One of the hallmarks of an options trader is the ability to reach into his trading tool bag and pull out different trading vehicles in order to accommodate the current market situation.

With few exceptions, a major component of any strategy our trader would select includes selling option premium. Premium sales usually are selected in out-of-the-money strikes where the time (extrinsic) premium constitutes 100% of the price received.

Examples of pure premium sales would include being short naked puts or calls. Another version of option premium sales would include credit spreads and iron condors wherein premium sales are combined with selling options.

It is important to remember that the time, or extrinsic premium of an option is directly related to time to expiration and implied volatility in the current 0% interest rate environment.

This current week of the options cycle is particularly difficult for two reasons. The first reason is the result of the fact that the September monthly expiration is one of four annual five week monthly options cycles. Remember that there are twelve monthly option expiration cycles, a clearly obvious fact for those possessing a calendar. What is not immediately obvious is that since there are 52 weeks in a year, four monthly cycles must contain five instead of four weeks.

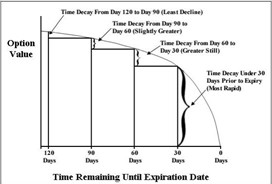

Now remember from our previous discussions that the time decay of option premium is not linear. As illustrated below, time premium decay accelerates relentlessly into the closing bell at an ever accelerating pace.

From a practical level, the extra week of time in our five week cycle gives us an extra week of relatively sluggish decay before the accelerating decay begins to erode time premium significantly. Each week of the option cycle has particular characteristics; living in the fifth week of a five week cycle is like watching paint dry for traders depending on theta decay to benefit their positions.

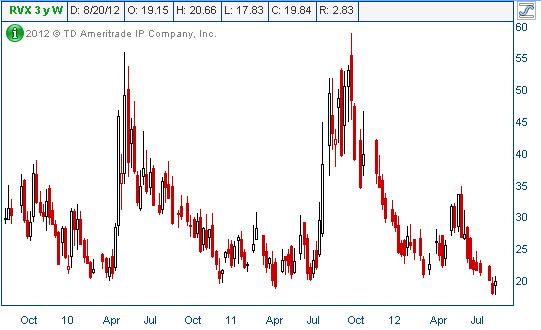

The next factor that exists in our current cycle is the unusually low implied volatility that is routinely encountered across a wide variety of underlying assets. Let us look at the measure of implied volatility of the Russell 2000 index, the RVX. This measure is similar to the more frequently encountered measure of volatility for the SPX, the VIX.

As can be seen in the weekly candle chart of this volatility measure, implied volatility is at multi-year lows.

I consider the implied volatility to be the “stealth” component of options trading. It has impacts far greater than expected for traders and for this reason must be carefully analyzed in both a historic and current time frame for each trade considered.

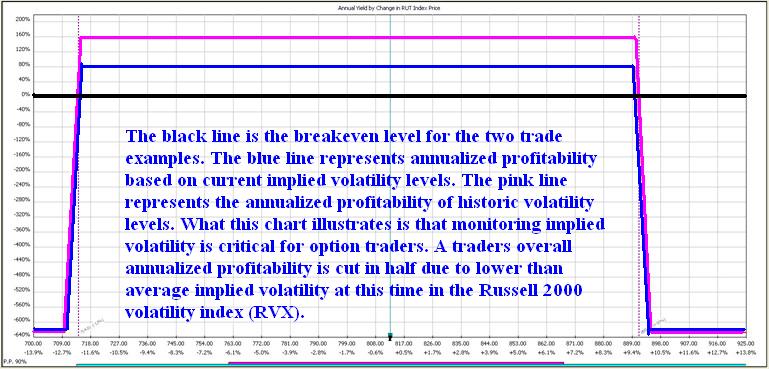

In order to provide a practical example of the impact of the variable of implied volatility, let us consider how it affects a common “bread and butter” trade for most option traders. The trade is a “high probability” iron condor and consists of the combination of an out-of-the-money call credit spread and an out-of-the-money put credit spread.

The trade under discussion will be opened today and has fifty seven days to expiration. The high probability of its success derives from selecting the short options for the spread having a current delta below 10. This essentially means that these short options have a greater than 90% probability of expiring out-of-the-money. The trade therefore has a probability of being profitable in excess of 80%.

For purposes of illustration, I want to allow the magic of trade modeling to look at this trade under two different implied volatility scenarios. Displayed below is the comparison between the actual available trade today and the trade that would be possible if the volatility of the calls alone were at recent historic mean levels. I have purposely not used extreme values for the implied volatility in order to emphasize the impact of this routinely underestimated factor.

The curves above represent the expiration P&L graphs of the same trade taken at more normal volatility levels (the higher curve) and current volatility levels (the lower curve). The benchmark for comparison I have used is the annualized yield. The seemingly small modification of increasing implied volatility of the calls alone doubles the annualized trade yield from 80% to 160%!

I am a realist and understand that if we wish to trade, we must live in the world we are presented. The point of today’s missive is to call attention to the fact that what seem to be minor factors of trivial impact can have huge results on overall trading results.

Happy Trading!

Simple ONE Trade Per Week Trading Strategy?

Join www.OptionsTradingSignals.com today with our 14 Day Trial

JW Jones

This material should not be considered investment advice. J.W. Jones is not a registered investment advisor. Under no circumstances should any content from this article or the OptionsTradingSignals.com website be used or interpreted as a recommendation to buy or sell any type of security or commodity contract. This material is not a solicitation for a trading approach to financial markets. Any investment decisions must in all cases be made by the reader or by his or her registered investment advisor. This information is for educational purposes only.