US Equity Market Recovery Hinges On The Next Move

The research team, at The Technical Trades Ltd., has been calling this market move quite accurately. We made predictions on September 17, 2018, that called for a -5~8% downside market rotation, followed by price support just before the November…

45 Days Until A Multi Year Breakout For Precious Metals

Today is the day we want to warn our followers that we expect the precious metals to continue to base with a fairly narrow price range for about 45 to 65 more days before upside pricing pressures start to take hold of the markets. There has…

Will Oil Find Support Above $50?

Recent global news regarding Venezuela, China, and global oil supply/production have resulted in the price of Oil pausing over the past few weeks near $53 to $55 ppb. We believe the continued supply glut and uncertainty will result in oil…

Why Everyone’s Talking About Gold & Silver

If you have been following some of the research posts by some of the biggest names in the precious metals industry, you may understand “why” so many people are so excited about the opportunities in Gold and Silver recently. There are so…

Will China Surprise The Us Stock Market?

Recently, we openly discussed the potential for global turmoil related to Europe, Asia, China, and South America. The issues before the globe are that the global economy may not be firing in sync and that there are credit and debt, as well as…

Pay Attention To The Russell and Financial Sectors

For those that still believe the US markets are weak and poised for a total collapse, we want to bring something to your attention. Throughout weeks of uncertainty about China trade deals, the US government shutdown, continued Brexit issues…

Crude Oil Will Find Strong Resistance Between $52~55 ppb.

Our Adaptive Fibonacci modeling system is suggesting Crude Oil may have already reached very strong resistance levels just above $50 ppb. It is our opinion that a failed rally above $55 ppb will result in another downward price move where prices…

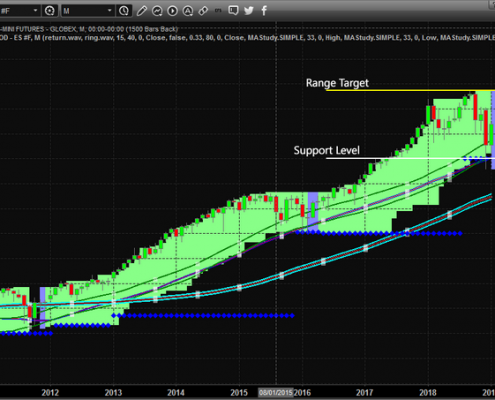

US Indexes Reaches Fibonacci Target Zone – Where to Next?

Near December 21, 2018, our research team began a series of posts indicating the US Major Indexes should be set up for the “Ultimate Bottom” low that we suggested would take place after the US Elections (November 2018) and which would launch…

This Weeks First Trade Setup

It's hard not to get excited when we kick start the week with a winning trade within the first 2 hours of trading. Our proprietary price spike trading strategy that has generated 6 winning trades before the opening bell for the last 6 days…

Will Natural Gas Breakout Or Breakdown Next?

We called the move from $4.75 to $2.90 in Natural Gas, and our predictive modeling solutions are suggesting a new upside rally in price is setting up for early Spring.

Very cold weather across the Northwest and Eastern US, as well as moderate…