Compared To The USD, Auto Company Stocks Are On A Summer Vacation

Summer is here, and it’s time for a vacation. But this year, flight schedules are anything but reliable, and that new car for the road trip is probably not available at the local Toyota, Honda, Tesla, General Motors, Ford, etc dealership. Due to chip shortages and other issues, most car dealerships have little to no inventory to sell.

High inflation and rising interest rates combined with high gasoline prices are causing people to rethink or pay more attention to their monthly budget expenditures.

Furthermore, if you do decide to buy a used car, be prepared to pay top dollar. In some cases, a 3-year-old model may cost you as much as a new one. Historically autos almost always depreciate, but we are in an unusual market phenomenon where many used cars have appreciated significantly.

What about the auto company stocks themselves? Cash is looking great versus owning one of these auto brands.

Before we motor into the auto company stocks, let’s take a quick look at cash (the U.S. Dollar).

U.S. DOLLAR +18.81%

- U.S. Dollar making a new 14-year high

- 2020-2022 U.S. Presidential Cycle: USD appreciated +18.74% to date

- 2016-2020 U.S. Presidential Cycle: USD depreciated – 12.80%

- 2012-2016 U.S. Presidential Cycle: USD appreciated +37.20%

US DOLLAR INDEX • DXY • CAPITALCOM • WEEKLY

TOYOTA -26.93%

- January 2022 to present

- -$56.77 or -26.93%

- 22 weeks or 154 days down

- The bear market has more room to drop; if you own it consider selling on rallies and going to cash

TOYOTA MOTOR CORPORATION • TM • NYSE • WEEKLY

HONDA -27.57%

- August 2021 to present

- -$9.19 or -27.57%

- 47 weeks or 329 days down

- The bear market has more room to drop; if you own it consider selling on rallies and going to cash

HONDA MOTOR COMPANY, LTD. • HMC • NYSE • WEEKLY

TESLA -47.38%

- November 2021 to present

- -$582.69 or -47.38%

- 32 weeks or 224 days down

- The bear market has more room to drop; if you own it consider selling on rallies and going to cash

TESLA, INC. • TSLA • NASDAQ • WEEKLY

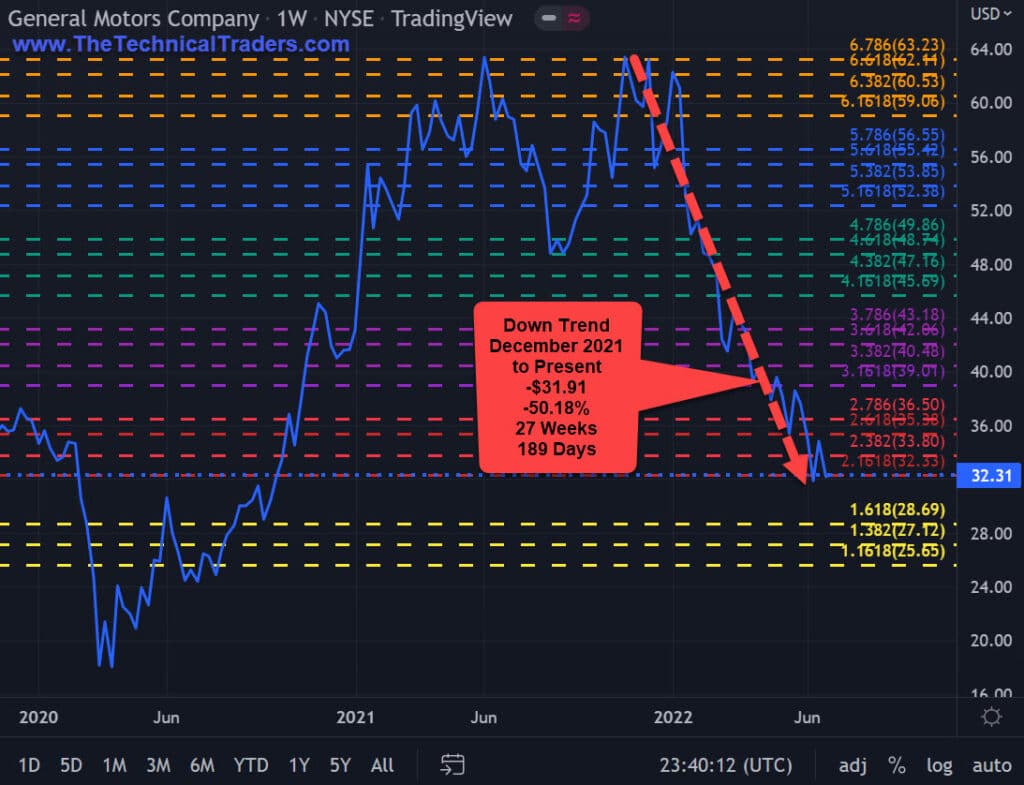

GENERAL MOTORS -50.18%

- December 2021 to present

- -$31.91 or -50.18%

- 27 weeks or 189 days down

- The bear market has more room to drop; if you own it consider selling on rallies and going to cash

GENERAL MOTORS COMPANY • GM • NYSE • WEEKLY

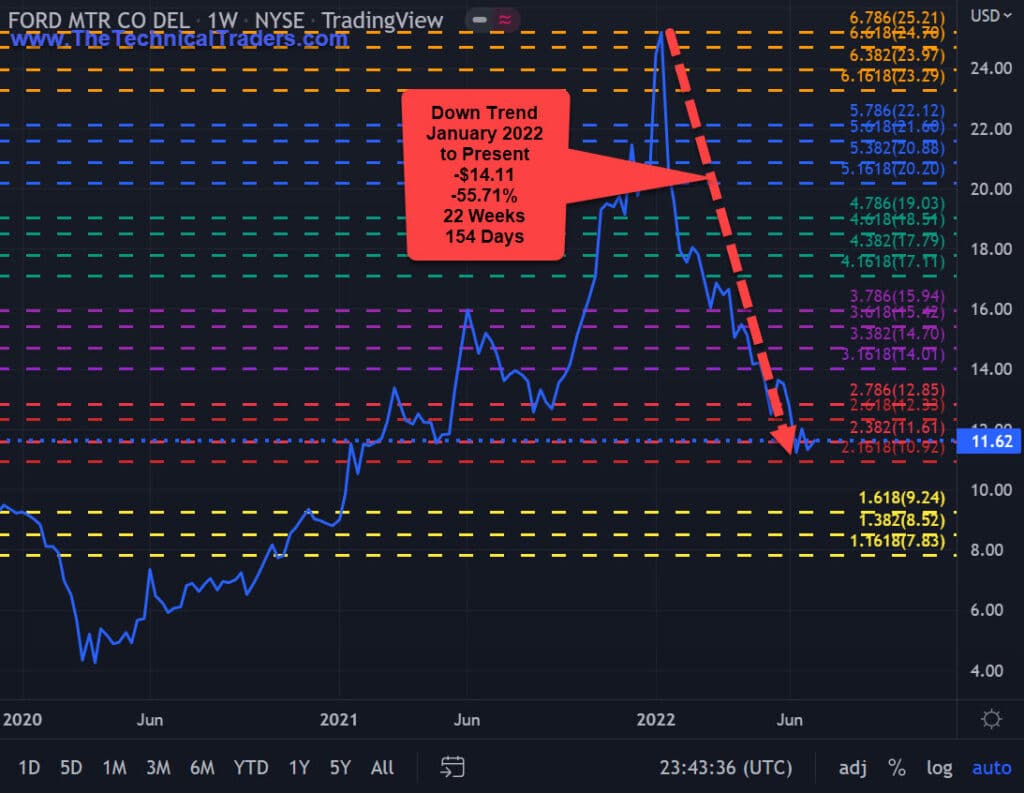

FORD -55.71%

- January 2022 to present

- -$14.11 or -55.71%

- 22 weeks or 154 days down

- The bear market has more room to drop; if you own it consider selling on rallies and going to cash

FORD MOTOR COMPANY • F • NYSE • WEEKLY

VALUABLE INSIGHTS FROM SUCCESSFUL TRADERS

Market Wizards by Jack D Schwager (www.Amazon.com) is packed with insights from successful traders who have shared their wisdom based on firsthand trading experiences. The following are some of Jack Schwager’s thoughts after his first set of super trader interviews that seem relevant for today’s market:

Jack Schwager:

- “Sometimes, being out of the market may be nearly as important to success as the investments made.”

- “The critical lesson is that it is important not to be involved in the market when the opportunities are not there.”

- “Many super traders consider risk control more important than the methodology.”

HOW WE CAN HELP YOU LEARN TO INVEST CONSERVATIVELY

At TheTechnicalTraders.com, my team and I can do these things:

- Reduce your FOMO and manage your emotions.

- Have proven trading strategies for bull and bear markets.

- Provide quality trades for investing conservatively.

- Tell you when to take profits and exit trades.

- Save you time with our research.

- Proved above-average returns/growth over the long run.

- Have consistent growth with low volatility/risks.

- Make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition by clicking on the following link: www.TheTechnicalTraders.com

Chris Vermeulen

Chief Market Strategist

Founder of TheTechnicalTraders.com