SPX, SP500, SDS, HSD Trade Idea & Setup

Good Morning,

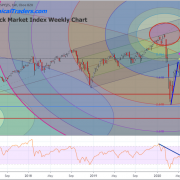

Looks like today will be an exciting with stocks and commodities jumping in price up 1-3% as the US dollar pulled back in overnight trading. The SP500 is setting up for another short play which is showed in the video.

Yesterday our protective stop was triggered on the SP500 which was set at the previous day’s high. We locked in quick 7% on that position in only 5 trading sessions. You should be in cash at the moment.

Pre-Market Analysis Points:

– Dollar index has pulled back and is now at support. Looks as though it may bounce or rally any day now which means more selling in stocks and commodities.

– Oil is trading at major support on the weekly chart but overall the intraday price and volume action remains bearish at this time.

– Natural gas has bounced the past three sessions and is not trading at resistance. Lower prices are to be expected though Nat Gas is more of a wild card.

– Gold, Gold miners and Silver are moving higher by 1-3% this morning but volume is not behind the move and higher highs and lows have not yet been formed.

– Bonds have pulled back the past few sessions and could bounce or consolidate for a few more days yet. Price is floating in no-man’s land so it’s more of a wild card at this time.

– SP500 just continued to move higher in overnight trading up over 1%. This is going to put stocks in an overbought market condition at the open. Sellers may step in today or tomorrow and force prices back down for a 1-2% drop as talked about in the morning video.

Chris Vermeulen