This single signal alone is absolutely screaming that a major financial crisis is imminent: Read Full Article Click Here

Read Exclusive Article On CNA-Finance: http://cnafinance.com/the-global-depression-and-deflation-is-currently-underway/7130

Back in August I wrote about MGX Mineral Inc. (Symbol CSE: XMG). There has been some great progress with this company and things continue to look even better.

Technical analysis and trading is my passion and getting involved in new companies which have a quality product, proven management, and have the right timing for entering a market which is close to starting a new bull market is one of the most exciting types of long term investments to watch unfold.

Don’t get me wrong, investments are just that… long term, and take years to unfold, but if you are positioned with the right company at the right time returns can be life changing 3-5 years down the road.

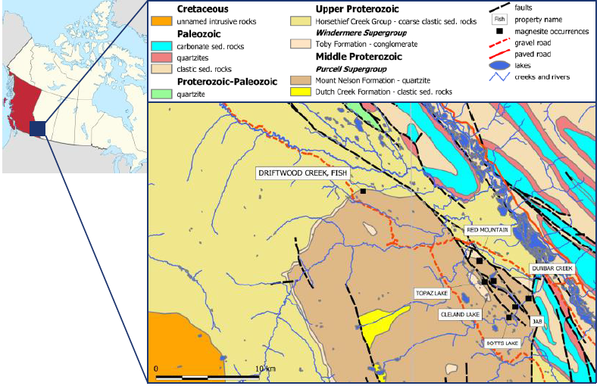

Long story short MGX Mineral’s has what myself and many others believe to be a world class open-pit mine for Magnesite. It’s high-grade mineral, location and potentially lowest processing and shipping costs position this company at the top of my investment list. This is not a 2-3 year mine that will be out of material like most gold and silver mines, this a 100+ year operation in the infancy stage.

This is new company which means two things:

- It’s still unknown and share price is still cheap.

- Share price has been trading at all-time highs which means no overhead sellers/resistance.

Looking at the chart below we can see share price is rising with a bullish pattern. At this point the chart is indicating the next rally should reach 92.5 cents per share up 50%.

To be honest, I have never had the opportunity to find and be involved with a company that has this much potential long term. Jared the CEO and myself both see this being a billion dollar company way down the road and know that makes this company an incredible value at this price.

My partner Kal Kotecha who helps me find and research these micro cap stock plays for our long term portfolio just release his update which I have added below for you. Check it out!

Kal Kotecha’s Recent MGX Mineral Inc. Report

MGX Minerals Inc. – Analysis

- Steadily growing demand for high grade magnesite at a compound annual growth rate of 6% (Berry, 2015)

- MGX’s strategic partnerships with Eaton Corporation (NYSE: ETN) and Highbury Energy to secure long-term financing support and low-cost energy solutions

- Strong value chain management capabilities derived from the location and geology of Driftwood Creek

- The company’s demonstration of advanced business planning with Driftwood Creek’s near-term cash flow combined with low initial capital expenditures, producing limited investment risk

Drilling Operations

|

DDH |

From (m) |

To (m) |

Interval (m) |

MgO% |

CaO% |

Fe203% |

SiO2% |

LOI% |

|

2015-1 |

6.0 |

63.0 |

57.0 |

43.07 |

1.30 |

1.49 |

4.47 |

48.50 |

|

2015-1 |

81.0 |

121.92 |

40.92 |

43.87 |

0.50 |

1.46 |

6.76 |

45.35 |

|

2015-2 |

2.74 |

45.0 |

42.26 |

42.60 |

0.67 |

1.43 |

7.56 |

46.32 |

|

2015-2 |

54.0 |

91.44 |

37.44 |

41.55 |

0.31 |

1.43 |

11.46 |

42.49 |

|

2015-3 |

0.61 |

65.53 |

64.92 |

40.71 |

0.92 |

1.48 |

13.13 |

40.97 |

|

2015-4 |

30.0 |

128.02 |

98.02 |

44.28 |

0.97 |

1.51 |

3.4 |

48.55 |

Infrastructure Development

Investment Opportunity

Works Cited

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by MGX Minerals Inc. In addition, the author owns shares of MGX Minerals Inc. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

DOWNLOAD SPECIAL REPORT:

Click Here – http://www.algotrades.net/wp-content/uploads/2015/10/OCT2015.pdf

SPECIAL EXCLUSIVE REPORT: http://www.gold-eagle.com/article/why-fed-needs-go-negative-interest-rates

Treasury Secretary Jacob Lew said the government will run out of money to pay its bills sooner than previously thought around November 5, 2015. Lacking sufficient cash, it would be impossible for the United States of America to meet all of its obligations for the first time in our history.

Again, another year, to increase the USA debt limit by the government. Will monetary and fiscal policy ever return to “sanity”? Will the political leaders ever become brave enough to quit spending more of the taxpayer’s monies than they bring in without fear of losing elections? Will Americans ever elect someone who doesn’t just promise them more and more “stuff,” and who will just start acting responsibly with the nation’s treasury?

Political leaders continue to “kick the can down the road” over and over again. Now, like games that involve kicking something over and over again, it won’t get rid of the economic grim reaper. Their “Keynesian mantra” is that the solution to debt is simply to spend more money. They believe it will stimulate an economic recovery that never occurred in the first place over all these years.

Until a proper resolution is reached to these issues, debt will rule. When a nation loses control of its finances through debt, bad things happen in all other aspects of its existence. It loses its power and survival becomes a challenge and no longer a taken for granted right.

What is really required is the attention to what is really going wrong. There must be a willingness to repair, reform, correct and heal it. This awareness is now growing throughout the world. There is a feeling that something is out of balance financially in the world. The issue of tax reform and getting rid of government waste continues to be discussed and that surely has not helped.

The key of all this will be to get people back to work. The USA “unofficial” unemployment rate is approximately 21%. Let’s correct these policies and activities that aren’t working. Make them work again in new and different ways

Why Is The Federal Reserve Bank of New York So Important?

The Federal Reserve Bank of New York plays a special role in the Federal Reserve System for several reasons. First the reason for the New York Fed’s special role is its active involvement in the bond and foreign exchange markets. The New York Fed houses the open market desk, which conducts open market operations, the purchase and sale of bonds, which determine the amount of reserves in the banking system. This is the process of how the FED creates liquidity and controls the money supply.

The involvement in the Treasury securities market, as well as its walking-distance location near the New York and American Stock Exchanges, the officials at the Federal Reserve Bank of New York are in constant contact with the major domestic financial markets in the United States. In addition, the Federal Reserve Bank of New York also houses the foreign exchange desk, which conducts foreign exchange interventions on behalf of the Federal Reserve System and the U.S. Treasury. Its involvement in these financial markets, means that the New York Fed is an important source of information on what is happening in domestic and foreign financial markets, particularly during crisis periods, as well as a liaison between officials in the Federal Reserve System and private participants in the markets.

Second, its district contains many of the largest commercial banks in the United States, the safety and soundness of which are paramount to the health of the U.S. financial system. The Federal Reserve Bank of New York conducts examinations of bank holding companies and state-chartered banks in its district, making it the supervisor of some of the most important financial institutions in our financial system. Not surprisingly, given this responsibility, the Bank Supervision group is one of the largest units of the New York Fed.

The third reason for the Federal Reserve Bank of New York’s prominence is that it is the only Federal Reserve Bank to be a member of the Bank for International Settlements (BIS). Thus the president of the New York Fed, along with the chairman of the Board of Governors, represent the Federal Reserve System in its regular monthly meetings with other major central bankers and interaction with foreign exchange markets means that the New York Fed has a special role in international relations, both with other central bankers and with private market participants. Adding to its prominence in international circles is that the New York Fed is the repository for over $100 billion of the world’s gold, an amount greater than the gold at Ft. Knox.

Finally, the president of the Federal Reserve Bank of New York, is the only permanent member of the FOMC among the Federal Reserve Bank presidents, serving as the vice chairman of the committee. Each of the Federal Reserve banks is a “quasi-public”, part private and part government, institution owned by the private commercial banks in the district in which they serve. The member banks own stock in their Federal Reserve Bank. This is a requirement of membership. Originally, the FED was not responsible for the health of the economy. . Over time, it acquired the responsibility to promote a stable economy through its control of the money supply and its ability to influence interest rates. It is subject to the influence of Congress because of the legislation that structures it is written by Congress and subject to change at any time. It reports quarterly to the banking committees of the House and the Senate.

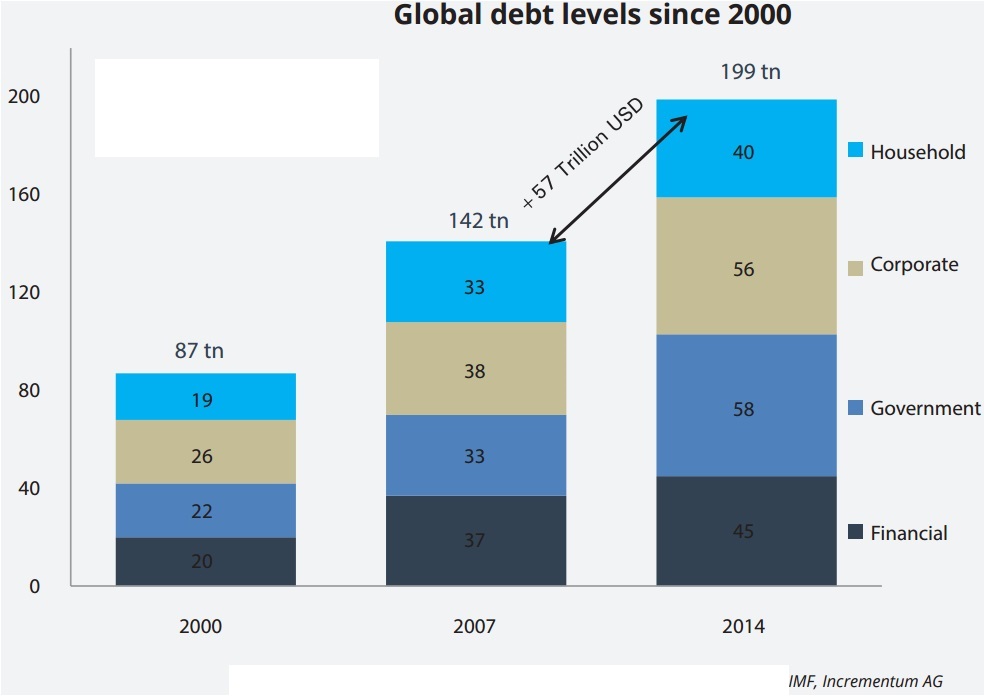

Our debt problem is now out of control. Between 2007 and 2014, the total global debt increased by over 40%. Governments, financials, corporations and households have all increased their absolute debt levels in the last few years. The chart shows that total global debt has reached $200 trillion USD. World global output measured by the gross world product was around 76 trillion USD in 2013. This means that on a global scale we have a debt ratio of approximately 270% of the total yearly world output.

In short, the Treasury is part of the executive branch of the US government. They must follow the direction of the President. The Federal Reserve is independent of the executive branch, almost like the Supreme Court. The voting members of the controlling body of the Fed are nominated by the President. The goal is to limit the impact of short-term politics on decisions about the money supply. Specifically, there is a concern is that if the Federal Reserve was not independent, politicians would seek to obtain short-term economic growth through expanding the money supply, at the cost of long-term inflation. But the fact of the matter is, everyone is addicted to creasing the money supply and every week that goes buy with this artificial stimuli the worse uglier things will be in the future for those not prepared.

A Global Rest is required. Gold is the only asset I know that has no sort of counterparty risk and has been considered to be of value for thousands of years. I follow gold’s price daily. I am currently awaiting for my Proprietary Trend Systems Analytics’ Model to confirm that the bottom is in place so that I may load up on much more.

I believe it is possible that this gold/silver/miners play alone could potentially fund an individual’s retirement if invested in at the correct time. And I will be sharing this with members of my Gold newsletter at: www.TheGoldAndOilGuy.com

Chris Vermeulen

“Liquidity crunch” is the watchword in the bond trading market that threatens to cause deep rifts in the financial market. The fixed income market in the U.S. finds itself suffering from the unintended consequence of injecting half a trillion dollars in the market in the forms of corporate and sovereign bonds.

Companies in the US have offered record number of bonds this year with the assumption that the fed rates will remain low and investors will still have an increased appetite for fixed income financial instruments.

And up until now they have been spot on in their predictions about the federal rates. On September 17, 2015, the Federal Reserve members had unanimously decided to keep the rates low at 0% to 0.25%. But with the U.S. corporate bond ballooning by an astounding 47% from $5.4 trillion at the end of 2008 to $8 trillion currently, the stage looks set for the bursting of the bond market bubble.

Liquidity Crisis: A Fling or the Real Thing

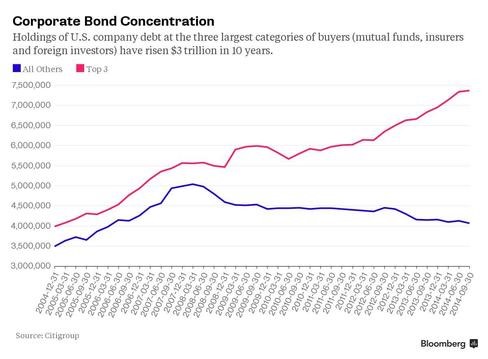

The size of the corporate bond market in the U.S. has increased by $2.6 trillion in the past seven years. However, most of the growth in the market has been concentrated in three types of buyers: i) Foreign Investors, ii) Mutual Funds, and iii) Insurance Companies, according to a report by Citigroup.

This represents a serious concern that can have a significant knock-out impact on the entire US economy. If the Fed pulls the trigger and increases the rates for the first time in nearly a decade, it could result in increased selling – much more than the market could absorb – leading to what experts are calling a severe liquidity crunch in the U.S.

The current situation in the bond market has the potential to bring the next financial crises that could have a ripple effect in every major industry in the U.S.

The lack of liquidity that currently exist in the fixed income market is something that the bond buyers, sellers, and regulatory authority need to be concerned about. In the past there were more than 23 different type of investors but now we have only three. And that according to analysts is the main reason that the bond market could pop.

All that is needed is a spark in the form of a fed rate hike that would fuel liquidity crises when the investors flee bonds. This shortage of liquidity could result in a fall in asset prices below their long run fundamental price, thereby deteriorating external financing conditions, a reduction in the number of market participants, or simply difficulty in trading assets.

But, how did the liquidity crises started in the first place? Well, in the past big banks took an active part in the bond market. They acted as a market maker facilitating trade between the bond buyers and sellers. They maintained stability in the market by buying when the market wanted to sell in large lots, and selling in the case of the opposite situation.

However, the new regulations and higher capital requirements meant that banks had to curtail their bond trading activities. It doesn’t makes financial sense to trade in the market anymore. As a result the liquidity has all but dried up in the bond market.

Liquidity in the context of bond market reflects how easily buyers and sellers can transact the bonds. In a liquid market markets can easily trade the bonds and at low transaction costs. An illiquid market, on the other hand, would lead to wild and instantaneous swings in the prices.

A Single Spark Could Lead to a Liquidity Crunch

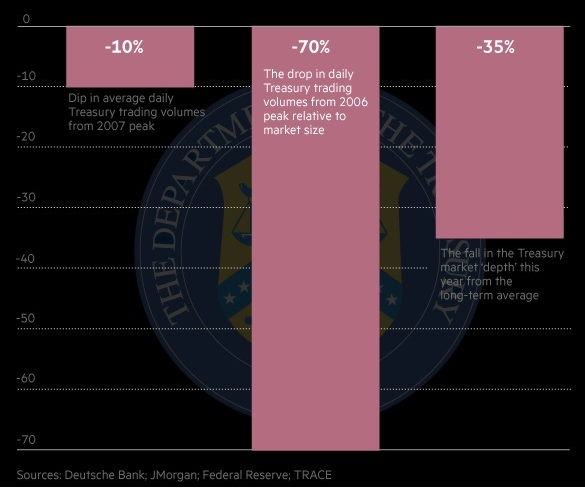

According to an estimate by JPMorgan Chase about five years ago, you could trade around $280 million worth of bonds in the U.S. treasury market without affecting the price. Now, that figure has gone down to just $80 million, which represents a decline of more than 70%.

Reduced liquidity represents a warning shot according to JPMorgan CEO Jamie Dimon as when the panic sets in there won’t be anyone buying the bonds. The lack of demand for the bonds serve is the main crux of a liquidity crisis.

A single hiccup in the market like the fed raising its interest rate could lead to great strain in the market especially for small bond owners. Without adequate liquidity, the sellers will not see lower prices. In fact they will see no prices at all as there won’t be anyone major market mover stepping in with the intention of stabilizing the prices, a part that has been played by banks in the past.

The mutual funds and Wall Street money managers do not have that much funds to purchase depreciated bonds.

International Warnings about the Bond Market Collapse

Earlier this year, Robert Stheeman, head UK Debt Management Office, warned that the gilt market has been threatened by falling liquidity in the bond market.

Recall the unprecedented “flash crash” of the Germany’s 10-year Treasury yields whose primary factor was its faltering liquidity. The sudden drop was extraordinary because the Treasuries are supposed to be the most “liquid” market on the globe.

The most pressing problem is occurring in the corporate bond market where the post-financial crisis era’s ultra loose monetary policies (pursued by the European Central Bank, the Federal Reserve, and the Bank of England) caused a torrent of bond insurance during the recent years as companies tried to capitalize on the rock bottom interest rates.

Imagine the state of the European and British companies (excluding banks) who sold a combined $435.3bn of investment-grade debt last year, and $458.5bn in 2013. This was possible because of the high level of issuance during the post-financial crisis.

These issuances have occurred in the primary market (where they have grown). However, they are not assured the required level of liquidity in the secondary market to insure a balance. As liquidity dries up, an imbalance in the secondary market has been created, caused ironically by the regulations aimed at averting the 2008 crisis.

The Bank for International Settlements has also cautioned that conditions in the less liquid securities is deteriorating as liquidity concentrates in the more readily traded securities whereas Edwin Schooling-Latter from Financial Conduct Authority pointed out (earlier this year) that the reduced liquidity in corporate bonds now warrants “careful regulatory monitoring”.

However, the most impacting warning had already been delivered November last year when a survey of traders, analysts, and investors of the European corporate bonds by the International Capital Market Association (ICMA) concluded that “meltdown” of a global credit markets was unavoidable

Now, we come to the main question that given the present market position. Will the Feds ever pull the trigger under the current Obama Administration?

The answer to this looks like a complete No. Although market pundits were predicting, rather praying, that the fund rates would rise this month, the Feds took the opposite decision and decided unanimously to maintain the rates for the time being.

The reason is that it will not just be the corporate bonds that would be hurt by the collapse in bond prices. The sovereign bond will also be hit with unprecedented and ‘flash’ crash. The sudden drop in yields will be more significant for Treasury bonds as they are considered the most liquid all over the world.

Janet Yellen, the Fed Chairman, has not given any timeframe as to when the Feds would raise the rates. “I can’t give you a recipe for exactly what we’re looking to see,” she had said airing her views about the fund rates.

However, the reasons for the feds reluctance to hike the rates are not that hard to decipher. The inflation is running low, unemployment and the real wages remain flat. Unless these two factors start to spiral out of control, the Fed has no incentive to strengthen the rates at the moment.

In addition, concerns about economic situation in China, which is the biggest bondholder, is also what is holding the current administration to increase the fund rates. Any further strain in the worlds’ second largest economy could lead a global economic meltdown and would hurt U.S. exports, which had exceeded $116 billion on average in the past five years. It would greatly hurt the American manufacturers and may well lead to another economic recession in the U.S.

Final Remarks

Regulators have tried real hard to insure that the economy and financial system could avert, or at least withstand moments similar to 2008, when Lehman crashed; 1994, when US rates rose aggressively; and 1987, when stocks crashed.

Given that the bond market is much larger than the equity market, and that investors have piled into fixed income in the recent years, the fears of a bond market liquidity crunch are very real.

Therefore, it’s important that the Feds take steps to prevent a mass selloff of bonds in case it decides to raise the rates. Because if the credit investors attempt to sell their bonds in masses, and head for the exit, the liquidity in the market has the potential to create a rift similar, if not larger, in magnitude to the recent credit crunch experienced in 2008 that shook the very foundation of the global financial market.

Learn more and get my trade alerts to profit from this mess: www.TheGoldAndOilGuy.com

Chris Vermeulen

Monday, September 21, 2015, the SHEMITAH – the 7 year cycle started its reign.

Yesterday, Tuesday, September 15, 2015, The US Treasury market suffered a steep sell-off. This was primarily due to the fact for the first time in 9 years The FED is going to raise its benchmark interest rate.

The Fed must pull the trigger on a rate hike tomorrow, or it will lose all credibility. It will risk “negative interest yields” on more of their trading securities in the US Securities Market as currently in place in Europe. The yield of the two-year Treasury had jumped by 8 basis points to a new four-year high of 0.8 per cent and the 10-year Treasury climbed 10bp to a six-week high of 2.29 per cent. The fear and reality of the downturn in liquidity have unfortunately spread to what was before considered the most liquid bonds in the world.

NYSE MKT Stocks – ISHARES 20 YEAR TREASURY BOND ETF – 16-Sep-2015 02:42

Every seven years is a Sabbath year also called a Shemitah year. This is a year of rest, just as the seventh day of the week is a day of rest. Every seventh Shemitah (7×7=49) is followed by a Jubilee year, a year of celebration. This Shemitah of Shemitah’s has also had a Tetrad of four Blood Moons all occurring on Jewish feast days, which has not happened in 2000 years!

During a Shemitah Year, God can raise up nations or tear them down. These raising up or tearing down effect all sectors of a country. It can effect a countries’ economy and wealth, its military preparedness, its leaders, and the health and wellbeing of its people.

Elul is the last month of the Jewish calendar year. During this month of a Shemitah year, God declares all debts must be forgiven: the financial ledger wiped clean. This forgiving of debts often causes the Stock Market to fall. The first week of Elul (Aug. 17-21, 2015) the Stock Market dropped 1061 points.

Sept. 28, is the last Lunar Eclipse of this Tetrad which occurs on a Jewish feast day. This Blood Moon will also be a Super Moon meaning it will appear at its largest possible size in the sky. The Eclipsed Super Moon ends setting in the west as seen in Jerusalem, Israel in the early morning of Sept. 28, 2015.

In early October 2015, Brazil, Russia, India, China, and South Africa, The BRICS Nations, will have an economic summit where they plan to set up an alternative monetary standard to the U.S. petro-dollar. Shanghai, China will be the location of the headquarters of this new banking system. If the Chinese Yuan becomes the new world standard of exchange, it will have disastrous effects on the U.S. economy.

This Shemitah of Shemitah’s year could change the economic global power causing greater shifts in our future. China has toppled America to become the biggest economy in the world.

The US has been the global leader since it overtook Britain in 1872, but has now lost its status as the #1 global economy. The Chinese economy is worth £11 trillion compared with £10.8 trillion for the US.

You certainly do NOT want to miss a day without our market updates. I will do it slowly so you can follow along. This is barley the tip of the Iceberg.