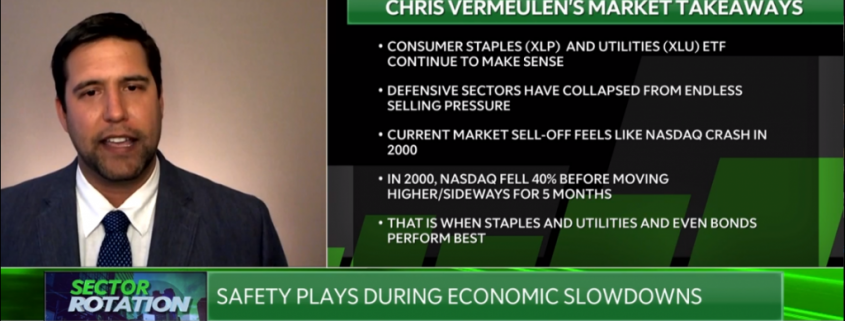

Chris Featured on TD Ameritrade TV – Safe Plays During Slowdowns

Recently I have been asked to talk on multiple TV shows, radio stations, and podcasts during this wild market correction in almost every asset class.

The reason being I think is from some recent articles I posted publically clearly shows how a technical trader can successfully time, trade, and protect capital no matter what happens in the equities, bonds, and commodities market.

In short, I had subscribers move their money into the leading assets in January which were GDXJ (gold miners) and TLT (bonds). I also talked about consumer staples, and utilities as safe havens.

These assets were outperforming the stock market and that is where you want your money to be positioned as you will earn more over time owning leaders that increase in value more than that of the average stock market index.

Spotting the leaders is not really that difficult, but what is tough is knowing what position size you should have in any given trade, where to place profit targets, and where to place stop losses/trailing stops.

As you have likely noticed gold miners GDXJ fell a whopping 57% from the highs if you didn’t have proven strategy then your likely still holding them and have endured one hell of a rollercoaster ride. Subscribers and I exited GDXJ at the high tick the day price reversed for a 9.5% profit because we had a trading strategy and executed our trading plan.

GDXJ had reached our extreme price target using technical analysis which was a clear resistance level for sellers to unload shares and that’s what did, sold our shares as well.

TLT actually had the biggest and best-looking chart out of all other asset classes which is why we focused mainly on that position with our capital. See our trade below as it paints a clear picture.

TLT/Bonds historically show that when they rally 20% in price quickly the instantly reverse and crash. Well, our Fibonacci upside target worked out to be a 20% gain and if that level was reached we would close out any remaining position we had, which we did. During the rally, we scaled out of the position at 5%, 7.5%, 10% gain, and then the last portion once 20% was reached. The next day, TLT reversed and fall 15% over the next two weeks.