Precious Metals, Equities & Oil Long Term Outlook Part II

Yet another major market correction has begun to unfold over the past couple of weeks.

I have a much different outlook on the markets than most everyone else. This likely includes you as well. However, before you stop reading what I have to say, hear me out. My outlook and opinions are based strictly on price, volume, inter-market analysis, and crowd behavior. I hope you will consider my ideas and how they might affect your current positions.

My fundamental thinking is contrarian in nature. I feel that gold and silver have risen because of obvious reasons, those mainly being the printing of money. Also, fears that fiat currencies will become obsolete in the next 5 years continue to push the metals higher.

The flaw with that thinking is that most or all of the bad news has come out with European crisis. We know there are still major issues to resolve, however, the end of the world did not happen. Looking forward 5 years, countries will likely have stopped acting like teenagers who spend more money than they have on their credit cards. Hopefully they start creating budgets which they can and will abide by.

Should this happen, it would mean that the global economy as a whole will be stronger than ever before. We may have a few bumps along the way, but I feel countries and individuals will be better positioned than ever a scant 5 years from now.

Two weeks ago, I sent my “big picture” outlook to my subscribers, followers, and financial websites in which I warned of a major pullback. You can take a quick look at what the charts looked like 2 weeks ago: http://www.thegoldandoilguy.com/articles/the-currency-war-big-picture-analysis-for-gold-silver-socks/

Since my warning we have seen the financial markets fall:

SP500 down 2.6%

Crude Oil down 4.4%

Gold down 9.6%

and Silver down 12.2%

If you had invested in any of the leveraged exchange traded funds of these items, you could have doubled or tripled your returns. The numbers of those who have been cashing in on my advice about these recent pullbacks, have been very gratifying to hear about. The exciting part about trading is the fact that moves like this happen all the time. So if you missed this one, don’t worry because there is another opportunity just around the corner.

While my negative views on stocks and precious metals may rub the gold and silver bugs the wrong way, I just want to point out what is unfolding in an objective way in order for everyone to see both sides of the trade. I also would like to mention that this analysis can, and likely will change on a weekly basis as the financial markets and global economies evolve over time. The point I am trying to get across is that I am not a “Gloom and Doom” kind of guy. I don’t always favor the down side. Rather, I am a technical trader simply providing my analysis and giving odds for what to expect next.

Let’s take a look at some charts and dig right in…

Dollar Index Daily Chart:

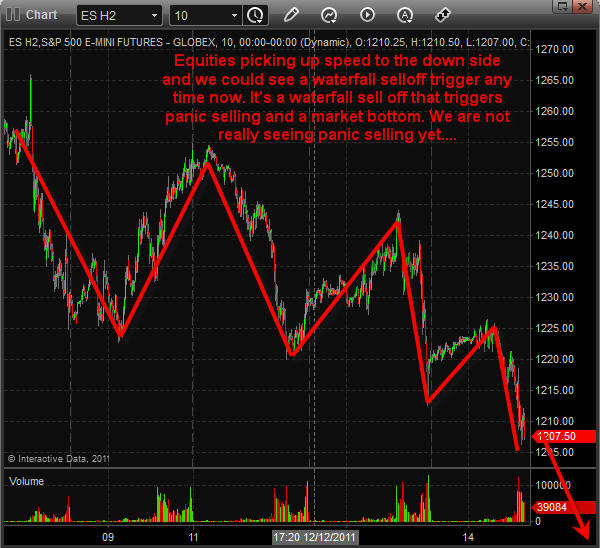

SP500 Futures Index Daily Chart:

Silver Futures Daily Chart:

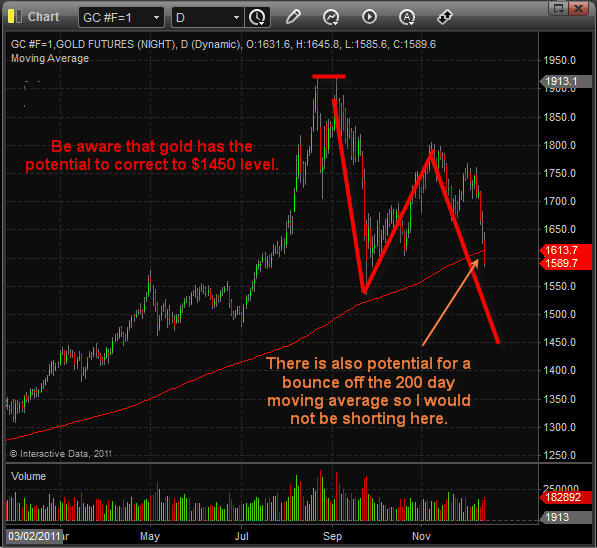

Gold Futures Daily Chart:

Crude Oil Futures Daily Chart:

Mid-Week Market Madness Trend Analysis Conclusion:

In short, stocks and commodities are under pressure from the rising dollar. We have already seen a sizable pullback but there may be more to come in the next few trading sessions.

Overall, the charts are starting to look very negative which the majority of traders/investors around the world are starting to notice. With any luck they will fuel the market with more selling pressure pushing positions that my subscribers and I are holding deeper into the money.

Now that the masses are starting to get nervous and are beginning to sell out of their positions, I am on high alert for a panic washout selling day. This occurs when everyone around the world panics at the same time and bails out of their long positions. Prices drop sharply, volume shoots through the roof, and my custom indicators for spotting extreme sentiment levels sends me an alert to start covering my shorts and tightening our stops.

Hold on tight as this could be a crazy few trading sessions….

Get these Free Weekly Reports EVERY WEEK