https://thegoldandoilguy.com/wp-content/uploads/2020/03/160.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2020-03-05 10:46:002020-03-05 10:46:00US Fed Panics – Predictive Modeling Shows You What’s Next

https://thegoldandoilguy.com/wp-content/uploads/2020/03/160.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2020-03-05 10:46:002020-03-05 10:46:00US Fed Panics – Predictive Modeling Shows You What’s NextImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2020/03/160.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2020-03-05 10:46:002020-03-05 10:46:00US Fed Panics – Predictive Modeling Shows You What’s Next

https://thegoldandoilguy.com/wp-content/uploads/2020/03/160.png

516

850

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2020-03-05 10:46:002020-03-05 10:46:00US Fed Panics – Predictive Modeling Shows You What’s Next

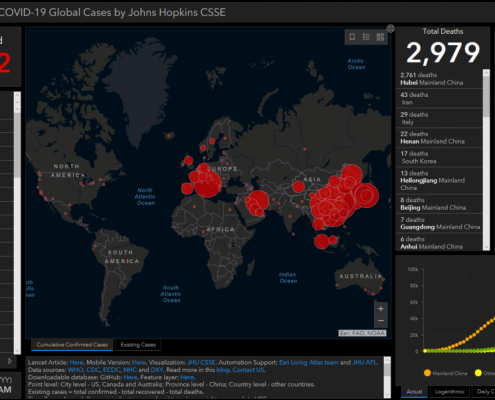

Stock Market & Flu Breakdown Metrics – Where’s The Bottom?

The end of February was brutal for traders that were not prepared for the breakdown in the US stock markets. The breakdown in price actually started on February 20th and 21st. Most traders didn’t pay attention to these minor downside price…

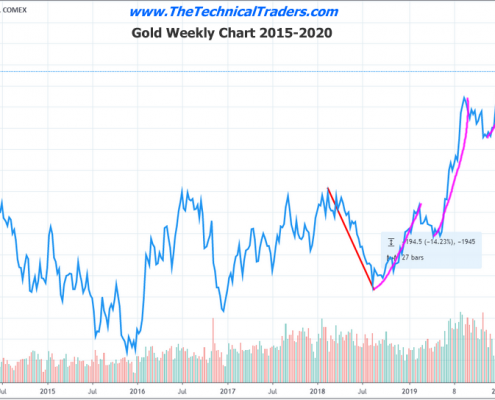

Gold Sets Up For Another Massive Move Higher

Our research team believes the recent downward price activity in Gold and Silver are indicative of past price patterns we saw in Gold over the 2007 to 2012 rally. Throughout almost every rally in precious metals (Gold), there have been a number…

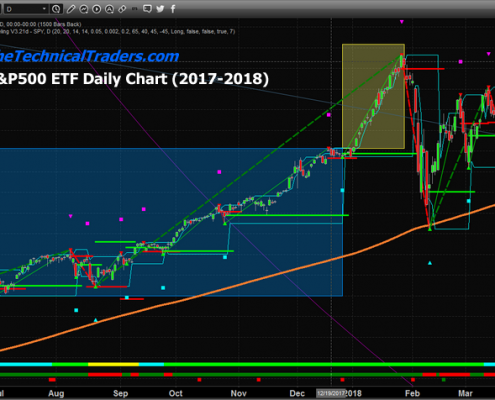

Is This A Repeat of February 2018 Market Crash?

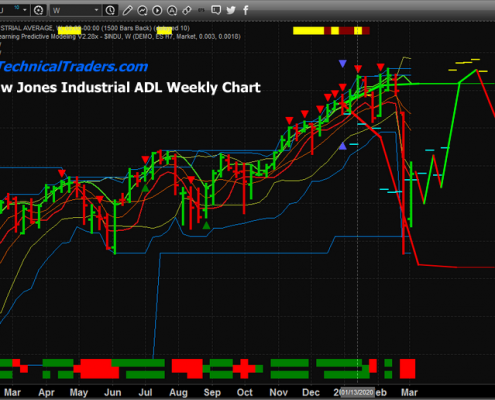

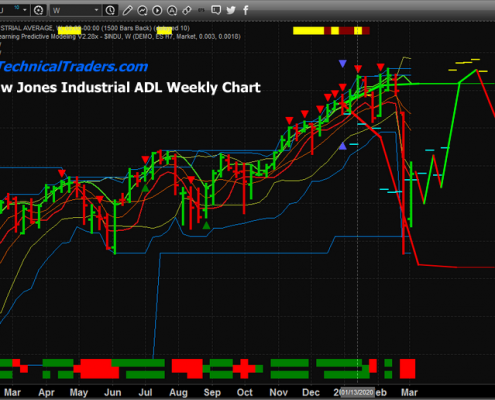

Back in early 2018, after a dramatic rally in early January 2018, the US stock market collapsed suddenly and violently – falling nearly 12% in a matter of just 9 trading days. Our researchers asked the question, is the current collapse similar…

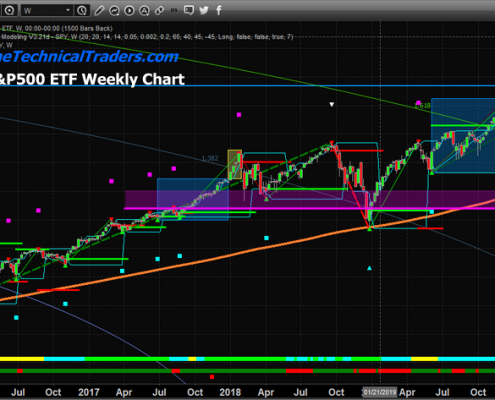

SPY Breaks Below Fibonacci Bearish Trigger Level

Our research team wanted to share this chart with our friends and followers. This dramatic breakdown in price over the past 4+ days has resulted in a very clear bearish trigger which was confirmed by our Adaptive Fibonacci Price Modeling system. …

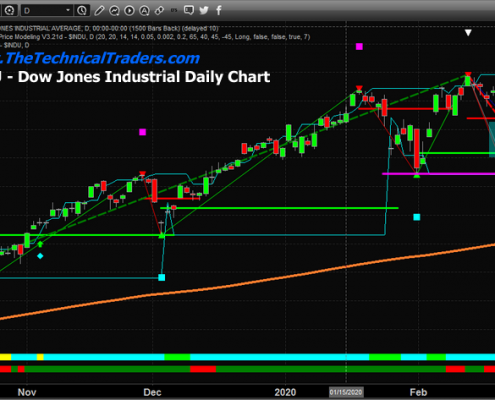

Has the Equities Waterfall Event Started Or A Buying Opportunity?

Over the past 5+ days, a very clear change in market direction has taken place in the US and global markets. Prior to this, the US markets were reacting to Q4 earnings data and minimizing the potential global pandemic of the Coronavirus. …

Yield Curve Patterns – What To Expect In 2020

Quite a bit of information can be gleaned from the US Treasury Yield Curve charts. There are two very interesting components that we identified from the Yield Curve charts below. First, the bottom in late 2018 was a very important price…

Gold Rallies As Fear Take Center Stage

Gold has rallied extensively from the lows near $1560 over the past 2 weeks. At first, this rally didn’t catch too much attention with traders, but now the rally has reached new highs above $1613 and may attempt a move above $1750 as metals…

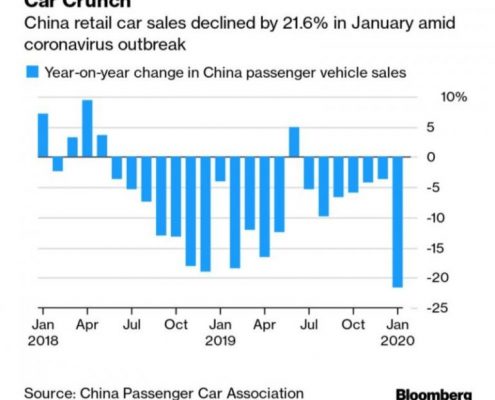

Is The Technology Sector Setting Up For A Crash? Part IV

As we continue to get more and more information related to the Coronavirus spreading across Asia and Europe, the one thing we really must consider is the longer-term possibility that major global economies may contract in some manner as the…