart price action. What also makes this strategy exciting is that it works with virtually any time frame, thought each time frame and investment vehicle will require its own custom settings in order to track properly.

I call this strategy a Momentum Trend Crossover. It’s based on 2 moving averages that use intraday day, or intra-bar price action to calculate its value. And a Donchian channel to track recent highs/lows for protective stop placement.

Below are three charts showing how it looks and works.

Close Up Of Momentum Crossovers – 30 Minute Chart

The chart below clearly shows how the two average track very closely to another. They both have slight variations in how they calculate their value. In short, when the blue moving average crosses below the red the market is in distribution mode (down trend/sell bounces). And it’s the opposite for when the blue trend line crosses above the red which is accumulation mode (up trend/buy dips).

The Donchian channel is used for entry and protective stops. This indicator has three parts, the upper, middle and lower bands. It tracks the most recent highs and lows providing clear protective stop levels for each trend.

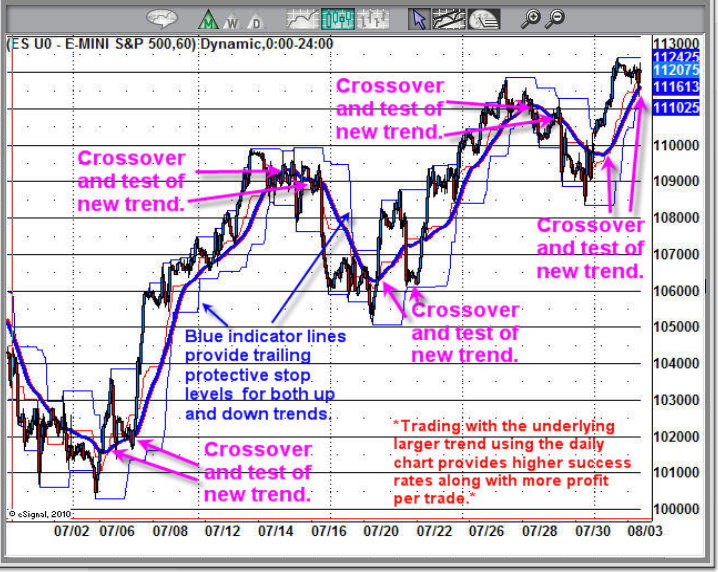

60 Minute Chart – Moving Average Trend Trading Chart

This is an example of a 60 minute chart which I find very helpful in catching decent size trades. As you can see when the moving averages crossover the market reverses direction. The really cool thing about this is that there is almost zero lag in this indicator. Many times the cross over happens before the price starts to drop.

For best results I always make sure the next larger time frame is in favor of the trade I am looking to take. Doing this increased the probability that more trades will become profitable.

30 Minute Chart – Short Term Trend Trading

This chart shows key reversals and low risk entry points using the Donchian channel and moving average price levels. I know these are intraday charts I am showing you but it can be used with daily weekly and monthly charts also. The intraday charts really show it in action and how choppy market conditions can be filtered to be smooth.

Momentum Trend Crossover Benefits:

• Can be applied to any investment vehicle – Stocks, ETFs, Futures, Currencies

• Customizable to work with any time frame

• The trend is your friend and this always keeps you inline with the trend.

• Eliminates the noise in the market during choppy conditions

• Reduces emotions because you instantly can see when to enter and exit positions

My Thoughts On This Trading Model

I have never been a fan of Moving averages because they lag the market so much. Over the years watching intraday price action in conjunction with the daily chart I found a way to make the moving averages carry over the intraday strength/weakness which in turn gives us an almost real-time, if not early signal about a trend change.

This is one of the strategies I use within my trading newsletters to help generate low risk trading signals. Takes some of the guess work out of trading, that’s for sure!

If you would like to get my trading alerts and learn more about this, please go to www.TheGoldAndOilGuy.com to see what I have to offer.

Chris Vermeulen

GET MY FREE WEEKLY TRADING REPORTS DIRECTLY IN YOUR INBOX

Leave a Reply

Want to join the discussion?Feel free to contribute!