The group of charts is this article may look a little noisy and overwhelming but this is really simple analysis if you look at in bite size pieces. Let me explain each chart and you will start to see the power that technical analysis provides those who accept this so-called witchcraft…

So here it is, No Fluff, Just Trading Stuff…

ES 24hr Trading – 240 Minute Chart:

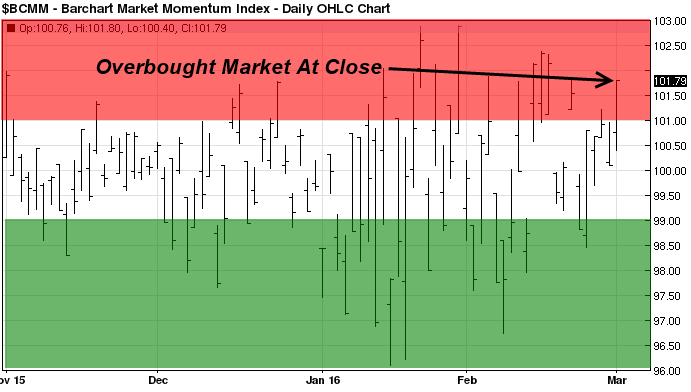

This 24-hour moving chart gives you the ultimate view of the current stock market trend and overbought/oversold levels. I use simple moving averages to gauge trend and how far price is from a mean average price for a visual of how far the market is overbought or oversold.

Also, I use these MA’s as possible support and resistance levels to add confirmation when other indicators I use confirm at the same price and time.

At the bottom of this 24 hour chart you will see my custom panic selling volume indicator. When this spikes I know traders and investors are fearful and panicking out of positions. That is when I start looking for bottoms because I want to take the other side of these emotional trades placed by the masses.

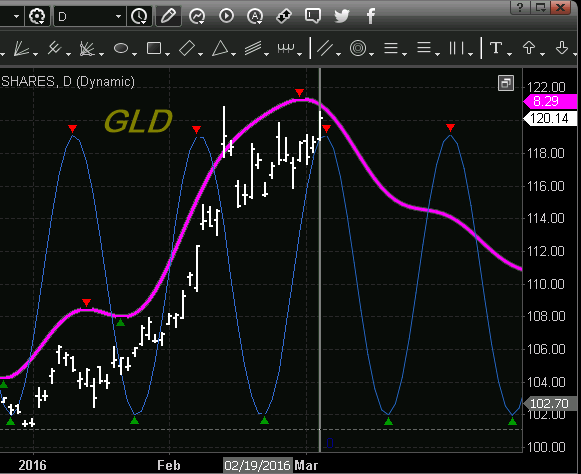

SPY Daily Chart:

The daily chart of regular trading hours has many different characteristics from the 240 intraday chart. Where the 24-hour chart above shows ALL PRICE ACTION, the SPY only shows 1/3 of the days price (9:30am – 4pm ET). This is when most of the day’s volume is traded and I like to see how the masses/average joe traders perceive the market.

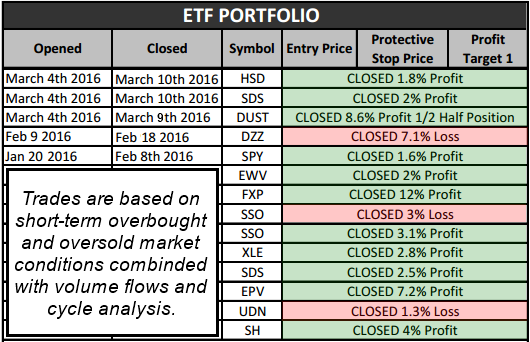

I use these time frame just for my cycle analysis which allows me to identify the market trend/direction (pink cycle line), to identify short-term noise or counter trend moves within that uptrend using the shorter cycle analysis (blue line).

Both of these cycle lines use a combination of the most active cycles in the market across multiple time frames and then are blended and weighted into one line. This tells subscribers and me where the market is most likely to move and when it should be struggling or reversing.

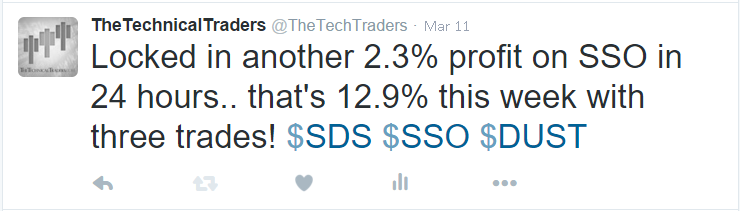

In fact, I saw the pullback coming in stocks and shorted the market for a quick counter trend trade, and exited it Thursday morning, and then go long again and this new SSO long SP500 trade is already up 3% within a few hours for us. Very exciting stuff to say the least.

ES Regular Hours 9:30am – 4pm: 30 Minute Chart

This is one of my trading signal systems that I am building which will identify these market conditions and will eventually autotrade them. This is my newest improvement and is still a work in progress, but I expect it will replace some of my other systems later this summer. My focus is to have something like this trade futures and the SP500 ETFs.

CONTINUE TO NEXT PAGE:

Both

Both