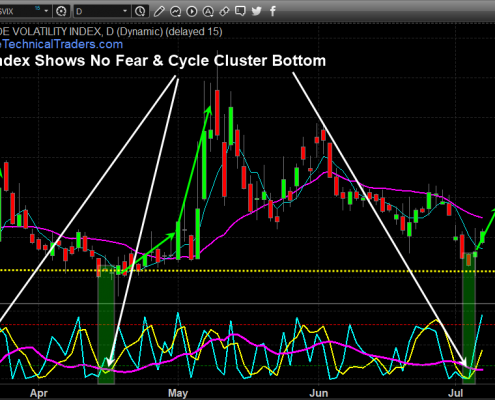

Stock Market Cycle Top and Fearless Vix Signal Turning Point

Everything in the world goes through cycles including investors level of fear, and stock prices. In this report, I want to show you how you can identify short-term and longer-term market tops and bottoms using technical analysis that focuses…

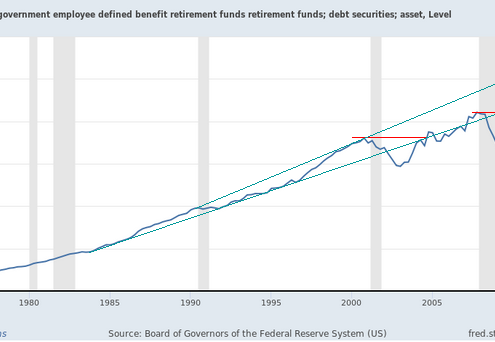

PART III – Debt Crisis To Be Reborn In 2020

This final portion of our multiple part research post regarding the future of a crisis-like price revaluation event will focus on two components that we want to highlight for every trader, investor, and reader. It does not matter if you…

PART II – Is The Debt Crisis About To Be Reborn In 2020?

There are some key elements of political and economic Super-Cycles that all traders must stay aware of listed below. But if you have not yet read PART I do so now.

_ Very often, 12+ months before a major US political election cycle,…

Is The Debt Crisis About To Be Reborn In 2020?

We have been focused on the upside price move in Gold and Precious Metals, we've been engaged in multiple private conversations with members and friends about the potential for a renewed debt crisis between now and the end of 2020.

This…

Gold Forecast: Gold Is Going Parabolic And Which Way Up Or Down?

As a technical analyst since 1997 for Technical Traders Ltd., I believe gold is entering the final leg of an advanced upside price wave formation that will ultimately target $1650 to $1750 in the coming months BUT...

READ FULL ARTICLE…

The Long and Short Plays For Gold Traders

The last few weeks for gold trader has been really exciting. Let face it, metals are starting to outperform us Equities late in a US stock bull market and we all know what that means. If you don’t know what I mean check out these charts!

…

Palladium Sets Up Another Double Top Pattern

Is this Double-Top setup in Palladium another warning of a potential downside price move? Back in April 2018, we issued a Double-Top pattern warning in Palladium which preceded a downside price move of nearly 28%. We believe this new…

Crude Oil Pummeled, Where Is It Going Next?

On Tuesday, July 2, 2019, the price of Crude Oil fell over -4.5% on continued expectations of global economic weakness and supply gluts. We found this interview rather interesting because it attempts to suggest a narrative that ignores…

Transportation Index Warns Of Trouble Ahead?

Any weakness in the Transportation Index near current levels would indicate investors and traders believe the global economy may continue to contract going forward and may be an ominous sign for the global stock markets.

The Transportation…

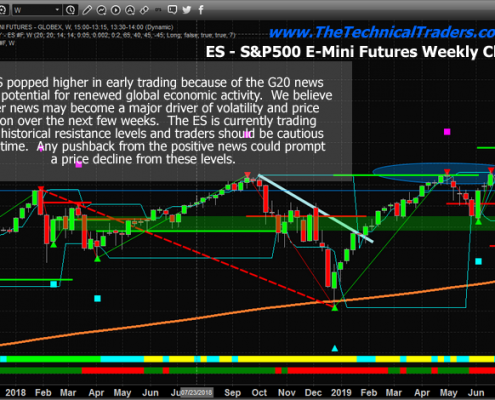

G20 News Drive Big Moves In The Markets

This past weekend was full of exciting news and information. Combine this with the strong US economic activity, the potential for some type of reprieve in the US/China trade issues and the historic meeting in North Korea between President…