A crucial cycle is presently occurring!

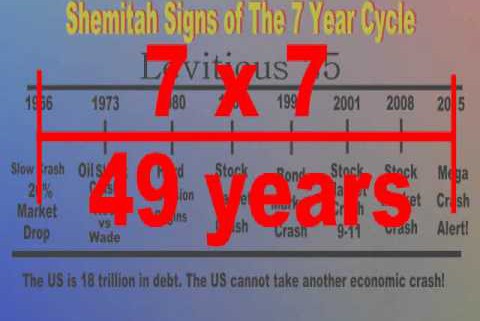

A crucial Shimitah cycle is presently occurring! It is a cycle that was first observed by the Jewish people while living in the Holy Land. Every cycle culminates in a Sabbatical year, (7th year) known as Shemitah; literally translated means “to release.” This Shemitah 7 year cycle is occurring at the same time that the American economy appears to be “on life support”.

After so much excitement within the last couple of weeks, the markets have been somewhat anticlimactic. Which way will we go? Bullish or bearish? I believe, we are totally CONFIRMED bearish, and expecting a re-test of previous lows. We may even see, within the Dow Jones Industrial Average, a lower low, down around 15,000. Lately, the volatility has stabilized and THE MARKETS HAVE BEEN CONSOLIDATING. The base is about 1,000 points so that when the breakout does occur, I expect a move of about that same size. When I decipher my charts, it looks as though this breakout should happen within the month of September, and/or early October 2015. If it breaks bearish, the news media will likely blame it on the FOMC meeting, and if it breaks bullish, they will, most likely, blame it on the Federal Reserve.

This nation has never experienced six years of hyper-low interest rates before! What impact has this had on the restructuring of the balance sheets of insurers and banks? In striving to match assets and liabilities, across 24 consecutive quarters of near-zero rates, what deception might financial institutions have inflicted (reaching-for-yield through derivative positions) that could backfire, and trigger a financial crisis!

It will result in a strong price movement. If the market thinks honestly, the investment community seems much closer to panic and hysteria than it does to euphoria and optimism. It would not take much more to depress the markets further; however, it would take a lot to make it feel confident and secure about the Fed’s ability to stay ahead of “the curve” and manage the transition smoothly.

The SPX is very similar, in structure, in relation to the Dow. It appears as if it was ready to complete its triangle formation, but the pattern has continued to expand into a symmetrical triangle. A triangle normally forecasts a continuation of the trend, which existed prior to its formation; more weakness ahead continues to be the logical forecast. This is also supported by important cycles which should not make their lows until late this September and/or early October 2015.

Since the SPX reached 1,865, it has worked its’ way into a consolidation pattern, which has the appearance of a triangle. If it is a symmetrical triangle, the odds are in favor of a continuation of the selling, after the pattern is completed. This could happen as early as this coming Thursday, September 17th, 2015, when the Fed will announce its decision on interest rates, but since the indexes could also stage a surprise move, in the opposite direction, it is best to wait until we are past that critical period and before hazarding a short-term forecast.

The NASDAQ has a slightly different formation. This one looks like an ascending triangle. Statistically, there is not much difference between ascending and descending triangles. Outside of this triangle formation, the NASDAQ looks like the others do, for the most part. The 100 and 200 simple moving averages have not yet crossed bearish; however, they are headed sideways. I am foreseeing the area around 4,850, as resistance. Otherwise, I see much of the same signals as the other two indexes.

Global Stock markets had modestly rallied last week, following their most serious dramatic plunge since 2011; which lasted from July 20th, 2015 into August 26th, 2015 (declines of over 15%) which occurred in that brief five week period within most of the world’s indexes. Some were much worse. The German DAX, for instance, fell nearly 21% within that time frame, and down nearly 25% from its yearly high, in April 2015. The Chinese Shanghai Index plunge was even more disturbing. Prices dropped nearly 45% from their yearly high of June 15th, 2015. Thus, a rally from that first leg down was well overdue, which has now lasted nearly three weeks.

However, the markets’ form has been unimpressive, and more indicative of a corrective retracement within a bear market, rather than the start of a new bull campaign. This week’s highly anticipated Fed announcement of a rate hike, which is due out on Thursday, September 17th, 2015, nearly guarantees that the bullish or bearish argument in equities, around the world, will be revealed. One course would set the indexes on a bullish trajectory and the other on a bearish one. The rallies off of the lows of August 24th through the 26th of 2015, seem to be losing momentum. Not that they ever had very much to begin with. There have been sharp up days, but, in almost all instances (like last week) they were quickly followed by sharp down days. We are all currently waiting for Dr. Yellen’s announcement. This should be a rather shocking announcement to hear, globally! If one thinks that some world leaders have been judgmental in their policies and behaviors, then you have not seen anything yet, unlike what you are about to witness now, well into 2016, and even into 2017.

While the stock market appears to be on hold during this week’s Fed meetings, gold and silver were also unimpressive. Gold fell below $1100.00/oz., again, during Friday’s session, September 11th, 2015. GLD should retrace itself down to 100 before any BULLISH/BUY confirmation will be given. Silver tried to rally above $15.00/oz., but could not do so after Wednesday, September 9th, 2015, and began a retreat down to $14.25/oz. during Friday’s trade.

Bearish trends of this week are extremely potent. They coincide with the Fed meeting this Thursday, September 17th, 2015, which is expected to result in dramatic market moves. These spurts may still be short-lived, but the amplitude, in any direction, is likely to be both sharper and greater than it is, in any given day. Possibly, two or three days.

The Bank of China devalued the Yuan and depegged it from the US Dollar, most likely, because the leaders of China did not want the Fed to raise US interest rates. Higher US interest rates mean a higher US Dollar value. We are still in a global race to the bottom in currency values, as well as we are in the currency wars zero interest rates policy era of the continued quantitative easing. A rising currency is seen as hurting a nation’s balance of trade. Hence, the unexpected surprise move made by China, has temporarily worked, on a short-term basis. It had paralyzed the Fed’s expected action to raise interest rates. The Federal Reserve has delayed the expected rate hike, until now. If they do not raise their bench mark interest rates, the US risks the possibility of negative interest rates.

I foresee the “hidden signs” that the Federal Reserve will slightly raise its bench market interest rate, which will result in the selling of stocks, following their announcement.

Trade with me and profit from this cycle: www.TheGoldAndOilGuy.com

Chris Vermeulen