A Bear Market Rally or the Resumption of the Bull Market?

January was the worst start of a New Year in the history of the US stock market.

Last week was one of the most intriguing weeks in global equity markets ever. As the week got started, there was a powerful sense of foreboding that stock markets around the globe were going to crash. Last Wednesday, January 20, 2016, many global indices were making new yearly lows, some of which had fallen below the 20% mark which have been associated with a new bear market.

Investors have been so scared and they pulled $24 Billion from their equity funds so far this month. They are fleeing into US Government funds shifted $5 Billion so far this year. This was the largest inflow of cash in over one year.

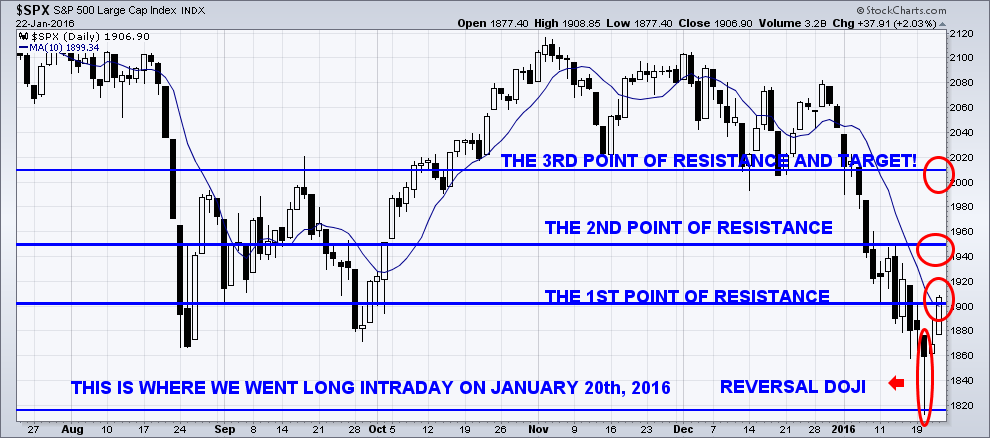

As I mentioned in last week’s article we should see the stock market stage a bounce or rally, and why this was a good price level for it to start. With everyone jumping off the ship bodes well that the market should go against the masses emotional trade. I took a long position on the SPY on Wednesday, January 20th 2016 with subscribers.

The SPX index took out the low of August 24, 2015, while the DJIA is still 600 points higher. The Dow Jones Industrial Average held above their lows of August 24, 2015 for a clear case of intermarket bullish divergence. This was validated last Friday, January 22, 2016, when each of these indices closed above daily resistance as the DJIA up over 200 points. That is not a bad recovery. However, maybe it was not so great when you consider that it had fallen 2300 points from the 17,750 high of December 29, 2015 just three weeks earlier.

The Asian markets, except the Chinese Shanghai Index, broke below its low of August 26, 2016 last week. It bounced back spuriously by the end of the week. The Hang Seng of Hong Kong fell to 18,534, its lowest level since June 8, 2012. The Japanese Nikkei plummeted to 16,017 on January 21, 2016, its lowest point since October 2014.

Now everyone is wondering if this is the end to the stock market decline? Will stocks resume their bull market? Do not be surprised to see a bounce up first from these levels.

Rallies in bear markets tend to be quite strong, fueled by short covering. Investors will be quite surprised this week as this is only a “counter trend rally” and not a “buy the dip” investment opportunity.

This big problem will become crystal clear to everybody in 2016. Oil is likely to continue to struggle, and China will continue its struggle. There is no money printing, and with a recent interest rate increase the stock market is inevitably going to go down. It appears likely that we will see a point when the Dow Jones is around 15,000, the same place it was at its peak in 2007. The worst has yet to come.

We are still going to have to face all the same problems. The continued debt crisis in Europe is unsolvable and the psychology of the financial community is going to be very bleak heading into 2017.

Debt, which is always the root of financial crises and their resulting economic contractions, didn’t go away. The financial system is even more dysfunctional than the one the U.S. was facing in 2007 to 2008. The Office of the Comptroller of the Currency, as of September 30, 2015 which insures U.S. commercial banks and savings associations, reported that they had exposure to $192.2 trillion notional (face amount) of derivatives. The report goes on to verify that only four banks hold 90.8 percent of all derivatives: Citigroup, JPMorgan Chase, Goldman Sachs and Bank of America.

January’s sharp decline, coupled with all the negative news regarding the stock markets, presents a situation where the market participants should go elsewhere with their investment capital.

Crisis always brings opportunities for those who can see the obvious realities. I am very excited about what’s starting to unfold. You will be presented with these opportunities to make more profits in the next 3 years than you accrued in the previous 9 years.

Watch My Video About What Is About To Happen Next: www.TheGoldAndOilGuy.com

Chris Vermeulen