Will the FED Ever Pull The Trigger Under The Obama Administration? RE: Fixed Income Markets?

“Liquidity crunch” is the watchword in the bond trading market that threatens to cause deep rifts in the financial market. The fixed income market in the U.S. finds itself suffering from the unintended consequence of injecting half a trillion dollars in the market in the forms of corporate and sovereign bonds.

Companies in the US have offered record number of bonds this year with the assumption that the fed rates will remain low and investors will still have an increased appetite for fixed income financial instruments.

And up until now they have been spot on in their predictions about the federal rates. On September 17, 2015, the Federal Reserve members had unanimously decided to keep the rates low at 0% to 0.25%. But with the U.S. corporate bond ballooning by an astounding 47% from $5.4 trillion at the end of 2008 to $8 trillion currently, the stage looks set for the bursting of the bond market bubble.

Liquidity Crisis: A Fling or the Real Thing

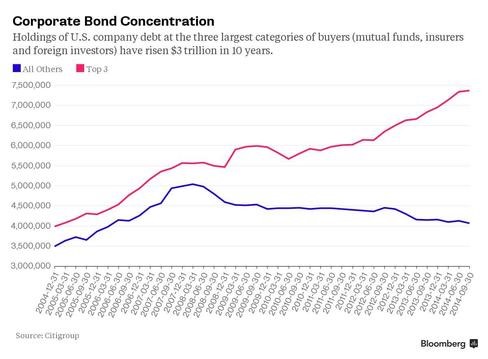

The size of the corporate bond market in the U.S. has increased by $2.6 trillion in the past seven years. However, most of the growth in the market has been concentrated in three types of buyers: i) Foreign Investors, ii) Mutual Funds, and iii) Insurance Companies, according to a report by Citigroup.

This represents a serious concern that can have a significant knock-out impact on the entire US economy. If the Fed pulls the trigger and increases the rates for the first time in nearly a decade, it could result in increased selling – much more than the market could absorb – leading to what experts are calling a severe liquidity crunch in the U.S.

The current situation in the bond market has the potential to bring the next financial crises that could have a ripple effect in every major industry in the U.S.

The lack of liquidity that currently exist in the fixed income market is something that the bond buyers, sellers, and regulatory authority need to be concerned about. In the past there were more than 23 different type of investors but now we have only three. And that according to analysts is the main reason that the bond market could pop.

All that is needed is a spark in the form of a fed rate hike that would fuel liquidity crises when the investors flee bonds. This shortage of liquidity could result in a fall in asset prices below their long run fundamental price, thereby deteriorating external financing conditions, a reduction in the number of market participants, or simply difficulty in trading assets.

But, how did the liquidity crises started in the first place? Well, in the past big banks took an active part in the bond market. They acted as a market maker facilitating trade between the bond buyers and sellers. They maintained stability in the market by buying when the market wanted to sell in large lots, and selling in the case of the opposite situation.

However, the new regulations and higher capital requirements meant that banks had to curtail their bond trading activities. It doesn’t makes financial sense to trade in the market anymore. As a result the liquidity has all but dried up in the bond market.

Liquidity in the context of bond market reflects how easily buyers and sellers can transact the bonds. In a liquid market markets can easily trade the bonds and at low transaction costs. An illiquid market, on the other hand, would lead to wild and instantaneous swings in the prices.

A Single Spark Could Lead to a Liquidity Crunch

According to an estimate by JPMorgan Chase about five years ago, you could trade around $280 million worth of bonds in the U.S. treasury market without affecting the price. Now, that figure has gone down to just $80 million, which represents a decline of more than 70%.

Reduced liquidity represents a warning shot according to JPMorgan CEO Jamie Dimon as when the panic sets in there won’t be anyone buying the bonds. The lack of demand for the bonds serve is the main crux of a liquidity crisis.

A single hiccup in the market like the fed raising its interest rate could lead to great strain in the market especially for small bond owners. Without adequate liquidity, the sellers will not see lower prices. In fact they will see no prices at all as there won’t be anyone major market mover stepping in with the intention of stabilizing the prices, a part that has been played by banks in the past.

The mutual funds and Wall Street money managers do not have that much funds to purchase depreciated bonds.

International Warnings about the Bond Market Collapse

Earlier this year, Robert Stheeman, head UK Debt Management Office, warned that the gilt market has been threatened by falling liquidity in the bond market.

Recall the unprecedented “flash crash” of the Germany’s 10-year Treasury yields whose primary factor was its faltering liquidity. The sudden drop was extraordinary because the Treasuries are supposed to be the most “liquid” market on the globe.

The most pressing problem is occurring in the corporate bond market where the post-financial crisis era’s ultra loose monetary policies (pursued by the European Central Bank, the Federal Reserve, and the Bank of England) caused a torrent of bond insurance during the recent years as companies tried to capitalize on the rock bottom interest rates.

Imagine the state of the European and British companies (excluding banks) who sold a combined $435.3bn of investment-grade debt last year, and $458.5bn in 2013. This was possible because of the high level of issuance during the post-financial crisis.

These issuances have occurred in the primary market (where they have grown). However, they are not assured the required level of liquidity in the secondary market to insure a balance. As liquidity dries up, an imbalance in the secondary market has been created, caused ironically by the regulations aimed at averting the 2008 crisis.

The Bank for International Settlements has also cautioned that conditions in the less liquid securities is deteriorating as liquidity concentrates in the more readily traded securities whereas Edwin Schooling-Latter from Financial Conduct Authority pointed out (earlier this year) that the reduced liquidity in corporate bonds now warrants “careful regulatory monitoring”.

However, the most impacting warning had already been delivered November last year when a survey of traders, analysts, and investors of the European corporate bonds by the International Capital Market Association (ICMA) concluded that “meltdown” of a global credit markets was unavoidable

Now, we come to the main question that given the present market position. Will the Feds ever pull the trigger under the current Obama Administration?

The answer to this looks like a complete No. Although market pundits were predicting, rather praying, that the fund rates would rise this month, the Feds took the opposite decision and decided unanimously to maintain the rates for the time being.

The reason is that it will not just be the corporate bonds that would be hurt by the collapse in bond prices. The sovereign bond will also be hit with unprecedented and ‘flash’ crash. The sudden drop in yields will be more significant for Treasury bonds as they are considered the most liquid all over the world.

Janet Yellen, the Fed Chairman, has not given any timeframe as to when the Feds would raise the rates. “I can’t give you a recipe for exactly what we’re looking to see,” she had said airing her views about the fund rates.

However, the reasons for the feds reluctance to hike the rates are not that hard to decipher. The inflation is running low, unemployment and the real wages remain flat. Unless these two factors start to spiral out of control, the Fed has no incentive to strengthen the rates at the moment.

In addition, concerns about economic situation in China, which is the biggest bondholder, is also what is holding the current administration to increase the fund rates. Any further strain in the worlds’ second largest economy could lead a global economic meltdown and would hurt U.S. exports, which had exceeded $116 billion on average in the past five years. It would greatly hurt the American manufacturers and may well lead to another economic recession in the U.S.

Final Remarks

Regulators have tried real hard to insure that the economy and financial system could avert, or at least withstand moments similar to 2008, when Lehman crashed; 1994, when US rates rose aggressively; and 1987, when stocks crashed.

Given that the bond market is much larger than the equity market, and that investors have piled into fixed income in the recent years, the fears of a bond market liquidity crunch are very real.

Therefore, it’s important that the Feds take steps to prevent a mass selloff of bonds in case it decides to raise the rates. Because if the credit investors attempt to sell their bonds in masses, and head for the exit, the liquidity in the market has the potential to create a rift similar, if not larger, in magnitude to the recent credit crunch experienced in 2008 that shook the very foundation of the global financial market.

Learn more and get my trade alerts to profit from this mess: www.TheGoldAndOilGuy.com

Chris Vermeulen