Last week the market sent us one of those special price spikes and member took full advantage of it for some quick and easy profits.

Spike Alert Chart

Next Day Spike Target Reached

The FED and the Corporate World understand that there is NO economic recovery. They need to keep feeding this ‘bull market’ with plenty of accommodative easing or this ‘bull’ will die. The FED will do whatever it takes to maintain this by cutting rates to near zero and below so as to spruce up the economy. However, these conventional policies that are being applied, by the FED, will not work seeing as the ‘deflationary forces’ have gained momentum. Global economies cannot sustain rate hikes. They will continue to use ‘expansionary monetary policy’, indefinitely: (https://finance.yahoo.com/news/trump-says-fed-chief-yellen-114816250.html).

The FED will no longer remain the ‘lone wolf’ Central Bank of and by keeping interest rates from going negative. The New Zealand Central Bank went through this same cycle, last year, at which time the economy could not sustain a rate hike, thus resulting in a quick cycle of rate cuts.

The ‘herd mentality’ is now at the stage where they must accept this as the ‘new norm’. They want to keep this illusion alive and do not want to deal with the reality.

When the FED does implement negative interest rates, the stock markets are going to soar so high that it will probably even shock the ‘bulls’. Thus, this is the reasoning that the market will not currently crash, but will experience sharp corrections. In this current market environment, I now recommend putting your money into precious metals.

This is one of the most detested ‘bull markets’ in history. The FED has provided this market with the ingredients that it needs to take it to the ‘bubble level’. The masses will embrace this market in the same manner as the corporate world has done so for the past eight years.

The main trigger for the financial crisis of 2008 was the issuance of mortgages that did not require down payments. The ease at which one could get mortgages, in the past, is what drove housing prices into unsustainable levels.

Currently, Barclays has launched the “Family Springboard Mortgage” which allows homebuyers the opportunity to purchase a property with a mere 5% deposit. In order to acquire this 5% deal, one will need guarantors to put up the cash, which, in turn, will be lost if one fails to repay the mortgage.

Ones’ family/guarantor must place savings which are equal to 10% of the purchase price into a Barclays Helpful Start savings account. No withdrawals are allowed for three years. The Helpful Start savings account pays the Bank of England’s’ base rate plus 1.5%, which currently means getting 2% interest, before taxes. This is not a lot of interest considering the lengthy period of time: (https://96972f03709b8f4a50b8e00099c51f3f482ee823.googledrive.com/host/0B6Tux37BPgNpRzctWDlCNXBfNW8/Mortgages/FamilySpringboardMortgage/P1242627640100.html).

When the FED starts purchasing private assets, this will negatively impact economic growth and consumers’ well-being. This reasoning is that the FED will use this power to keep failing companies alive and thus preventing the companies’ assets from being used to produce goods or services which are more highly valued by consumers.

The Reality:

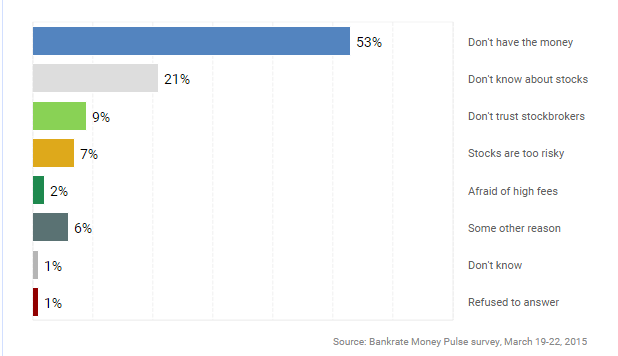

Over 50% of Americans do not have enough money to invest in stocks. The U.S., unfortunately, is currently appearing to be closer to that of a third world nation. Americans appear to be living hand to mouth thus making it more and more difficult for the average person to focus on his/her financial security. One in every seven Americans currently depend on food stamps in addition to using Food Banks, despite this ‘so-called economic recovery’.

The chart below from Banktrate.com illustrates that a total of 74% of individuals either do not have enough money to invest in the stock market or they do not know anything about stocks.

Random tests have already shown that the monkeys with darts fare better than most of these experts would.

The severe economic contractions which I have been speaking of, over the last couple of years, should now be evident to all of us, today. Productivity has now fallen to a negative rate. Investment has stalled and individuals have turned against globalization. Without productivity growth, capitalism becomes unpopular, globalization becomes unpopular and politicians, in turn, become unpopular.

Conclusion:

Gold and silver should be viewed as a form of insurance against the impending future financial disaster. We will also experience another disaster, sooner or later. I am not advocating that you should load up on bullion seeing as the precious metals sector has put in a bottom. I am referring to one obtaining insurance against another financial crisis that has the potential to be larger than the 2008 financial crisis was.

Every crisis also brings with it an opportunity, hence, one should make the best use of this opportunity before the price of gold and silver jump and value. It is better to invest now and see one’s investments multiply rather than waiting for the crisis to commence and pay a premium for insurance later.

Chris Vermeulen – www.TheGoldAndOilGuy.com

Although the seeds of the 2008 ‘financial crisis’ were sown at a much earlier period of time, the banking institutions continued to reap the benefits of ‘easy money’ until the financial crisis of 2008 negatively impacted the economy. The damage would have been much larger had U.S. taxpayer’s money not been used to bail out a large number of struggling banks and companies.

It is now more than eight years since the last financial ‘crisis’ has occurred and the current global situation is now beyond that of the financial ‘crisis’ of 2008. The Central Banks have been able to “kick the can down the road”, but that has only produced such vast proportions of debt that the next financial ‘crisis’ will not be manageable by the Global Central Banks.

European Banks have already begun the ‘crisis’:

The world’s riskiest bank, according to the U.S. Federal Deposit Insurance Corporation, is the Deutsche Bank.

The Bank’s leverage ratio of 2.68% is far worse than that of what the U.S. banks were before the 2008 ‘crisis’.

“In 2008, the 10 largest US banks held on average 3.1% tangible equity capital-to-assets. When the financial crisis hit, these institutions experienced significant losses and required extraordinary government support,” said FDIC Vice Chairman Thomas M. Hoenig, reports the Business Insider.

The recent fine of $14 billion demanded as RMBS settlement, by the U.S. authorities, is 80% of the bank’s market cap and twice the amount that the bank has in reserve for litigations. The Deutsche Bank is on the brink of collapsing and will need a full-fledged bailout immediately.

However, it is not only the Deutsche Bank. There are other European banks in trouble, as well. Primarily, it is the Italian banks which are under considerable pressure.

With a GDP of approximately €16.2 trillion (nominal), the European Banks have approximately €1.2 trillion of bad loans. The total non-performing loans, of the Italian banks, is around €360 billion which represents 20% of Italy’s GDP.

However, Italian and German counterparts both continue to spar over their struggling banks.

Recently, the Italian Prime Minister Matteo Renzi told Bundesbank Chief Jens Weidmann to sort out the mess of the German banks which have “hundreds and hundreds and hundreds of billions of euros of derivatives”, rather than worry about the Italian banks.

“The European Banking Authority said in July that the region’s banks may need as much as 470 billion euros ($524 billion) in additional MREL-eligible funding. The EBA sample consisted of 114 banks representing 70 percent of the EU’s banking assets, including lenders not overseen by the SRB,” said Elke Koenig, Single Resolution Board Head, who is the resolution authority for 142 banks, reports Zero Hedge.

Will U.S. banks be immune to a financial ‘crisis’ since their European counterparts are experiencing such a ‘crisis’?

Although the Fed Chairwoman Janet Yellen wants us to believe that the large U.S. banks are in a much better situation as compared to 2008, because they “have put in place numerous steps and have more in the works that will strengthen these [financial] institutions, force them to hold a great deal of additional capital, and reduce their odds of failure. There will be much lower odds that a so-called systemic firm will fail, and should that occur, we’ll have better tools to deal with it”.

What is the reality? Even before the 2008 ‘crisis’, the regulators of Bear Stearns, Wachovia, Washington Mutual, Fannie Mae and Freddie Mac all kept on assuring the public that the institutions were well-capitalized, until the very end.

Therefore, we cannot accept the regulator’s word as final and/or factual truth.

In a recently published paper for the Brooking Institute, authors, former Treasury Secretary Larry Summers and Harvard Ph.D. candidate in economics, Natasha Sarin found the opposite to be true!

“To our surprise, we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased,” the authors wrote.

The authors analyzed the six largest U.S. banks and fifty of the largest banks, around the world.

Conclusion:

Multiple experts like Steve Eisman have pointed out that the next financial ‘crisis’ will originate within the European Union. The politics of the region is unlikely to allow for a logical solution to the problems plaguing both the Italian and the German banks.

If one had believed the regulators, in 2007, they would have incurred huge losses. Similarly, if one believes that the American banks are immune to the next financial ‘crisis’, believe so at your own risk.

This is the beginning of “The Great Reset”, globally.

Learn more and profit from this big change in within the financial sector.

Chris Vermeulen – www.TheGoldAndOilGuy.com

It’s a knows fact that Sept and October are typically weak times for US stocks. Going back 37 years shows us the tendency for investors to sell and rebalance their portfolios to try and perform better during the final quarter.

But that’s not really the point of this article. The chart below shows a comparison between the SP500 bullish percent index and the SP500 index.

What is a bullish percent index?

in short, it’s based on point-and-figure charts and is one of the oldest and simplest stock charting tools to help identify the overall market strength or weakness. This index shows us how many stocks have generated a buy signal within the group of stocks its tracks.

Bullish Percent Index Proves Market Is Weakening:

The chart below shows the bullish percent index at the top and the SP500 at the bottom. I think the charts paint a clear picture of what is taking place. Currently the BPI is trending lower and picking up speed, while the SP500 index has been rising. This means fewer and fewer stocks are holding the stock market up and this typically ends with a sharp market correction. The last time we saw this was in June.

In fact, the drop in gold miners of 10% on Tuesday and the pullback in the SP500 I talked about it happening the day prior in a conversation with Kerry Lutz and also shared what we should expect next.

The Time of Year Stocks Correct:

Below is the seasonal chart of the SP500 taking into account all monthly price movements over a 37 year period. September is usually weak which it close lower for the month and so is October.

Concluding Thoughts:

In short, stocks are under pressure for the month of October. I expect increased volatility, and large intraday price swings to be more of the norm.

Stay tuned for my next update on the crashing metals and gold miners report next, and be sure to follow my trades at: www.TheGoldAndOilGuy.com

Chris Vermeulen

A financial system stability assessment report, from the International Monetary Fund (IMF), on one bank in Europe identified Deutsche Bank AG (NYSE: DB), as the TOP bank that poses the greatest systemic risk to the global financial system. Systemic risk was identified as a major contributing factor in the ‘financial crisis’ of 2008. This is essentially the risk of contagion by the failure of one firm leading to failures throughout its’ industry.

On February 24th I talked about DB (Deutsche Bank) as the next major bank to fail. Since then price has plunged 31% and its likely headed much lower yet.

IMF: The Top Bank That Poses Global Financial Risk Is DEUTSCHE BANK!

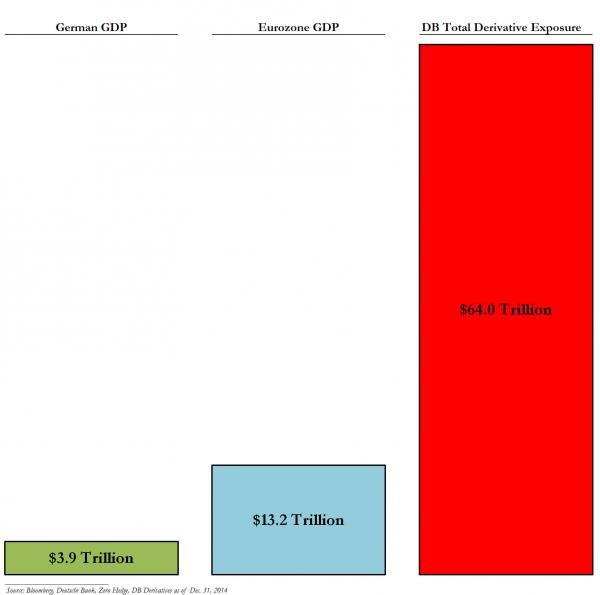

Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP!

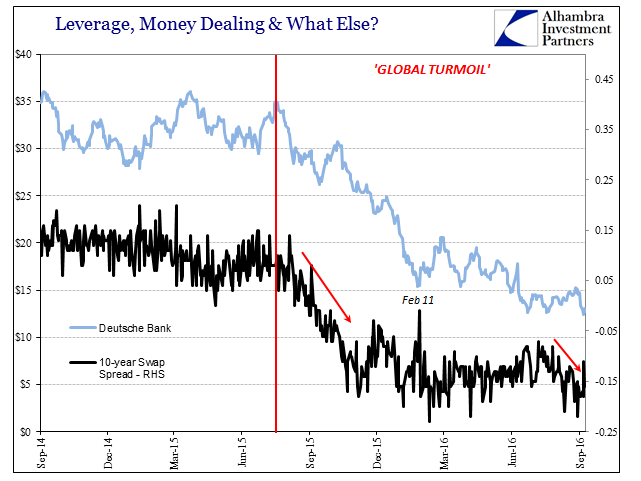

Deutsche Bank was historically one of the most respected banks in the world. Today, it is increasingly the subject of reports that it was on the verge of collapse which was primarily due to a massive exposure to derivatives estimated at $50 to $70 trillion. The bank has struggled continuously since the 2008 financial crisis, and its’ stock price, as of late July 2016, stood at a new seven-year low of just $14.57 per share which is less than 10% of its’ peak price, in 2007, before the ‘financial crisis’.

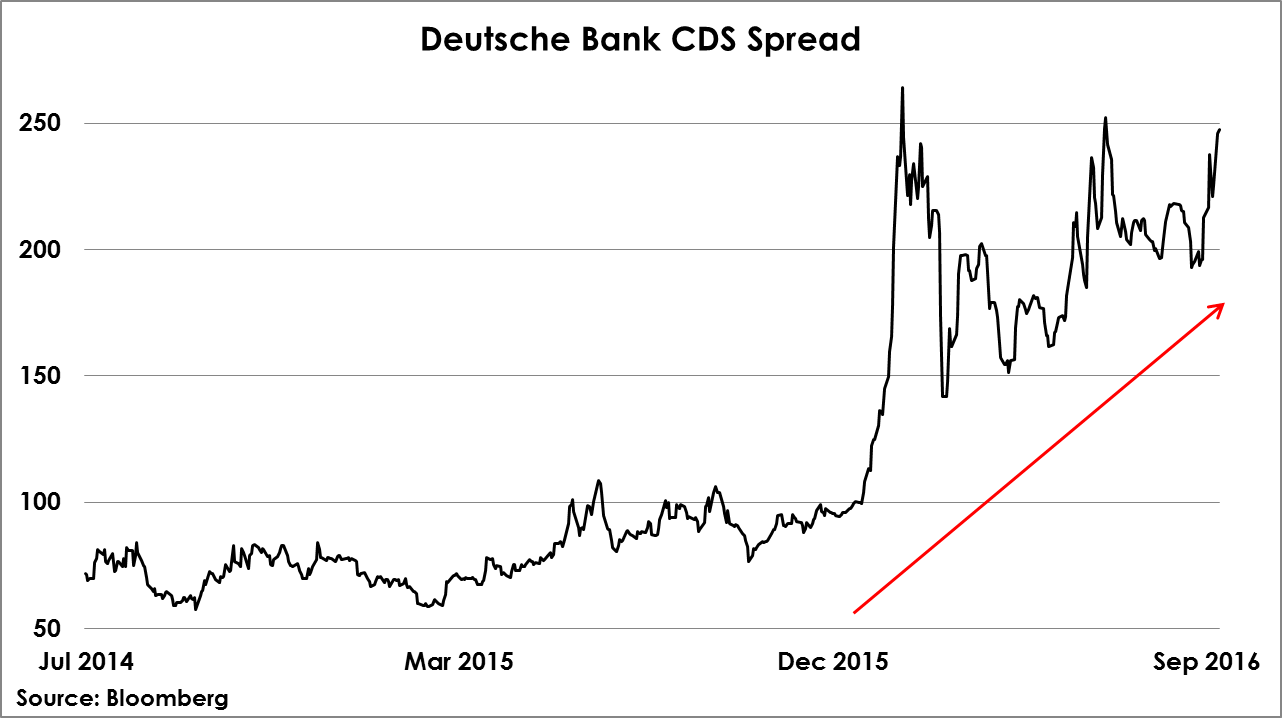

The bank’s CDS spread shot up to recent highs (a CDS is a measure of risk – higher is bad) and its’ share price hit 33 year lows. DB has been struggling in Europe’s negative interest rate environment. Negative interest rates have been crushing European and Japanese banks. Deutsche Bank’s CEO John Cryan told analysts that banks will increase fees and take other measures which will be passed on to customers.

The bank was hit with a $2.5 billion fine in October 2015 for its’ involvement in the LIBOR scandal regarding interest rate rigging. In January 2016, it announced a record loss of more than $6 billion for 2015 which is a stunning reversal from a 2014 profit of $1.6 billion. In my past articles, I issued a warning that Deutsche Bank was massively leveraged and that its’ problems were most probably insurmountable. In June 2016, the Fed announced that Deutsche Bank had failed its’ stress test for the second year in a row. The bank was also hit by the BREXIT decision seeing as it derived nearly 20% of its’ revenues from the United Kingdom.

Does Deutsche Bank Have Similarities to Lehman?

The biggest problem that Deutsche Bank faces is excessive leverage on its’ balance sheet. It faces insurmountable challenges from poor-performing core businesses and a lack of capital. I believe that the company ultimately must raise more equity capital to solve its’ leverage problems. Deutsche Bank’s valuation highlights the market’s pessimism. As of June 15th, 2016, the bank traded at 27% of tangible book value, which means that the company is worth less than its’ liquidation value.

In 2008, failures at Lehman Brothers and American International Group Inc. (NYSE: AIG) led to a run on banks and imperiled the financial system. Similarly, a failure at Deutsche Bank will have catastrophic consequences for the banking system during 2016.

The U.S. Department of Justice (DOJ) has ordered Deutsche Bank AG (DB) to pay $14 billion in order to settle claims of miss-selling mortgage-backed securities. Deutsche Bank said it would fight a $14 billion demand by the U.S. Department of Justice to settle claims that it miss-sold mortgage-backed securities which raises questions about the future of Germany’s largest lender.

The bank’s market value is about $18 billion. A pending fine of $14 billion is not a good sign. The bank, which is already battling multiple legal cases, has only around $6 billion in its’ litigation reserves. Therefore, paying a $14 billion fine would seriously impact the capital structure of the bank. It is important to note that Deutsche Bank has already been struggling in terms of profitability.

The Destruction Of An Illusion:

Last Monday, September 26th, 2016, their stock crashed yet again; down another 6%. Its’ bonds have slumped, while the cost of credit default ‘swaps’ are essentially a way of hedging against a collapse. It all has a very 2008 deja vu feeling to it.

Markets should be bracing themselves for the worst outcome. The European ‘debt crisis’ will create long-term systemic risks for ALL banks. Shares in all European banks continue to lag while at the same time U.S. indexes are making all-time highs!

Deutsche Bank has struggled in Europe’s negative interest rate environment and very recently the German Chancellor Angela Merkel has ruled out a government rescue of the bank. Deutsche Bank has the second largest ‘derivative’ book in the world while behind JP Morgan and that is indeed a serious concern. If the viability of Deutsche Bank is put in jeopardy, many other Euro banks will go under, as well, which would induce “global turmoil” reminiscent of 2008. The IMF has highlighted Deutsche Bank as the most important net contributor to ‘systemic risk’. Once confidence is lost, a bank is in big trouble. If Deutsche Bank does go under, it will most likely take Merkel with it and quite possibly the euro as well!

This is Your Biggest Buying Opportunity Of Your Life!

The difficulty in identifying asset bubbles is directly related to credit expansion. The problem is not the asset bubbles, whether they be in stocks, housing, or student loans. This is merely a symptom of a deeper condition. The real threat is the underlying credit expansion by easy monetary policies that has created these asset bubble problems in the first place.

Every crisis also brings an opportunity with it, hence, lets’ make the best use of the opportunity before the price of gold and silver blows through the roof. It is better to invest now and see our investments multiply, instead of waiting for the crisis to start, as, by then, more than half of the rally would be behind us.

Follow my trades and long-term investment position at www.TheGoldAndOilGuy.com

Chris Vermeulen

China’s debt is a staggering $24 trillion with 247% of annual GDP as of last year, which is, in fact, an increase of an astounding 465%, within a decade. The total borrowing, by both the financial and non-financial sectors, was only 78% of the GDP in 2007 and has since increased to 309% of GDP, according to economists at Nomura Holdings Inc., led by Yang Zhao and Wendy Chen.

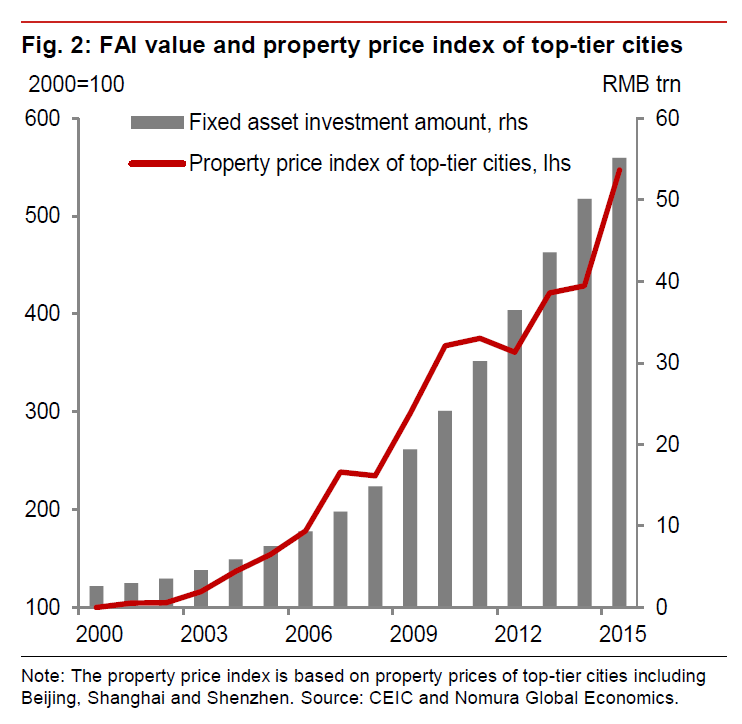

Although some naysayers believe that the leverage in China is still far below that of what the U.S. was in 2007 previous to the financial crisis. However, they neglected to note that the property sector has increased by 4.5 times, between 2000 and 2015, within the top-tier cities. Experience suggests that such a rise is both ‘unsustainable’ and ‘bubbly’. A sharp drop in the property prices will increase the leverage to astounding levels thereby threatening their economy.

Huge fiscal deficit challenge:

The IMF has forecasted that China will have a moderate budget deficit of 3%, which sounds very comfortable. The IMF has merely considered the governments’ debt so as to arrive at said figure, which accounts for less than 20% of public spending. The local governments and municipalities in China account for over 80% of public spending.

When the total figures are considered, the balloons to 10%, according to the IMF, whereas, Goldman Sachs believes that number is much higher being that of 15%. These numbers are far worse than the U.S.’s were directly before the financial crisis of 2008. Learn more here: fiscal deficit

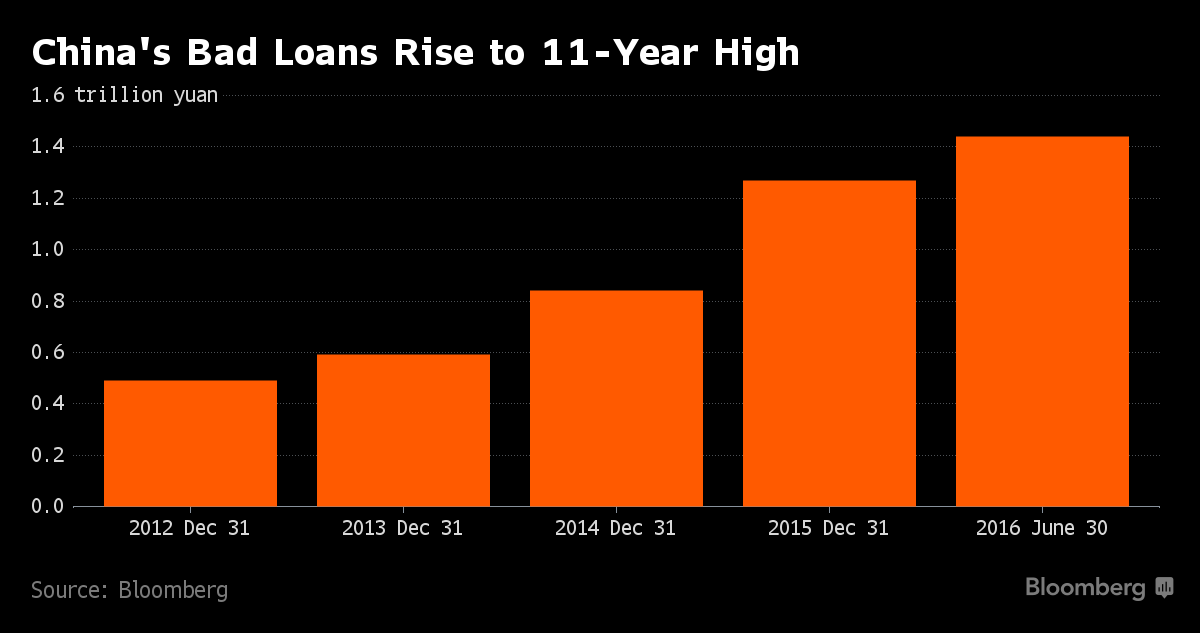

Most state-owned companies are taking on more debt in order to pay off their earlier debt. Bad loans soar as shown in the chart below. The government has not allowed any major firms to become bankrupt in order to keep their job numbers propped up. If the start to let companies fail unemployment numbers could skyrocket!

Growth is struggling:

With growth struggling, and in order to merely reach those of the beaten down estimates of the Chinese government, it appears highly unlikely that China will be able to manage their debt ‘overhang’.

In light of the forthcoming five-year congress of the communist party, the government will not want to push through unpopular reforms, although, they are indeed necessary. The Chinese debt binge has reached such a vast amount that the experts now believe that in order to raise the GDP by $1.00, China must take a credit of $4.00 which is most certainly a sign of an impending crash that will have both global repercussions and further consequences!

Major investors who have raised concerns about China:

Legendary investor, George Soros finds an “eerie resemblance” between the U.S., prior to the financial crisis, and the current Chinese situation. “It’s similarly fueled by credit growth and an eventually unsustainable extension of credit,” Soros told the Asia Society in New York in April, reports Bloomberg.

Similarly, BlackRock Chief Executive Officer Laurence Fink has also raised concerns about the Chinese debt.

The famous short seller Jim Chanos is short on China while stating that it “is the gift that keeps on giving on the short side,” reported CNBC, in May of 2016.

China shifting from dollars to gold!

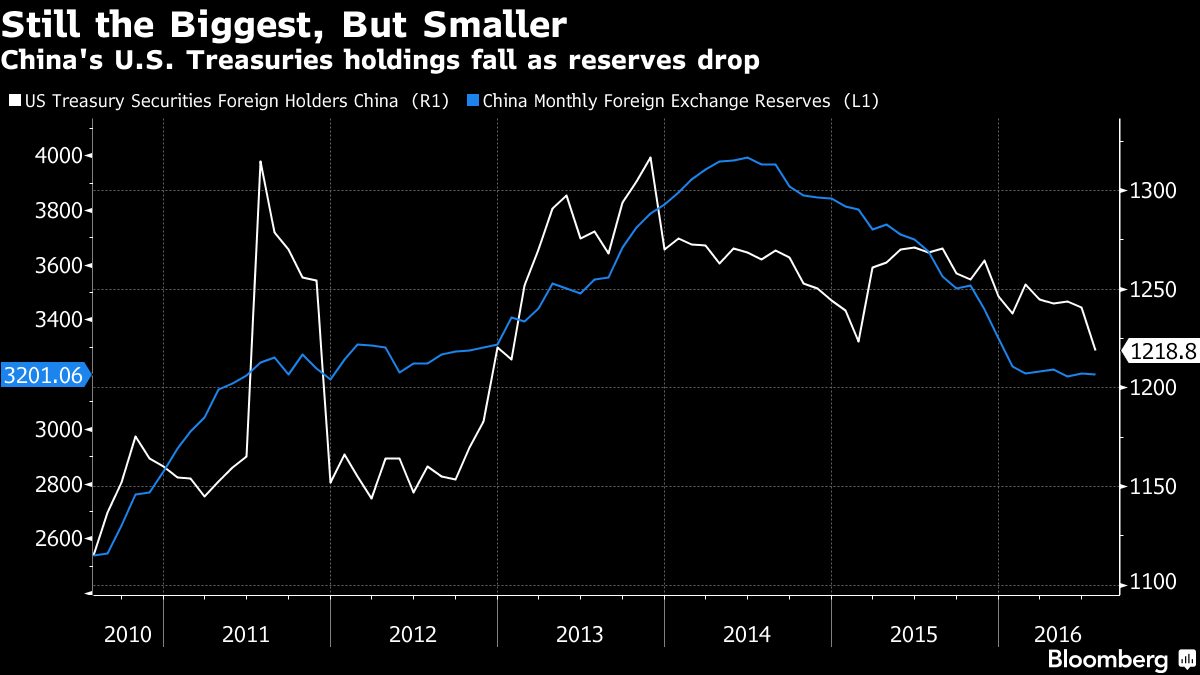

China is gradually reducing its’ holding in the U.S. treasuries. In July, it held $1.22 trillion of US bonds, notes and bills, which represents a drop of $22 billion since June of 2016. This is the largest drop, in three years, according to U.S. Treasury Department data which was released on Friday, September 16th, 2016.

There are many who believe that China’s mammoth holdings of US treasuries will restrict it from ‘dumping’ them. However, Bocom strategist Hao Hong said, “The gold reserve on the China balance sheet has almost doubled since 2009. By holding gold, and moving away from a US-dollar centric system, we actually require less U.S. dollars,” reports Zero Hedge.

China’s gold holdings, which was a paltry 395.01 tons, in the second quarter of 2000, has now risen sharply to 1,828 tons, according to the World Gold Council.

With the Chinese Yuan set to enter as the fifth currency in the International Monetary Fund’s SDR (Special Drawing Right) on October 1st, 2016, the Chinese are propping up the gold backed Yuan as a fierce competitor to the U.S. dollar!

“The recently-opened Shanghai Gold Exchange differs greatly from the London Gold Exchange in one fundamental area: In Shanghai, buyers take physical delivery of gold whereas London deals in paper-based gold futures contracts. In Shanghai, ‘what you buy is what you get’ whereas in the West, gold is a virtualized commodity,” Tom McGregor, Commentator and Editor at CNTV (China Network Television), told Sputnik.

Conclusion:

Similar to that of other developed nations, the Chinese debt has also reached ‘bubbly’ proportions. However, the Chinese are leaning towards gold, in a big way, as witnessed in their latest holdings. They know that, during the next crisis, those nations with a large gold backing will not only survive, but will become prosperous, as well!

China is most certainly going to increase their gold reserves even further, in the future. Imagine if only a portion of their U.S. treasury holdings are shifted to gold, the yellow metal will go parabolic. Therefore, keep an eye on gold and be well prepared to buy it when we reach that last dip, before the ‘bull run’.

Want to know where gold, silver and mining stocks are within their bull/bear market cycles? Or do you want to know when and how to take full advantage of these next major moves?

Follow me at www.TheGoldAndOilGuy.com

Chris Vermeulen

The FED has not followed through on their numerous promises of a rate increase that Yellen and other FED officials have made over the past several years. She spoke about purchasing assets of private companies and also mentioned that the FED could modify its inflation target.

Investors will most likely purchase shares in companies whose assets have been purchased by the FED since it is likely that Congress and federal regulators would treat these companies as “too big to fail.” Federal ownership of private companies would also strengthen the movement to force businesses to base their decisions on political rather than economic considerations.

Politicians will never restore sound money policies unless forced to do so by either an economic crisis or a shift in public sentiment, not because a crisis leaving Congress with no other choice!

The failure of the FEDs’ eight-year spree of money creation through quantitative easing and historically low interest rates have failed to “restart” the failing economy. They continue to add new tools to “artificiality inflate” the stock bubble. They will stop at nothing as they discuss implementing NIRP.

The collapse of the “fiat system” will not only cause a major economic crisis, but also the collapse of Capitalism as we knew it. Congress has also failed the American people and its’ economy by refusing to consider meaningful spending cuts, it will not even pass legislation to audit the FED.

The FED has lost even more of its ‘Credibility’!

Governor Fischer has lost all his credibility. He predicted four rate hikes at the beginning of the year for 2016. His speech on August 21th, 2016 on the slowdown in productivity: “We just don’t know.” Last week, he was down to two rate hikes for the year.

The perceived first takeaway on the meeting at Jackson Hole was the one that made all the headlines. She is joining the “chorus” of FED officials who have been saying it is time for another rate hike: “Indeed, in light of the continued solid performance of the labor market and our outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” This appears to be the FEDs’ new “mantra”. She added, “And, as ever, the economic outlook is uncertain, and so monetary policy is not on a preset course. When shocks occur and the economic outlook changes, monetary policy needs to adjust. What we do know, however, is that we want a policy toolkit that will allow us to respond to a wide range of possible conditions.” The FED now calls that “forward guidance.” In other words, they just do not know!

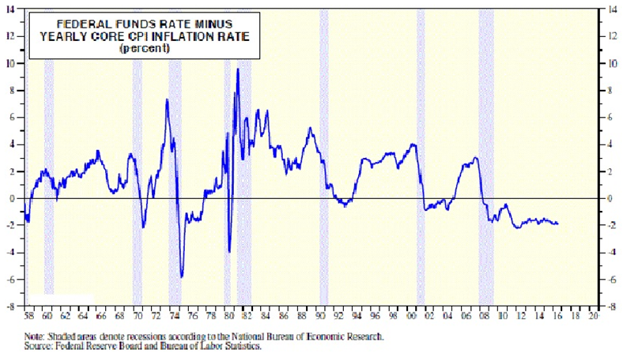

She did mention that QE purchases could be broadened to other assets. The real FED FUND rate has been trading deeply “negative” since 2008.

Negative Interest Rate Policy (NIIRP) Is Dangerous!

Yellen has now established the fact that it is legal for the FED to authority the use of NIRP. She has now put it into her tool box and is developing specific plans for implementing it.

The consensus is dangerously wrong by relying on flawed theory and flawed policy assessment. NIRP draws on fallacious pre-Keynesian economic logic that asserts interest rate adjustments can ensure full employment. The consensus is dangerously wrong, resting on flawed theory and flawed policy assessment. A negative nominal rate on money being held by your bank, can be thought of as a form of a tax on deposits that lowers “real wealth” and negative wealth effort on consumer spending and “aggregate demand”.

Conclusion:

Gold in your portfolio:

Investors should consider doubling their gold allocations amid negative interest rates. The long term effects of these policies are unknown, but I see discouraging side effects: unstable asset price inflation, swelling balance sheets and currency wars to name a few. Looking forward, government bonds are likely to have limited upside, due to their low-to negative yields

Amid higher market uncertainty:

We have entered a new and unprecedented phase in monetary policy. Central Banks in Europe, Japan and soon in the United States have implemented Negative Interest Rate Policies (NIRP). Investors, including long term investors, should assess the implications of holding bonds with negative return expectations on portfolio composition and risk management.

My analysis shows that Investors will benefit from increasing their gold holdings up to 2.5 times, depending on the asset mix, even under conservative assumptions for gold. In addition, we expect that demand for gold as a portfolio asset may structurally increase due to NIRP.

The only “recovery” that we have experienced has been an artificially inflated recovery on Wall Street. For the rest of the country, our long-term economic decline continues.

Secular investors should start turning their attention to commodities and precious metals. Golds’ bull market is far from over. The volatility in gold in recent days is principally due to sharp fluctuations in the expected path of US rates amid surprises in the macro data and diverge ring comments from FED officials. The recent consolidations were fueled by profit taking will end shortly. The next FED meeting will result in more dovish FED speech resulting in new and more purchases.

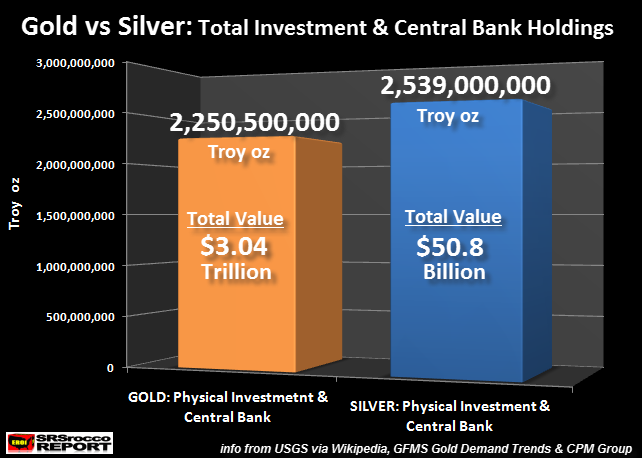

When investors realize that they are holding potentially worthless currencies, the big money will rush into the precious metals sector. Consider this, the total world’s investment holdings in silver are a paltry $50.8 billion, compared to $3.04 trillion in gold, as shown in the below.

Did you know that the hedge funds alone manage around $2.7 trillion, according to Barclay Hedge data? Even if a small portion of the trillions sloshing around out there, decides to enter into silver, the “white metal” will shoot through the roof.

The difficulty in identifying “asset bubbles” is directly related to credit expansion. The problem is not the asset bubbles, whether they be in stocks, housing or student loans. This is merely a symptom of a deeper condition. The real threat is the underlying credit expansion by easy monetary policies that has created these “asset bubble” problems in the first place.

Follow along with me as I navigate the financial markets for both short term swing trades and my long term investing positions: www.TheGoldAndOilGuy.com

Chris Vermeulen

The cycle since 2009 has been different from other market cycles, throughout history, in only one significant manner. That having been said, it is the Global Central Banks that have intentionally pushed interest rates to zero and below. This encouraged investors to speculate in the equity markets which have now become ‘dangerously overvalued, overbought, as well as ‘over bullish’ extremes according to all measures. In my opinion, this has “deferred” and not eliminated the disruptive unwinding of this “speculative” episode.

They have encouraged a “historic expansion” of public and private debt burdens with equity market overvaluations that rivals only those of the 1929 and 2000 extremes on reliable valuation measures. These brazen experimental policies, of Central Banks, have amplified the sensitivity of the global financial markets to “economic disruptions” and “distortions of value” in relation to investor risk aversion.

It is very clear that a zero interest rate policy has encouraged yield-seeking speculation by investors. As I have previously discussed, in many of my past articles, I detailed that monetary easing “in and of itself” does not “support” the financial markets. ‘Easy money’ merely stimulates speculation while investors are already inclined to embrace even more risk. The actions of the FEDs’ aggressive and persistent ‘easing’ will fail to prevent this “market collapse”.

Any financial professional who has any understanding of how securities are priced, should know that elevating the price that investors pay for financial securities does not increase “aggregate wealth”. A financial security (stocks) are nothing but a claim to some future set of cash flows. The actual “wealth” is embroiled in those future cash flows and the value-added production that generates them. Every security that is issued MUST be held by someone until that security is retired. Therefore, elevating the current price which investors pay for a given set of future cash flows simply brings forward investment returns that would have otherwise been earned later on. The FED is leaving “poorly-compensated” risk, on the table, for the future!

The total debt of the United States has reached gigantic proportions well beyond 2008 – CLICK HERE

The crisis ended precisely when, in the second week of March of 2009, the Financial Accounting Standards Board (FASB) responded to Congressional pressure and changed rule FAS157 so as to remove the requirement for banks and other financial institutions to mark their assets to market value. The mere stroke of a pen has eliminated any chance of widespread defaults by making balance sheets look financially stronger. The new balance sheets may be great, in the short-term, but ultimately have become weapons of “mass destruction”.

The Race to Debase Continues…

As of September 2nd, 2016, the BLSBS “disappoints” with a print of just 151,000 “jobs”. This will eliminate the possibility of a FED FUNDS increase, however, do not be surprised if some FED officials emerge to tell you otherwise, as we are already experiencing some counter-intuitive moves within several of the “markets”.

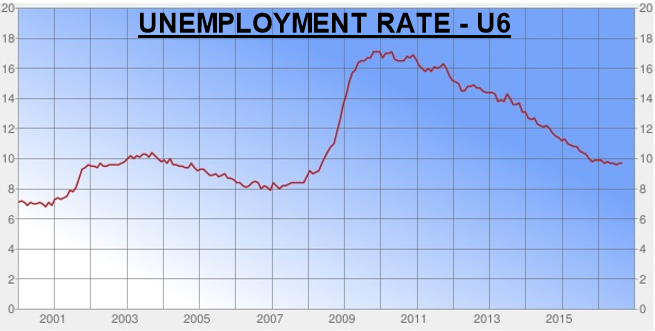

The true unemployment rate is ACTUALLY U-6! Consequently, the U-6 rate more accurately reflects a natural, non-technical understanding of what it means to be unemployed. Including discouraged workers, underemployed workers and other people who exist on the margins of the labor market, the U-6 rate provides a broad spectrum of the “underutilization” of labor within the country. In this sense, the U-6 rate is the TRUE unemployment rate which is close to 10%.

U-6 Unemployment Rate

Concluding Thoughts:

In short, this incredible bull market is stocks which we have embraced since 2009 is quickly nearing its end. The FED’s mass easy money policies, stock buyback programs, accounting rule changes have simply masked/covered up most of the financial mess people, business and global economies are in.

Eventually all these tactics to cover-up and kick the financial-can down the road will start to fail. One they start failing things will get really ugly fast for the entire economy for those not knowing how to avoid and profit from market weakness.

If you would like to learn more about how to take advantage and profit from tough times, follow me at www.TheGoldAndOilGuy.com

Chris Vermeulen