Stock Market Elliott Wave Count, Economic Cycle and Equities Cycle

As you know a picture is worth 1000 words so consider this short yet detailed post a juicy 2000+ word report on the current state of the stock market and economic cycle.

The charts below I think will help you see where the US stock market and economic cycles appear to be.

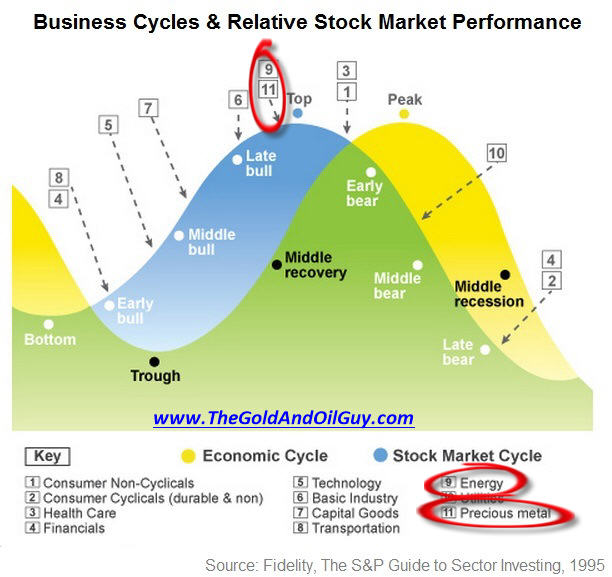

The first image shows two cycles, the blue one is the stock market cycle and which sectors typically outperform during specific times within the cycle. Here you will see that during the late stages of a bull market the safe haven plays become the preferred choice for investors – Energy and Precious Metals.

Typically, the stock market tops before the economic (business) cycle does. Why? Because investors can see sales starting to slow and that earnings will start to weaken and share prices will fall, so the market participants start selling shares before the masses see and hear about a weakening economy. The stock market usually moves 3-9 months before the economic cycle change I known by the masses.

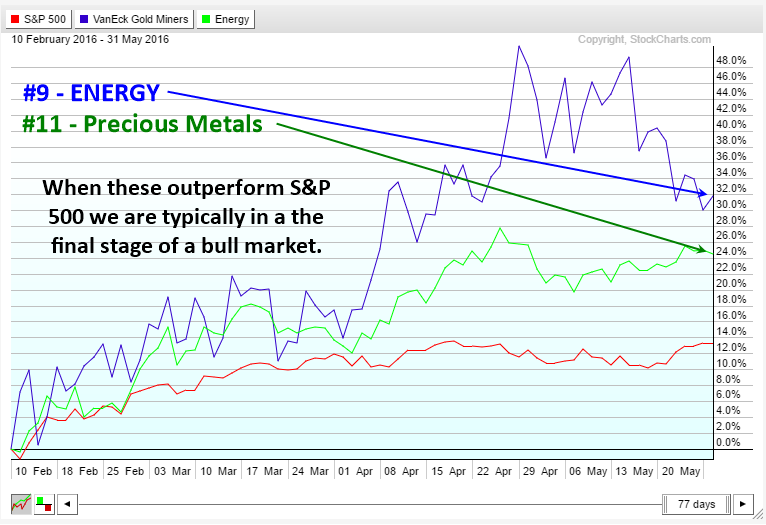

Stock Market Topping According to Sector Analysis

Elliott Wave Count – My Educated Guess

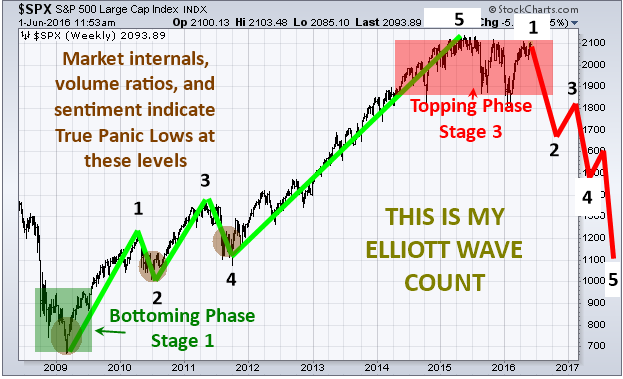

Elliott wave theory is a tough strategy to follow. Meaning, if you gave the same chart to 5 different people you would likely have 3 or 5 very different wave counts.

Recently I have seen a flurry of EW charts on the SP500 wave count which I do not think are correct. When I do Elliott Wave counts I like to use more than just price. I look into things deeper and use the market internals, volume flows, and overall market sentiment during those times. They must all be screaming extreme FEAR in the market in order for me to count it as a wave low.

Fear is much easier to read and time than greed. So based on waves of fear and I can plot the rest of the waves. By doing this, I feel it gives a truer reading of significant highs and lows we should use in our analysis.

See my analysis below for a visual… BUT REMEMBER:

I Use My Own Rules,

Which is Why Its Different Wave Count

Stock Market & Economic Cycle Conclusion:

In short, the current market analysis, in my opinion, is still very bearish and this could actually be the ultimate last opportunity to get short the market near the highs before we dive into a full blown bear market in the next 3-5 months.

I will admit, the market is trying VERY hard to convince us it wants to go higher as it flirts with the recent highs for its second time in the past 8 months. I know it is doing its job because so many traders and investors are changing their tune from bearish to SUPER BULLISH.

I don’t see it that way JUST yet, but it could happen as the market can do and will do whatever it wants. But all my analysis (much more than what you see here) points to substantially lower prices over the next year.

To learn more and get my ETF swing trades and long term investing signals join me at www.TheGoldAndOilGuy.com

Chris Vermeulen