Q1 GDP Data Masking The True Global Economic Future?

As Q1 GDP data is released on Wednesday, April 29, which will reflect the first three months of 2020 in terms of total economic output, we believe the number will skew the current true global economic conditions to a large degree. The pandemic shutdowns started in the US on March 15th – nearly 2 weeks before the end of Q1:2020. Thus, we had a fairly normal Q1 in terms of economic activity, production, and consumer engagement. Everything changed after March 15th, 2020.

Skilled traders need to watch the current economic data and “week over week” data that is presented. Skilled traders also need to pay attention to the news items that are being pushed out to the public. Larger and larger corporations and sectors are moving towards bankruptcy or screaming for a bailout. Airlines, Hotels, Car Rental, and dozens of other sectors have all collapsed over the past 5+ weeks. We expect real estate activity and pricing to collapse as well. The results of the last 5+ weeks, after the March 15th shutdown started, have been anything but normal.

We continue to believe the current data and news, which is still representative of the Q1 (pre-shutdown) economic activity may lull investors/traders into believing the global economy will rebound fairly quickly from this virus event. Traders/investors are looking at this current data and thinking, “well, this isn’t so bad”. But they are failing to understand the true scope of the economic contraction event and what the longer-term outcome is likely to be in terms of recovery.

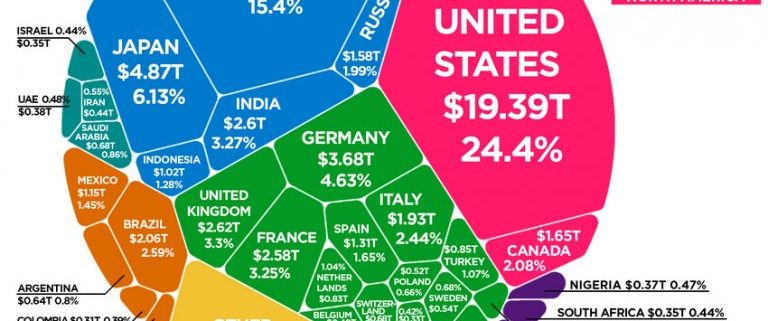

TOTAL WORLD GDP OUTPUT

The total world GDP output was approximately $190 trillion. An estimated 15% to 20% global GDP contraction as a result of the Covid-19 virus event would shave $28.5 to $38.0 trillion right off the top of the 2020 global economic output. Should the global shutdown last through the end of May 2020 (or beyond in some form), we believe the contraction in global GDP could become even more severe.

The complicated issues that arise from this global contraction in GDP also bleed over into supply-side economics. As the world attempts to “shelter in place” to avoid spreading the virus and risking more lives, demand collapses. Once demand collapses enough (resulting in price level collapses as we’ve seen in Oil) the result in production/supply issues becomes even more complicated. Unlike Eggs or Milk, one simply can’t bury or destroy other types of supply. The destruction of certain industries, resources, and capabilities will become very real over time as a result of any extended contraction event. The longer-term results of this type of event are sometimes called “stagflation” – where price levels rise as income and economic output stay moderately flat.

BEFORE WE CONTINUE, BE SURE TO OPT-IN TO MY FREE MARKET TREND SIGNALS SO YOU DON’T MISS OUR NEXT SPECIAL REPORT!

CUSTOM SMART STOCK MARKET INDEX

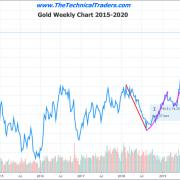

Our Custom Smart Cash Index highlights the “new price channel” that setup recently and why all traders/investors should really start to pay attention to how the global markets have transitioned into a new phase or price cycle. You can see from the chart, below, that the global markets broke below an upward price channel that has been in place since 2012 recently and has established a new downward price channel spanning the December 2018 lows to the February 2020 highs.

We believe the current upward price trend on this chart is nothing more than a “bullish retracement in a bearish trend” and that the global markets will begin another downside price move within 5 to 10+ days. As we’ve been trying to share with you over the past few weeks, the longer-term global economic disruption is just getting started.

US DOLLAR DAILY CHART

We believe the US Dollar will enter a new phase of increasing demand throughout the world as global economies begin to feel the pressures of the demand-side collapse. We believe the US dollar is uniquely positioned to benefit from the global economic crisis simply because the US economy is the biggest and most capable economies on the planet in terms of the ability to recover from this virus event. As foreign nations attempt to deal with weakening currencies and economies related to the collapse in demand and continued virus-related economic transitions, we believe the US economy will be one of the first global economies to regain any real growth over the next 2 to 3+ years.

Thus, we believe the US Dollar may attempt another quick downside valuation move, similar to what happened in February/March 2020, then rally to levels above 102 again as continued economic data hit the markets. Remember, valuation levels of currencies are often based on future expectations of economic stability and capability for any nation. The US Dollar is a bit different because it is also the “currency of choice” in terms of global economic activity. We believe the US Dollar could begin a moderate “melt-up” process as the virus data continues to scorch the world’s economic output.

CONCLUDING THOUGHTS:

These longer-term economic expectations are key to understanding how the recovery process will create opportunities for skilled traders and investors. We believe the world will survive this virus event. Yet, we also believe the global economic landscape will likely change over the next 3+ years as this virus event could very easily push many foreign nations away from economic relationships or projects they have engaged in over the past 10+ years. This virus event is really a “big game-changer” in terms of how and what the future of the global economic world will look like for many.

As we’ve warned many times, it is not the localized “one-off” economic event that presents a real problem for the global economy – central banks can simply patch the economy up with an infusion of cash. The bigger problems for the global economy happen when a fundamental shift takes place that lasts 6 to 12+ months and disrupts the “systems” in place throughout the globe. We believe this virus event could start a process that disrupts supply, demand, consumer engagement, and true valuation levels of almost all commodities and assets throughout the globe over the next 24+ months.

In Part II of this article, we’ll attempt to share more data and highlight where opportunities may present real profit objectives for skilled investors and traders.

The next few years are going to be full of incredible opportunities for skilled traders and investors. Huge price swings, incredible revaluation events, and, eventually, an incredible upside rally will start again.

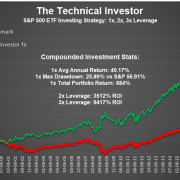

I’ve been trading since 1997 and I’ve lived through numerous market events. The one thing I teach my members is that risk is always a big part of trading and that’s why I structure all of my research and trading signals around “finding profits while reducing overall risks”. Sure, there are fast profits to be made in these wild market swings, but those types of trades are extremely risky for most people – and I don’t know many successful traders that want to risk their hard-earned money when daily price swings in various assets are moving 10% to 95%.

I’m offering you the chance to learn to profit, as I do with my own money from market trends that I hand-pick for my own trading. These are not wild, crazy trades – these are simple, effective, and slower types of trades that consistently build wealth. I issue about 2 to 4+ trades a month for my members and adjust trade allocation based on my proprietary allocation and risk algo – the objective is to gain profits while managing overall risks.

You don’t have to spend days or weeks trying to learn my strategy. You don’t have to try to learn to make these decisions on your own or follow the markets 24/7 – I do that for you. All you have to do is follow my research and trading signals and start benefiting from my trading experience. My new mobile apps make it simple – download the app, sign in and everything is delivered to your phone, tablet, or desktop – updates, videos, education, and trade alerts.

I offer membership services for active traders, long-term investors, and wealth/asset managers. Each of these services is driven by my own experience and my proprietary trading and risk modeling systems. I have a small team of dedicated researchers and developers that do nothing but research and find trading signals for us to take advantage of together. Our objective is to help you protect and grow your wealth.

Please take a moment to visit www.TheTechnicalTraders.com to learn more. I cannot say it any better than this… I want to help you create success while helping you protect and preserve your wealth – it’s that simple.

Chris Vermeulen

Chief Market Strategist

Founder of Technical Traders Ltd.