PART II – What Commodities and Transportation Telling Us

In Part I of this report we talked about and showed you what commodities and transports where doing in relation to each other. Here in Part II, we show you in detail what we expect to take place.

This final chart highlights our Custom Smart…

What Commodities and Transportation Telling Us – PART I

Our ongoing efforts to dissect these markets and to help educated and inform traders has led us on an exploration path into the general market activities of two leading market indicators; Commodity prices and Transportation Prices. These two…

NASDAQ and DOW – Two Spectrum’s of the Stock Market

Our researchers believe the NQ and YM chart illustrates a very different dynamic which is currently at play in the US Stock Markets. The NQ, the Technology heavy NASDAQ futures, appears to have stalled near the 75% Fibonacci price retracement…

VIX Likely to Pop Before March 21

Our researchers believe price cycles and our proprietary Fibonacci modeling system is suggesting the US and Global stock markets may be entering a period of price rotation very soon. Our team of researchers has identified a date span of between…

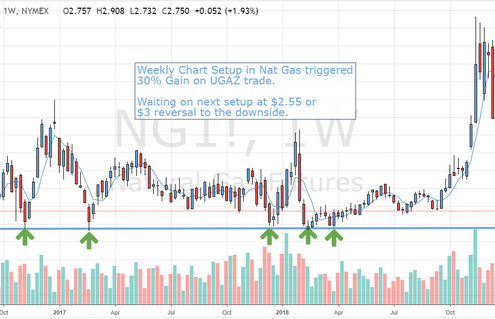

NG Bottom Rotation Sets Up New Opportunities

Our recent UGAX trade returned over 30% in profits in just a few days for our members. We believe this continued price rotation below $3 will also setup new trading opportunities for skilled traders. Traders just need to be patient and understand…

US Dollar Set to Rally and Gold Collapse?

The US Dollar is poised to rally back to near $97.50 as this recent downside price swing ends. We believe the US/China trade talks and North Korea deal with result in a strong upside potential for the US Dollar and the US stock market as time…

Gold and Silver Prepare For A Momentum Rally

Today we warn of a potential downside price rotation in precious metals that may last 3~5+ weeks as metals set up for a massive breakout rally which we believe will start in late April or early May. Our custom indicators are suggesting that…

Traders Must Stay Optimistic Part 5 – The End

This, the final segment of our multi-part research post regarding the potential future market direction as well as to identify if there is any real concern for traders regarding a “total market collapse” as some Doomsayers are predicting…

Momentum Stock Trading Strategy For Optionable Stocks

It been a great couple weeks for members of our newsletter as we start to provide more of our

MRM - Momentum Reversal Method Stock Picks.

As technical traders, we specialize in trading price action and momentum.

We don’t follow the news…

Traders Must Stay Optimistically Cautious – Part 4

Welcome to Part IV of our multi-part research post delving into the global markets, global opportunities and the current “revaluation” even that is taking place. We started this quest from a simple question, “are the Doomsayers correct…