A Micro Cap Turning Mega Cap –Top Long Term Play

Back in August I wrote about MGX Mineral Inc. (Symbol CSE: XMG). There has been some great progress with this company and things continue to look even better.

Technical analysis and trading is my passion and getting involved in new companies which have a quality product, proven management, and have the right timing for entering a market which is close to starting a new bull market is one of the most exciting types of long term investments to watch unfold.

Don’t get me wrong, investments are just that… long term, and take years to unfold, but if you are positioned with the right company at the right time returns can be life changing 3-5 years down the road.

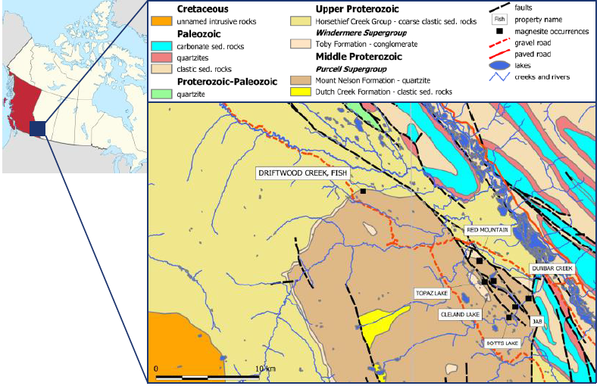

Long story short MGX Mineral’s has what myself and many others believe to be a world class open-pit mine for Magnesite. It’s high-grade mineral, location and potentially lowest processing and shipping costs position this company at the top of my investment list. This is not a 2-3 year mine that will be out of material like most gold and silver mines, this a 100+ year operation in the infancy stage.

This is new company which means two things:

- It’s still unknown and share price is still cheap.

- Share price has been trading at all-time highs which means no overhead sellers/resistance.

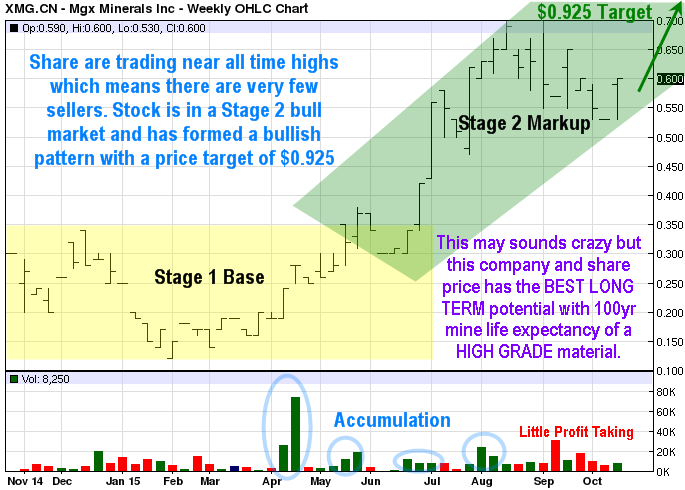

Looking at the chart below we can see share price is rising with a bullish pattern. At this point the chart is indicating the next rally should reach 92.5 cents per share up 50%.

To be honest, I have never had the opportunity to find and be involved with a company that has this much potential long term. Jared the CEO and myself both see this being a billion dollar company way down the road and know that makes this company an incredible value at this price.

My partner Kal Kotecha who helps me find and research these micro cap stock plays for our long term portfolio just release his update which I have added below for you. Check it out!

Kal Kotecha’s Recent MGX Mineral Inc. Report

MGX Minerals Inc. – Analysis

- Steadily growing demand for high grade magnesite at a compound annual growth rate of 6% (Berry, 2015)

- MGX’s strategic partnerships with Eaton Corporation (NYSE: ETN) and Highbury Energy to secure long-term financing support and low-cost energy solutions

- Strong value chain management capabilities derived from the location and geology of Driftwood Creek

- The company’s demonstration of advanced business planning with Driftwood Creek’s near-term cash flow combined with low initial capital expenditures, producing limited investment risk

Drilling Operations

|

DDH |

From (m) |

To (m) |

Interval (m) |

MgO% |

CaO% |

Fe203% |

SiO2% |

LOI% |

|

2015-1 |

6.0 |

63.0 |

57.0 |

43.07 |

1.30 |

1.49 |

4.47 |

48.50 |

|

2015-1 |

81.0 |

121.92 |

40.92 |

43.87 |

0.50 |

1.46 |

6.76 |

45.35 |

|

2015-2 |

2.74 |

45.0 |

42.26 |

42.60 |

0.67 |

1.43 |

7.56 |

46.32 |

|

2015-2 |

54.0 |

91.44 |

37.44 |

41.55 |

0.31 |

1.43 |

11.46 |

42.49 |

|

2015-3 |

0.61 |

65.53 |

64.92 |

40.71 |

0.92 |

1.48 |

13.13 |

40.97 |

|

2015-4 |

30.0 |

128.02 |

98.02 |

44.28 |

0.97 |

1.51 |

3.4 |

48.55 |

Infrastructure Development

Investment Opportunity

Works Cited

Except for statements of historical fact, certain information contained herein constitutes forward-looking statements. Forward looking statements are usually identified by our use of certain terminology, including “will”, “believes”, “may”, “expects”, “should”, “seeks”, “anticipates”, “has potential to”, or “intends’ or by discussions of strategy, forward looking numbers or intentions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results or achievements to be materially different from any future results or achievements expressed or implied by such forward-looking statements. Forward-looking statements are statements that are not historical facts, and include but are not limited to, estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to the effectiveness of the Company’s business model; future operations, products and services; the impact of regulatory initiatives on the Company’s operations; the size of and opportunities related to the market for the Company’s products; general industry and macroeconomic growth rates; expectations related to possible joint and/or strategic ventures and statements regarding future performance. Junior Gold Report does not take responsibility for accuracy of forward looking statements and advises the reader to perform own due diligence on forward looking numbers or statements.

Disclosure of Interest and Advisory Cautions: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by MGX Minerals Inc. In addition, the author owns shares of MGX Minerals Inc. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.