https://thegoldandoilguy.com/wp-content/uploads/2021/12/Howestreet.jpg

300

400

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2022-04-11 08:28:302022-04-11 08:28:40Oil Blow-Off Phase, Sanctions & Shortages Video

https://thegoldandoilguy.com/wp-content/uploads/2021/12/Howestreet.jpg

300

400

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2022-04-11 08:28:302022-04-11 08:28:40Oil Blow-Off Phase, Sanctions & Shortages VideoImprove your trading and

https://thegoldandoilguy.com/wp-content/uploads/2021/12/Howestreet.jpg

300

400

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2022-04-11 08:28:302022-04-11 08:28:40Oil Blow-Off Phase, Sanctions & Shortages Video

https://thegoldandoilguy.com/wp-content/uploads/2021/12/Howestreet.jpg

300

400

admin

http://www.thegoldandoilguy.com/wp-content/uploads/2014/11/tgaoglogo.png

admin2022-04-11 08:28:302022-04-11 08:28:40Oil Blow-Off Phase, Sanctions & Shortages Video

Greg Dickerson Podcast – Entrepreneurship, Investing, Real Estate, Coaching

Greg Dickerson

Sign up for my free trading newsletter so you don’t miss the next opportunity!

Welcome to the Technical Traders podcast. The show that brings you technically proven strategies and trade ideas from experts around the world.…

Maximum Financial Risk & PM Monthly Projections With Sprott – Video

Chris sits down with Craig Hemke of Sprott Money to talk about their Precious Metals forecast and the maximum financial risk. The big question is, in what phase are we in the stock market cycles? Are we in this pullback phase, or…

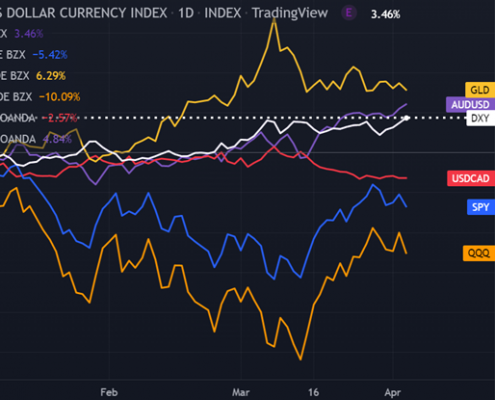

U.S. Dollar (USD) Is On Our Radar!

Since the USD plays such a strong role in global economics, we thought it appropriate to see how the USD performance is vs. other currencies and investments.

For the U.S. consumer, a strong USD means U.S. goods are more expensive in foreign…

Stock Market Technicals Nearing ‘Peak, Maximum Financial Risk’

At minute 08:55, Chris Vermeulen of TheTechnicalTraders.com joins Chuck Jaffe from Money Life to talk about the technicals of the stock market.

There is a lot going on beyond the technicals in the markets right now and many of these factors…

Waiting For GLD To Make New Highs – Gold Rally Is Still Intact

The calm of the last 3-weeks has resulted in a risk-on environment. This, in turn, has led to a nice recovery rally in stocks. For the time being, volatility has subsided. However, we believe there are many underlying market risks that can…

George Hartman – How Financial Advisors Prepare for Succession

George Hartman

Sign up for my free trading newsletter so you don’t miss the next opportunity!

THE TECHNICAL TRADERS PODCAST TRANSCRIPTION

TheTechnicalTraders.com 00:00

Jim Goddard: 00:47My guest is George Hartman, the President…

Yield Curve 101 – Steep, Flat, Inverted – What’s The Difference?

The yield curve plots the current yield of a range of government notes and bonds in the “primary market.” The worldwide bond market – including private and government debt -- currently represents about $120 trillion in outstanding obligations.…

Can Tracking Global Money Flow Provide Clues To Stay In The Black?

According to The Bank of International Settlements, the global foreign currency exchange (FX) daily transactional turnover averages $6.6 trillion. At Technical Traders, we track a variety of markets, asset classes, and global money flow looking…