https://thegoldandoilguy.com/wp-content/uploads/2019/08/Chris-and-Other-Guy.png

220

266

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-08-21 21:31:102019-08-21 21:31:10THIS IS A KEY WEEK FOR US MARKETS, GOLD, AND OIL

https://thegoldandoilguy.com/wp-content/uploads/2019/08/Chris-and-Other-Guy.png

220

266

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-08-21 21:31:102019-08-21 21:31:10THIS IS A KEY WEEK FOR US MARKETS, GOLD, AND OILImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2019/08/Chris-and-Other-Guy.png

220

266

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-08-21 21:31:102019-08-21 21:31:10THIS IS A KEY WEEK FOR US MARKETS, GOLD, AND OIL

https://thegoldandoilguy.com/wp-content/uploads/2019/08/Chris-and-Other-Guy.png

220

266

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2019-08-21 21:31:102019-08-21 21:31:10THIS IS A KEY WEEK FOR US MARKETS, GOLD, AND OIL

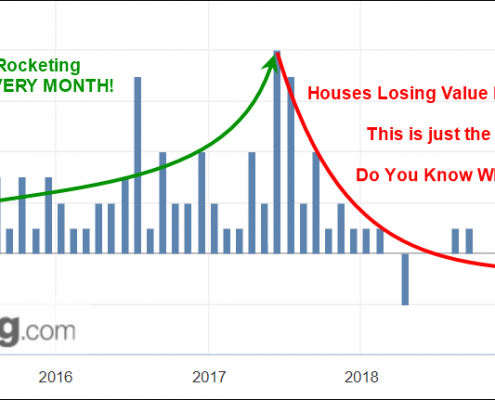

PART II – Fed Too Late To Prevent A Housing Market Crash?

In Part I of this research, we highlighted the Case-Shiller index of home affordability and how it relates to the US real estate market and consumer economic activity going forward. We warned that once consumers start to shift away from…

Fed Too Late To Prevent A Housing Market Crash?

Real Estate is one of the biggest purchases anyone will make in their lifetime. It can account for 30x to 300x one's annual income and take over 30 years to pay off. After you're done paying for your property, now you have to keep paying…

August 19 Turn Date is Tomorrow – Are You Ready?

Our August 19 breakdown prediction from months ago has really taken root with many of our followers and readers. We've been getting emails and messages from hundreds of our followers asking for updates regarding this prediction. Well,…

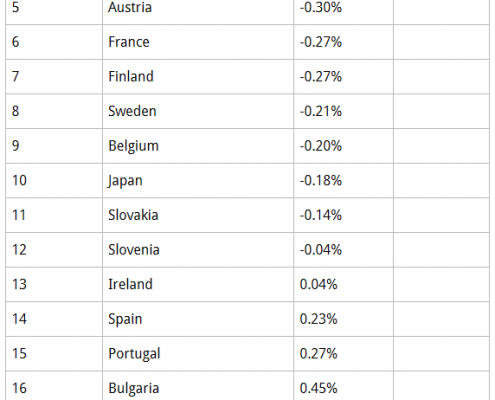

Negative Yields Tell A Story Of Shifting Economic Leadership

Negative yields are becoming common for many of the world's most mature economies. The process of extending negative yields within these economies suggests that safety is more important than returns and that central banks realize that…

Today’s Stock, Metal, and Energy Forecasts – Aug 16 2019

Good morning, Lots of great analysis including Bitcoin today.

Executive Summary:

- Stocks set to gap higher and at short-term resistance. We will see if sellers jump back into the market and drive prices lower to fill the gap.…

PART II – Silver, Transports, and Dow Jones Index At Targets – What Direct Next?

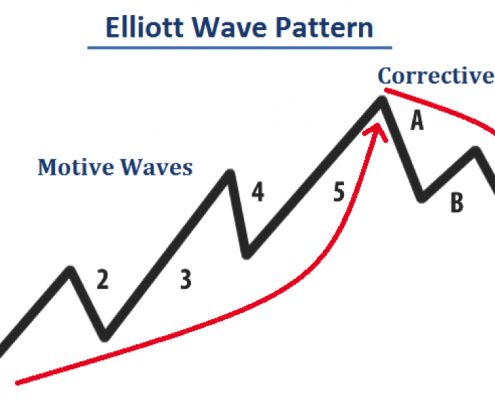

As you can probably imagine, we've received a ton of emails and questions about our recent predictions for precious metals and the August 19 breakdown date in the global markets. It seems everyone is reading our research posts and is curious…

Dow Plunge, Gold, Bonds Rally – AUDIO PODCAST

NEXT MOVES FOR GOLD, SILVER, MINERS, AND S&P 500

In early June I posted a detailed video explaining in showing the bottoming formation and gold and where to spot the breakout level, I also talked about crude oil reaching it upside…

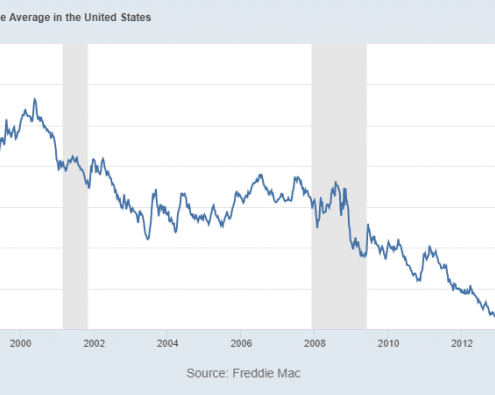

PART 4 – Global Central Banks Move To Keep The Party Rolling

In this last segment of our multi-part research post regarding the US Fed and the global central banks, it is becoming evident that the fear of a further market contraction is resulting in the decrease in rates and the push for additional…