The Platinum Breakout & Bull Market of 2020

Platinum has setup into a longer-term FLAG formation and has recently broken the APEX of this FLAG. The long term potential for Platinum, in conjunction with the advance in Rhodium, Palladium, Gold, and Silver, is a new Bullish Price Trend.

Our…

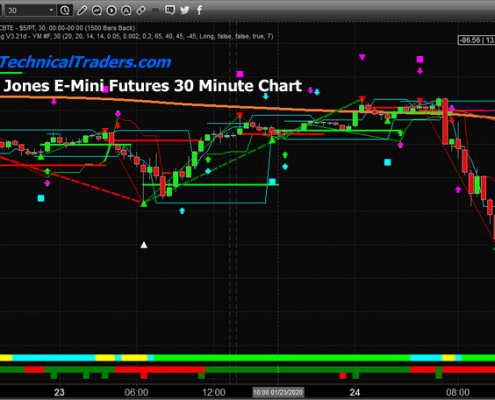

The Black Swan Event Begins

As the Asian markets opened on late Sunday, traders expected a reactionary price move related to the threat of the Wuhan virus and the continued news of its spread. The US Dow Jones futures markets opened close to -225 points lower on Sunday…

The Wuhan Wipeout – Could It Happen?

News is traveling fast about the Corona Virus that originated in Wuhan, China. 2744 cases and 80 deaths confirmed globally according to Bloomberg and the National Health Commission.

In most of Asia, the Chinese New Year is already in full…

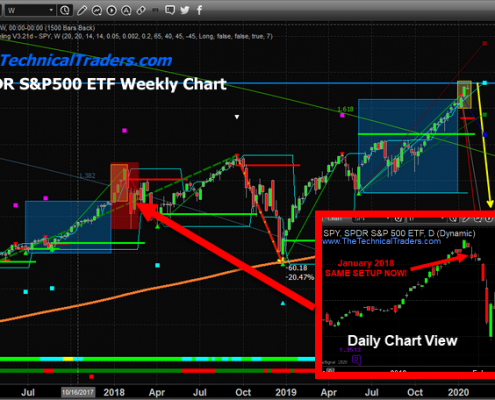

January 2018 Stock Market Repeat – Yikes!

Our research team caught a very interesting price pattern that correlates with the Put/Call ratio. We are alerting our friends and followers with this research post of this exciting, yet unconfirmed, set up today.

In late 2017, the US stock…

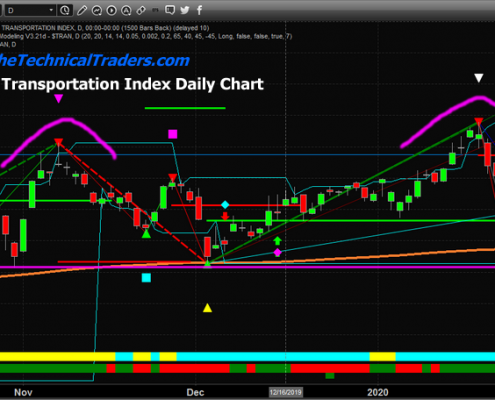

Transportation Sector Crashed Hard and What it Means

The Transportation Index, a common measure of economic optimism or pessimism, collapsed very early in trading after the Martin Luther King holiday (January 20, 22020). We found this very informative because a rotation like this suggests optimism…

Trading Strategies For GDXJ, SPY, Bonds, And Natural Gas

Chris Vermeulen joins me today to shares his trading strategy for 4 different markets. While most of these markets are not correlated he has reasons for why he is long in each. Pick and choose where you want to deploy your capital.

Get Chris’…

Gold Miners, Silver Miners and Safe Havens

Get Chris’ Trade Signals Today – Click Here

Junior Gold Miners Setting Up For Another Rally

Our recent research suggests the US stock market may be entering a period of volatility that may include a broad market rotation/reversion event. We believe this volatility event could begin to happen anytime over the next 10 to 30+ days. …

Q4 Earnings Setup The Rally To The Peak

Our research team believes the current Q4-2019 earnings season and expectations are prompting a “Rally To A Peak”. We’ve been warning our followers and clients that we believe the US Stock Market has rallied to levels that constitute…

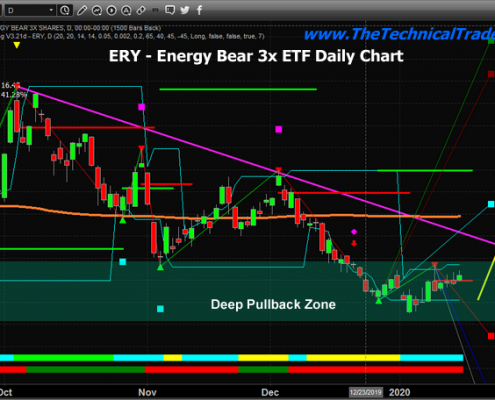

Energy Continues Basing Setup – Breakout Expected Near January 24th

After watching Crude Oil fall from the $65 ppb level to the $58 ppb level (-10.7%) over the past few weeks, we still believe the energy sector is setting up for another great trade for skilled investors/traders.

We are all keenly aware that…