Emergency Technical Traders Market Crash Update & Video Analysis

The US stock market opened Sunday, March 8, 2020, dramatically lower. Oil collapsed 25% to near $30. Gold shot higher to levels just above $1700. All of the major US indexes were lower than 5%. As of this morning, the US major indexes are lower by 6.40%, and oil down 23%. Bonds are set to open 7-8% higher at this time.

As mentioned in yesterday’s update, we could see metals and miners get hit with margin calls, and silver took a beating last night down over 5%, and miners are down 5% in pre-market, so things could get uglier yet.

The war on oil has officially started. To me, it’s a typical bully/bad guy move. When everyone is bleeding, and in trouble like the financial markets, everyone’s mental state, and our health, the true bullies and bad guys (sharks) come out of the woodwork. Russia is being difficult and will keep production high for oil; the Saudis are giving out hug discounts on oil and jacking up their production to flood the market with their oil and take as much of the market share possibly. When blood is in the water, the sharks attack.

This oil war is going to devastate the USA and Canadian oil sectors and businesses if the price of oil trades between $20-35 per barrel, which I think is what will happen and could last a few years.

The US futures for stock hit a circuit breaker and halted futures trading of the Indexes once a 5% drop took place, but ETF and regular stocks will continue to trade. The next round of circuit breakers are only during regular trading hours and was implemented after the May 10, 2010, flash crash.

This new set of circuit breakers have never been hit before which are:

A drop of 7% stock halt for 15 minutes.

A drop of 13% stocks halt for 15 minutes.

A drop of 20% stocks halt for the rest of the session.

This is a huge breakdown in the US markets and indicates much greater weakness within the global markets and further concern that the COVID-19 virus may continue to disrupt the US and European markets (as well as others).

The potential that multiple billion-dollar disruptions in the US and other foreign markets, including travel, leisure, autos, hospitality, and many others, may see a continued decline in sales and incomes over the next 6+ months. We don’t believe we will truly understand the total scope of this COVID-19 virus event until possibly well after July 2020.

The crazy part is I’m in a little secluded town in Canada, and people are starting to panic and buy food and toilet paper for their bunker stash. Almost everyone I talked to this weekend while out snowboarding has been affected by manufacturing, trade show cancellations, travel restrictions, etc.. We are in a full out global crisis that seems to affect everyone in some way no matter their location, occupation, or business.

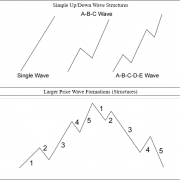

There will be some great opportunities to find and execute incredible trading opportunities – yet the risks are very high right now for volatility and price rotation. Think of the markets like a body of water in a severe storm. The waters are very choppy, unstable, and chaotic – just like the markets.

Unless you have the right information, skills, and vehicle to navigate these waters, there is a very high probability that a dangerous outcome could happen. I closed out our last position on Friday with our TLT bond trade for a 20.07% profit and we are 100% cash watching this market VS trying to survive it.

Right now, Cash is king.

Waiting for proper setups and understanding risks is critical. Timing your entries and targets is critical. Learning to stay away from excessive risk is essential.

We’ll scan the markets for you and find the best opportunities that set up over the next week.

We appreciate your loyalty and want to continue to deliver superior analysis and research. Please be well aware that the current market environment is very dangerous for traders. The VIX recently touched above 50. We believe it could reach levels above 75~90 still. These are incredible levels for the VIX.

WATCH VIDEO ANALYSIS

Stay tuned for more free info, but if you like what you read here and

watched then subscribe to the premium trading newsletter today and

get this information EVERY MORNING before the opening bell – CLICK HERE

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com