https://thegoldandoilguy.com/wp-content/uploads/2019/05/14.png

387

700

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-05-21 16:26:302019-05-21 16:26:30Global Economic Tensions Translate Into Oil Volatility

https://thegoldandoilguy.com/wp-content/uploads/2019/05/14.png

387

700

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-05-21 16:26:302019-05-21 16:26:30Global Economic Tensions Translate Into Oil VolatilityImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2019/05/14.png

387

700

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-05-21 16:26:302019-05-21 16:26:30Global Economic Tensions Translate Into Oil Volatility

https://thegoldandoilguy.com/wp-content/uploads/2019/05/14.png

387

700

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-05-21 16:26:302019-05-21 16:26:30Global Economic Tensions Translate Into Oil Volatility

Oil, Hot Stocks, and Currencies – Part III

In our continued effort to help skilled traders/investors understand the future risks associated with geopolitical market turmoil, the EU Elections next week and the continued US/China trade war, this Part III of our Sector Rotation article…

US vs. Global Sector Rotation – What Next? Part 1

Our research team, at www.TheTechnicalTraders.com, have been pouring over the charts and data to identify what is likely to happen over the next 60+ days in terms of global stock market volatility vs. the US stock market expectations. Recently,…

Major Gold caps getting more attention than Juniors

Get Chris' Trade Alerts Now - Click Here

Markets Rally Hard – Is The Volatility Move Over?

Many traders are watching the recent 3-day rally thinking “this is the end of the downside price move” and targeting new entry positions for the eventual upside price breakout. We're here to warn you that our ADL predictive modeling system…

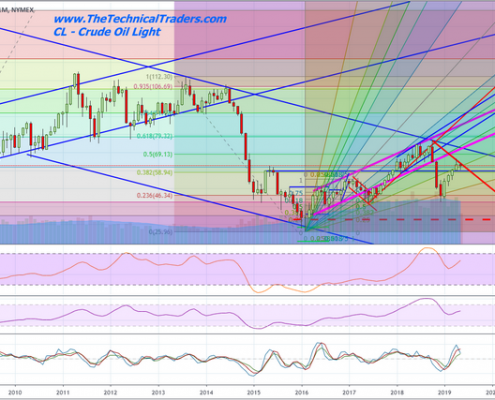

Crude Oil Fails At Critical Fibonacci Level

Crude Oil recently rallied up to the $63 level and failed. This level is a key Fibonacci price level based on our proprietary adaptive Fibonacci price modeling system. It represents a Fibonacci Long Trigger Level that would suggest that a…

How Sustainable Is The Move Into Safe Havens?

Chris Vermeulen. Founder of The Technical Traders joins me to share his thoughts on the recent flow of money into safe haven assets. During the selloff, yesterday in US markets money moved into bonds, gold, and back into the USD. We discuss…

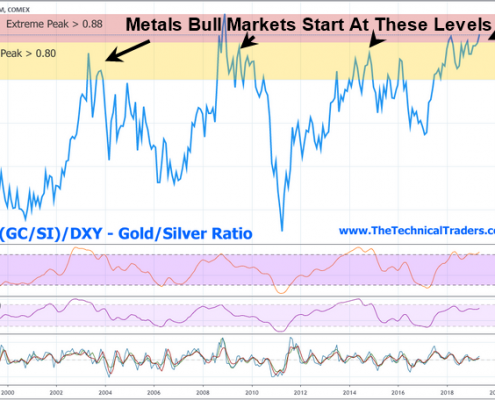

Our Long-Anticipated Gold Momentum Rally Begins

Over the past 6+ months, we've been covering the price rotations in precious metals very closely. We've issued a number of amazing calls regarding Gold and Silver over the past few months. Two of the biggest calls we've made were the late…

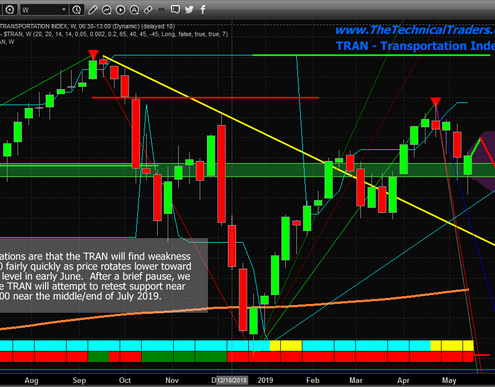

Trade Issues Will Drive Market Trends – PART II

In PART I of this report we talked about and showed you the charts of the Hang Seng and DAX index charts and what is likely to unfold. In today’s report here we touch on the US markets. As we've suggested within our earlier research posts…