China’s Plunging Currency and What Impact It Left on the United States and the US Stock Market

Last Tuesday, the 11th of August, the central bank of China devalued the Chinese currency, i.e. the Renminbi (or yuan), against the US dollar by nearly 2%, making it one of the biggest moves ever since the Chinese currency announced that it was de-pegging from the US currency back in 2005.

The reason behind the Chinese government’s decision to devalue the country’s currency last Tuesday had a considerable lot to do with a significant number of factors regarding the global currency markets over the need to aid Chinese exporters craft their goods for lesser prices on the global market.

What Does It Actually Mean for a Nation to Devalue Its Currency?

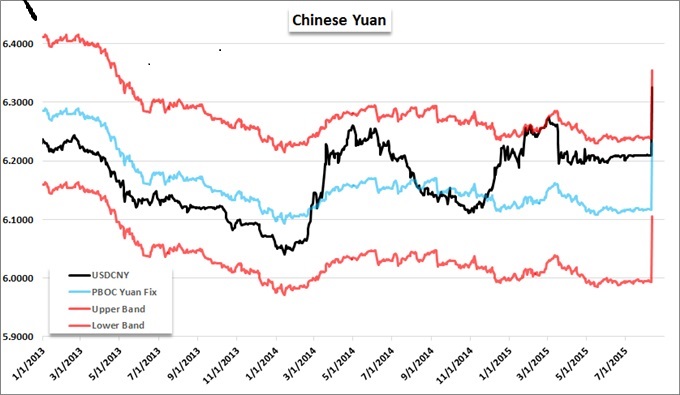

In global regards, devaluation is a decision carried out by the government in order to readjust the value of their currency downward, as compared to another standard or any other country’s currency. In the case of China, the central bank of the country had adjusted their daily trading brand for their currency. As per the regulations of the People’s Bank of China, the yuan is allowed to have a fluctuation of only 2% (either upwards or downwards) in accordance with a rate that is set by the authorities.

How the Chinese Government Played It Smart

If the Chinese government had devalued its currency, by, for example, 20%, it would have clearly been an effort to help increase exports for the country’s own benefit. On the contrary, however, a mere 2% devaluation is rather different; it largely keeps the Chinese currency at par with the currencies of its trading partners, keeping in mind that those currencies have lost their values against the US dollar.

In the rest of this article, we will be looking at what effects this plunge would have had on the United States and the US Stock Market, as well as some other major areas of concern that should be brought to light.

China’s Overall Impact on U.S. Growth Would Have Been Small

The action that was taken on Tuesday was not major enough to counter the Chinese currency’s appreciation over the span of the previous year, so it is unlikely that the growth rate of the country would have been effected all of a sudden on its own, or so were the assumptions made by some of the skeptics.

The People’s Bank of China presented a change in policy which shifted the government’s procedure for valuing the country’s currency to provide more importance to market prices within a system that is both a combination of market and state control. As such, currently we are still unsure as to what the 2% drop was all about and whether or not it is a part of a bigger picture that is being anticipated by the Chinese government. With that being said, the 5% drop would have never meaningfully influenced the Chinese exports.

The Aftereffect on the US Stock Market

Investors are still critical regarding the slow growth that China has been witnessing lately and what this could possibly portray for the world markets. As the Chinese currency plunged this week, so did the US stock prices. The primary area of concern for the consumer investors from now onward is the perception of Beijing’s apparent tactic for unexpected interventions in the currency markets.

According to Beijing, the move China made last week resulted due to a switch the country was trying to implement. This was the adaptation of a more market-oriented approach of the daily reference rate calculation. This rate is known for setting the value of the Chinese currency, the yuan (also called the Renminbi, or RMB).

Before this move, the authorities had based the rate in accordance with a poll which consisted of market makers. However, after the move was made, the authorities also considered taking into account the close of the day before this move. Other factors that were included were the rates of other major currencies, along with foreign exchange demand and supply.

With everything said and done, the important thing to note is the fact after the recent turn of events of the entire previous week, is that the yuan (RMB) is still only allowed a fluctuation of 2% either up or down as per the reference rate set by the People’s Bank of China.

Focusing on the “Now”

As events turned out on Friday, the 14th of August the Chinese central bank raised the value of its currency by 0.05% against the US dollar. This ended the three-day fall in an unexpected turn of events that consisted of a series of devaluations.

Regardless of this, however, there are still concerns regarding the slow growth in the country’s economy. The particular area of focus in this regard is China’s exports, as they require a serious stimulus which is only possible from additional cuts in the country’s exchange rate. Moreover, a swerve in recent figures also portrays that growth in a number of critical areas has further slowed down to a crawl in answer to contracting global trade. For example, the demand for one of the key measures of activity in China, i.e. oil, fell in tandem due to yet another drop in car sales. The event occurred this June when the exports took a tumble by 8.3%.

The most alarming point is the fact that China’s slump isn’t alone, as it is possibly spreading all across the Asian region. A perfect example is the shrinking of the Japanese economy back in April-June when the country’s exports dropped while the consumers also cut back on spending. Elsewhere, South Korea also went through its weakest growth in the last six years during the second quarter of the current year.

All in all, the devaluation of the yuan may have been a smart move for China, but for the rest of Asia, it does pose a rather disturbing outcome. Only time will reveal what’s next.

Let us share with you more interesting news, analysis and our trade alerts so you can be in control of your financial future.

Chris Vermeulen – www.TheGoldAndOilGuy.com – SPECIAL OFFER!