https://thegoldandoilguy.com/wp-content/uploads/2018/02/spike-alert.jpg

437

407

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2018-02-22 10:44:032018-02-22 10:44:03How to Trade Index Price Spikes & Alert

https://thegoldandoilguy.com/wp-content/uploads/2018/02/spike-alert.jpg

437

407

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2018-02-22 10:44:032018-02-22 10:44:03How to Trade Index Price Spikes & AlertImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2018/02/spike-alert.jpg

437

407

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2018-02-22 10:44:032018-02-22 10:44:03How to Trade Index Price Spikes & Alert

https://thegoldandoilguy.com/wp-content/uploads/2018/02/spike-alert.jpg

437

407

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2018-02-22 10:44:032018-02-22 10:44:03How to Trade Index Price Spikes & Alert

Breakout Rally will Squeeze Shorts In March

Our proprietary price modeling systems are showing us that our expected price basing, which we have been warning our members of for near 3 months, has altered in range and scope. What we did expect to happen near February 21 is now expected…

How To Trade Gold Stocks with Momentum

As a technical trader, I like it when multiple charts, indicators, and asset classes agree with each other for trade setups. This short article is to show you some of the things I look at which provide a buy signal for gold stocks.

One of…

Market Volatility and Precious Metals Bounce

Our articles, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors to explore the tools and techniques that discretionary and algorithmic traders need to profit in today’s competitive…

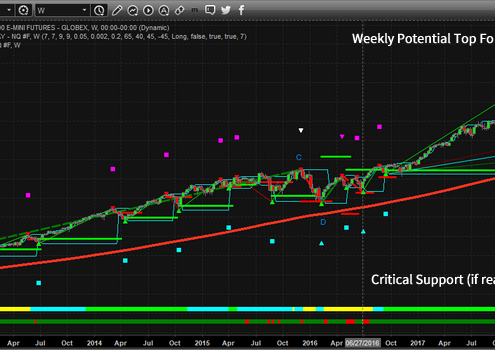

How to Trade as We Near March Top – Equities

Our focus is to provide you with updated and accurate market price predictions for all of 2018, we believe we are entering a period that will be fantastic for traders and active investors. We believe this recent volatility has shaken out the…

How Long Until Markets Settle Down?

Our articles, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors to explore the tools and techniques that discretionary and algorithmic traders need to profit in today’s competitive…

Trading Technical Analysis Made Easy Video

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely…

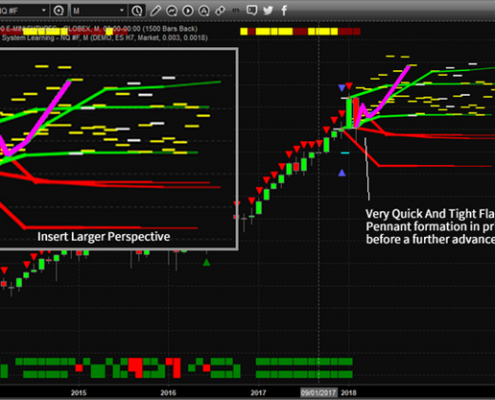

Math Behind the Crash and What’s Next – PART 2

Yesterday we shared with you Part I – big picture analysis “math” Behind the recent sell-off. Today, we want to show you the what the math is pointing to in the short term and what to expect next.

For this type of analysis, we are…

Math Behind Last Weeks Crash – PART 1

After surviving one of the biggest market rotations in the last 3+ years, we have been getting quite a bit of request for a detailed analysis of this move and asked what our specialized modeling systems are telling us is likely to happen. …