Equities In A Tight Spot

I am issuing a “Red Flag Warning” To Financial Markets for the next six months of 2015. I have come to this conclusion that the next and most devastating financial collapse lies right in front of us. This information comes from my confidential sources who have shared this with me, and is supported by my 15+ years of trading and investment analysis experience, as well as the implementation of our financial forecasting models.

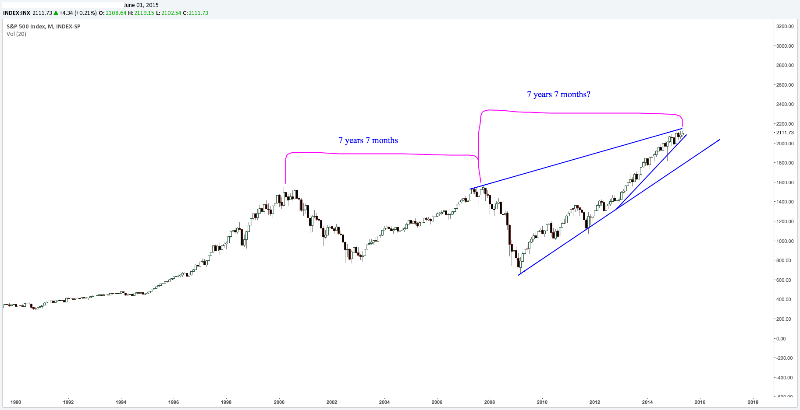

The SPX market internals/market breadth have started to correct itself and therefore the “rolling-over process” is now in progress. This is primarily due to the 7-year cycle. It has been slow, but steady. So far, the result has been to pressure prices into a short-term downtrend. This correction of the 7 year cycle will be significant! If we look at the first three trading days of 2015, the SPX was down 2.75%. The only other time in history that this occurred was when the SPX declined by more than 3% in the years 2000 and 2008.

Financial Markets do move in predictable waves, cycles and patterns. Economic cycles have enabled experienced analysts, as well as myself, to correctly forecast the timing of stock market peaks and stock market crashes/corrections over a very long period of time. These cycles are currently indicating that the U.S Financial Markets and the US Economy are about to enter a major downturn. These are repeating patterns that do occur in different fractals.

There are many cycles that I have studied over the last 15+ years. The 7 year cycle is most dominant and repetitive for our analysis and current application. We can look back at the most recent financial crisis which occurred in 2008 in which the stock market crashed, Lehman Brothers collapsed, and we were plunged into the worst recession that we had experienced since the Great Depression. Prior to that, the last time that the stock market experienced a major decline was during the bursting of the dot com bubble, seven years earlier. 2001 was a year of recession for the U.S. economy and of major problems for stocks. That was the year in which “9-11″ tragically occurred. Seven years earlier, in 1994, investors experienced the worst bond market of their lifetimes. Another seven years earlier brings us to 1987 in which most of us remember as “Black Monday”. These repeating patterns are well documented in history. The same price patterns appear, at any given time, from monthly, daily, hourly, even down to one minute charts. This is the reason why markets are “fractals”.

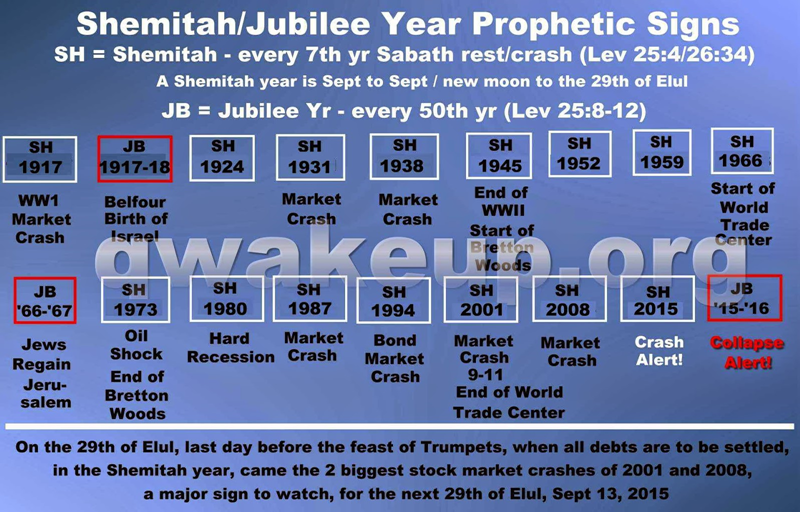

This current seven year cycle also aligns with the seven year “Shemitah cycle” that can be found in the Bible. The Sabbath year (shemita Hebrew: שמיטה, literally “release”) also called the sabbatical year or sheviit (Hebrew: שביעית, literally “seventh”) is the seventh year of the seven-year agricultural cycle mandated by the Torah for the Land of Israel and is still observed within contemporary Judaism. All of the great economic crashes in the U.S, including the Great Depression, have been in alignment with Shemitah years.

I first discovered a long term cycle when I came across “The Kondratieff Wave” while in my early years of studying finance and economics. It was developed by a Russian economist named Nikolai Kondratiev. Nikolai Kondratieff (Kondratiev), a Russian economist was the first to suggest that industrial economies followed a cycle of change

within business cycles which included “inflation”, the “expansion of the economy” and “deflation”, which is the contraction of the economy within a “business cycle”.

During these periods of decline that occur, in the long waves, a large number of important discoveries and inventions in the technique of production and communication have been made. These are applied on a large scale at the beginning of the next long upswing.

The originally estimated cycle length lasts 50 to 54 years. These are shifts over time between economic growth “expansions” and periods of economic declines of “contractions”.

This is my interpretation of the time frame.

I have defined 6 long economic waves (cycles) and each of them was initiated by a specific technological revolution:

- (1600-1780) The wave of the Financial-agricultural revolution

- (1780-1880) The wave of the Industrial revolution

- (1880-1940) The wave of the Technical revolution

- (1940-1985) The wave of the Scientific-technical revolution

- (1985-2015) The wave of the Information and telecommunications revolution

- (2015-2035?)The hypothetical wave of the post-informational technological revolution

The only thing predictable about todays’ global economy is the “K Long-Wave” economic cycle. This is the reason more and more analysts are embracing the “K Long-Wave Principle” as an unrivaled economic indicator, and the source for accurate economic forecasts.

Our clients will profit substantially from the use of this proven advantage of the “K Long-Wave Principle” This wave is characterized by four seasons: Winter, spring, summer and autumn. We are currently in the Economic Winter. We are in a global depression and experiencing an economic collapse during this period of time which is identical to the “roaring twenties”, but now it is similar to 1929. The last “Great Depression” lasted fifteen years and a World War to get out of that economic downturn.

My technical trader which is also a Capitol Hill insider went into development and research for a 5 year period of time 30 years ago. What was created was a financial forecasting model, which he implemented 25 years ago. It is a Predictive Model in its nature. It forecasts nearly every major market turn, within the U.S Financial Market. This gives you (my) private clients the EDGE which does not exist anywhere else. It signaled that we exit all U.S Market positions on November 25th, 2014 for putting new investment money to work in US Equities.

Since that period of time, in history, the markets have just been “channeling” and going into a neutral position and we have been sitting in a “cash position” for these respective markets, which was the optimal position to be in. When it has confirmed that the “TOP”, is in place, we will implement the proper position in which we will substantially obtain huge gains. Until this time arrives, I ask that you follow our weekend updates.

Both, the 7 year cycle and “The Kondratieff Wave” are occurring at the same time. This is a major occurrence that will take place very shortly.

Derivatives are going to play a major role in this next upcoming major financial crisis. When you start hearing that word, on the news, then you will realize that things have started to really unravel. “Too big to fail” banks in the U.S have over 250 trillion dollars of total exposure to derivatives while only having 9.8 trillion dollars in total assets.

Derivatives are one of the three main categories of financial instruments. The other two are stocks (equities or shares) and debt (bonds and mortgages).

When, not “if”, the derivatives market crashes, all U.S citizens will be responsible for bailing out the major derivatives clearing houses. According to The Dodd-Frank Act: Section 2, U.S. taxpayers will bare the brunt. This gives the Federal Reserve the power to provide “discount and borrowing privileges” to derivatives clearing houses in the event of a major derivatives crisis.

Derivatives almost caused the complete collapse of the insurance giant AIG back in 2008. This financial crisis is inevitable because the causes of the previous one have not been solved. The derivative markets are not regulated, and they continue to grow unchecked. The truth of this matter, is that there are no financial resources left. It is now out of control, and we just allowed it to get bigger and bigger and bigger. The Federal Reserve, the US Congress and President Obama have created this situation, in which, there is not enough money in the world to cover these debts.

Find out how to profit from the coming events here: http://www.thetechnicaltraders.com/GFWSS/

Chris Vermeulen