Nat Gas Ready To Pop?

By: Chris Vermeulen – www.GoldAndOilGuy.com

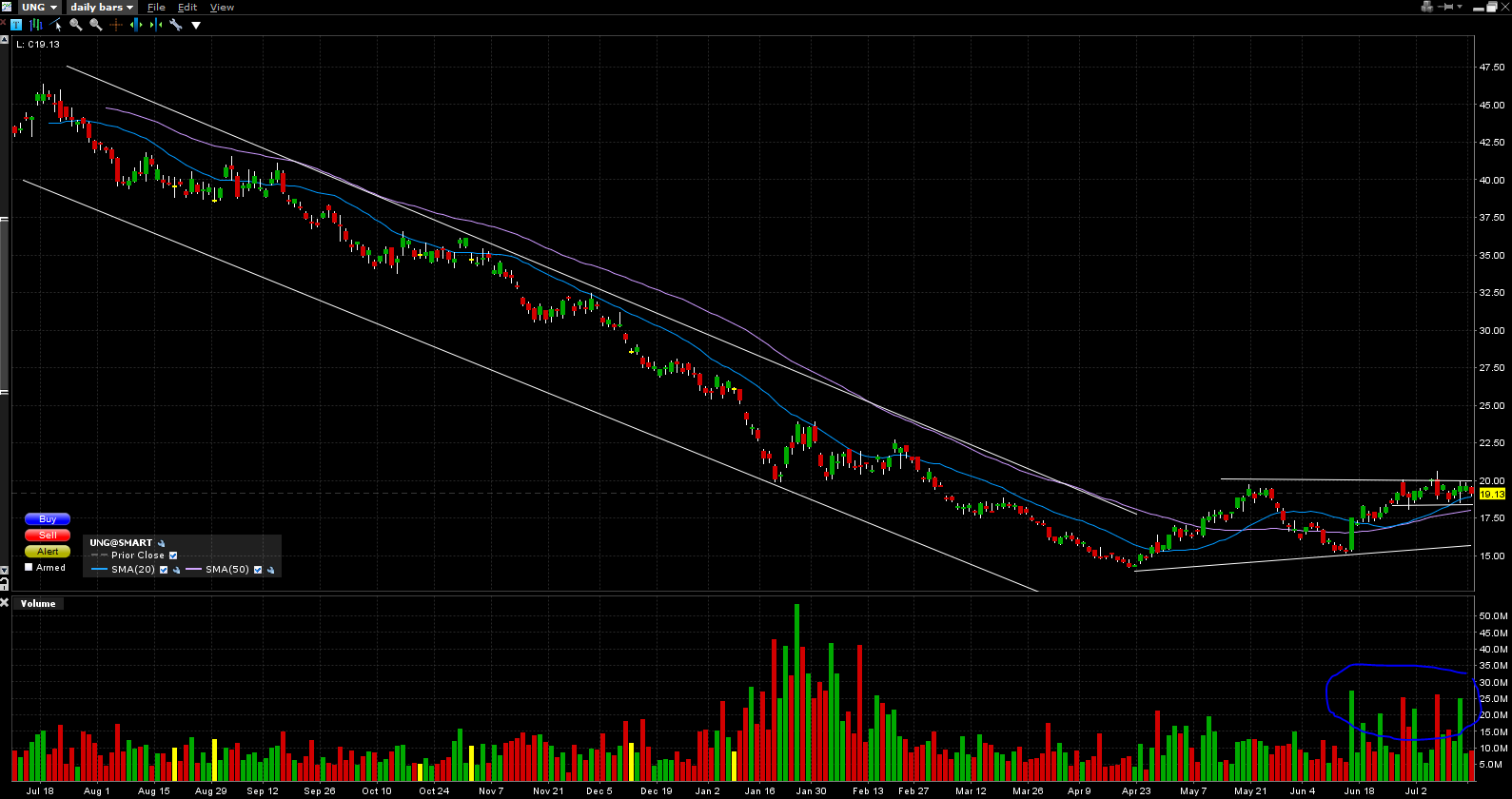

Nat gas (UNG) has recently caught my attention. While it was in a significant downtrend for the better part of a year it has recently been consolidating right under the $20 level. A look at the daily chart shows a long move down and then recently a sideways consolidation pattern. While this is typically a continuation pattern I am beginning to believe think that the next move may be up rather than an extension of the previous down trend.

- Over the last two weeks there been significant support above $18 and significant volume.

- The $20/$20.50 level has been tested multiple times and the more tests it undertakes the more likely it is to break.

- Both the 20-day and 50-day moving averages have turned upwards and UNG is trading above both

If we zoom in a bit and take a look at the hourly chart we are presented with two scenarios

- The rising wedge holds and UNG breaks through the $20 – $20.50 resistance level on high volume and a new long term up trend is produced

- The head and shoulders pattern within the wedge breaks downwards and the downtrend resumes

I’m leaning towards option one but will be waiting for a breakout confirmed with volume in either case.

Get our Free Weekly Trade Ideas and Trading Education Videos: www.GoldAndOilGuy.com