Ray Dalio Suggests USA Is Entering A Period Of Decline And New World Order

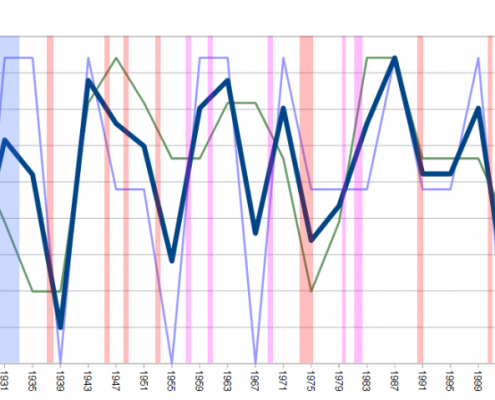

We find it interesting how researchers attempt to compare history, sometimes ancient history, to the applicable functions of today’s world and to attempt to translate the decline of empires in the past to what is happening in today’s world. …

Predictive Modeling Suggests US Markets 12% Over Valued

Our Adaptive Dynamic Learning (ADL) predictive modeling system has called some incredible moves over the past 24+ months. It predicted the moves in Gold moving from $1340 to $1750 – including many of the trend changes that took place over…

Gold Stocks Are Overbought. You Don’t Want Prices to Go Straight Up

Bill Powers of MiningStockEducation.com talks with a professional trader and market commentator Chris Vermeulen says gold stocks are overbought and need a breather which would be good for the overall upward trend.

Chris shares how he has…

Critical Price Level Could Prompt A Big Move After Holiday

As technical traders and researchers, we’ve been paying very close attention to the GREEN ARC Fibonacci resistance level on the SPY as a key level for the US stock market and any hope of a continued upside price rally. The SPY has traded…

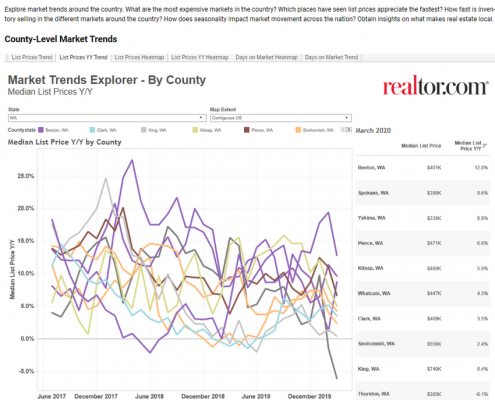

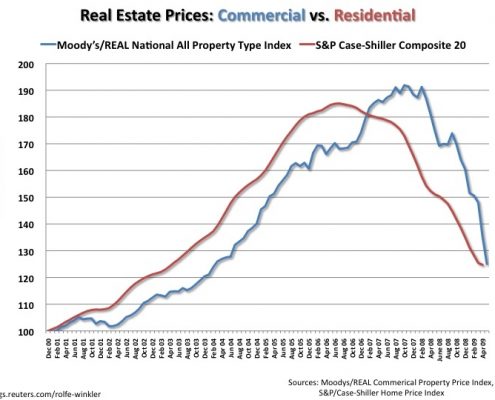

Real Estate Showing Signs Of Collateral Damage – Part IV

This final part of our multi-part Real Estate article should help you understand what will likely transpire over the next 6+ months and how the unknown collateral damage may result in a “Double-Dip” price event taking place before August/September…

US Markets, Metals, and Oil

Cory Fleck and Chris Vermeulen share their outlook and trading strategy for US markets, precious metals, and the oil price. When it comes to US markets the biggest question is – Do the US markets have another leg higher in them? After the…

Gold, Silver, Miners Teater On The Brink Of A Breakout

This week has been a wild and emotional one and it’s just started!

With Monday’s big pop in the stock indexes, the big rally was based on vaccine news and bullish comments from the fed, convincing most traders and investors to be overly…

Signs Of Long Term Devaluation Real Estate

Continuing our research into the Real Estate market and our expectations over the next 6+ months or longer, we want to point out the disconnect between the current US stock market rally and the forward expectations related to the real economy. …

Dow, Nasdaq, and Small Caps

If you are using our free public research for your own trading decision-making and/or using it as an opportunity to find and execute successful trades, please remember you are the one ultimately making the decisions to trade based on our interpretation…

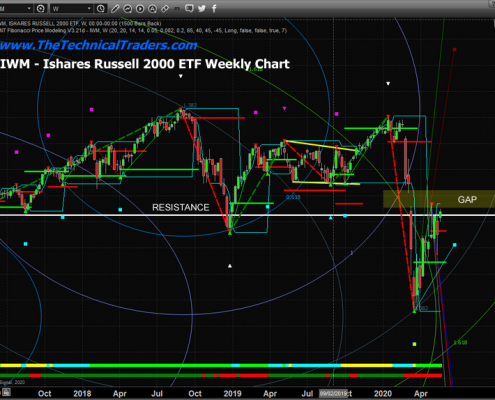

Small-Cap Stocks (Russell 2k) Is Headed For A Double Dip?

Our research team believes the Russell 2000 is leading the way in terms of technical analysis and future expectations. While the NASDAQ has rallied as a result of US Fed stimulus and foreign investor activity, the Russell 2000 has set up a…