Small Cap Stocks Show Reversal Pattern

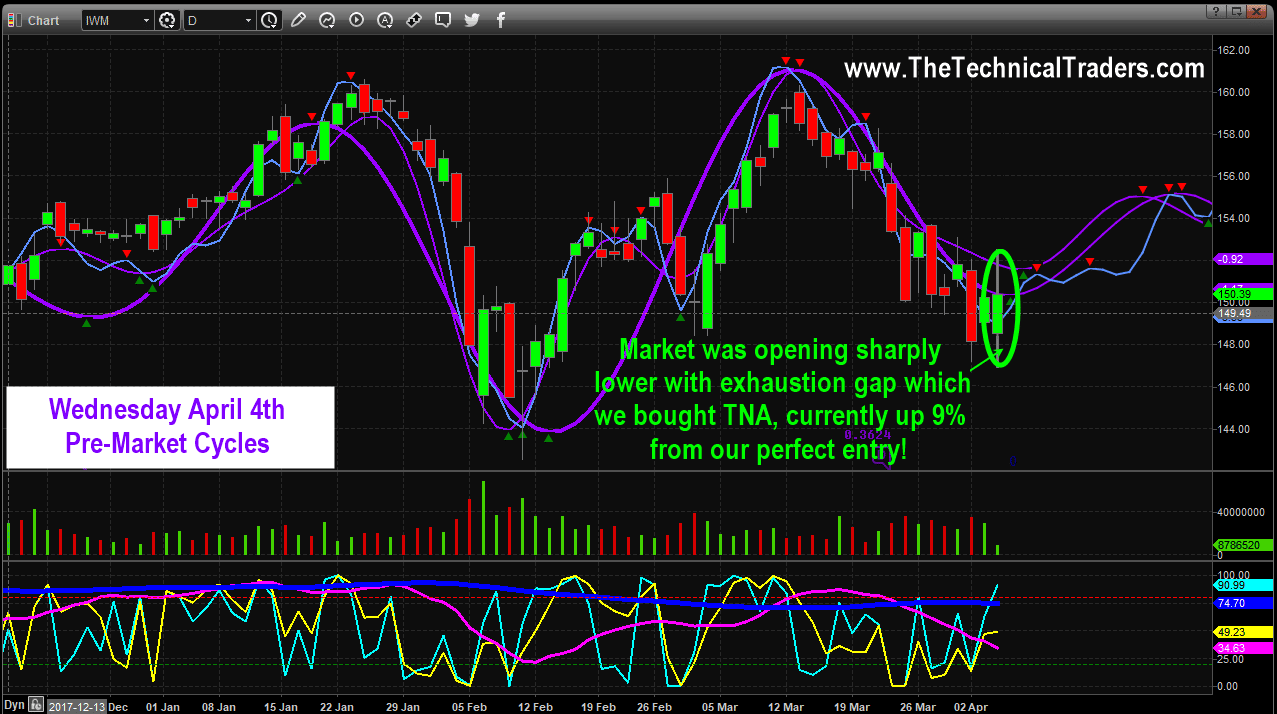

On April 4th in pre-market, we talked about how small-cap stocks were our favorite index because of their relative strength compared to the DOW, NASDAQ, and SP500.

On Wednesday morning stocks were set to gap sharply lower on heavy volume, and the VIX was rising fast indicating massive panic selling among traders and investors. While everyone was in a panic and worried about the trading session at the opening bell, our team and subscribers were sitting comfortably watching and waiting to get long the IWM Russell 2K (TNA 2x Fund).

Before the markets opened we showed our members our proprietary cycles analysis and price prediction model which shows a significant market bottom should take place any day. This same type of cycle analysis is how we profited 15.5% with DUST profiting when gold stocks fell in February, and 9.1% from the natural gas bottom in March and the list goes on.

Here is what we share with members of our Wealth Trading Newsletter:

GOT LONG TNA DURING BIG GAP DOWN

THE FOLLOWING SESSION

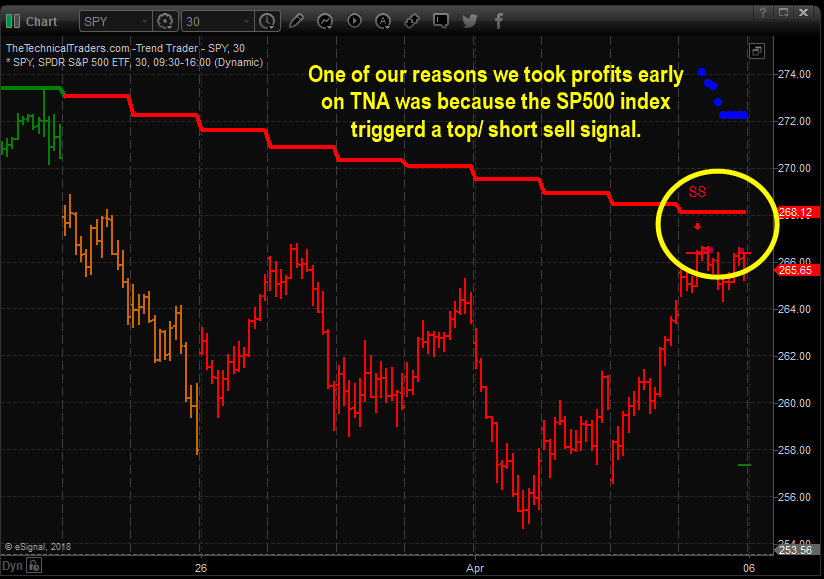

SP500 INDEX FLASHED SELL SHORT SIGNAL

WARNING OF POSSIBLE WEAKNESS ON FRIDAY

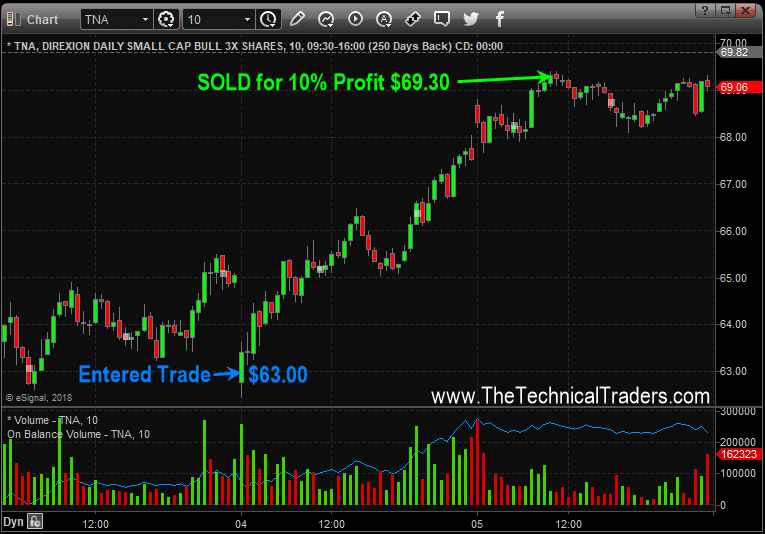

TNA ETF PROFIT TAKING AT 10% THE FOLLOWING DAY