Part II – We Are Concerned About The Real Estate Market

In this second part of our research into the potential collateral damage, the Covid-19 global virus event may cause in the housing and commercial real estate markets, we want to start by sharing some information that severe cracks are already starting to appear in the entire system.

Hedge funds and banking institutions may already be feeling the pressure to attempt to contain the losses that are piling up (source: https://www-bloomberg-com).

An extended decline in the global markets will continue to place pressure on institutional financial markets, banks, hedge funds, and other traditional lending and investment firms. Investors will start to pull investment capital away from risk (out of the markets and funds) and may expose some of these larger institutions’ excessive leverage and risk exposure in the process.

This is almost exactly what happened with Bernie Madoff when his firm, Bernard L. Madoff Investment Securities, collapsed in December 2008. As long as there was no pressure on his firm from clients pulling out capital or asking too many questions, he was allowed to continue running his Ponzi scheme. Once investors started pulling capital out of the firm and questioning the transactions/reports, it became evident that it was all a house of cards and would come crashing down quickly.

If larger investment firms and hedge funds are attempting to “buy the dip” at this point in time, we believe they are making a grave mistake. We believe the downside risks associated with the Covid-19 virus event are just starting to unfold and the collateral damage that may come from this massive global shutdown that is currently taking place will be unprecedented. We don’t believe there has been anything like this happening in any recent history – even WWII pales in comparison to this event.

News is starting to hit the wires about large investment firms and Real Estate investment companies sounding the alarm The one news item out this weekend that caught our attention was this one from https://www-bloomberg-com. The fear is evident in the short content of this news article.

“Loan repayment demands are likely to escalate on a systemic level, triggering a domino effect of borrower defaults that will swiftly and severely impact the broad range of stakeholders in the entire real estate market, including property and homeowners, landlords, developers, hotel operators, and their respective tenants and employees,” he wrote.

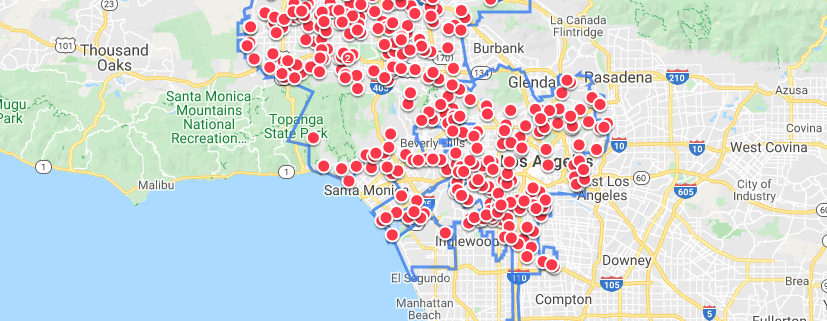

Just take look at the foreclosures in the major cities starting to spike in the maps below. This was before the virus closed down most businesses, and everyone losing their jobs. Give the fact that 70% or more of the world lives pay-check to pay-check, foreclosures and real estate values are likely to plummet lower to an extreme similar to how overpriced they are now.

I have talked about his in some presentations, and in videos in the past how real estate is grossly overvalued and when the music stops, prices will tumble. Huge opportunities for those who can preserve their capital until the recession matures enough will be able to buy real estate, businesses, and equipment for pennies on the dollar, but this will take another 1-2 years from now I imagine, but it will be great for those with money on hand when things get ugly.

Be sure to opt-in to our free market trend signals before closing this page, so you don’t miss our next special report!

CURRENT LOS ANGELES FORECLOSURE MAP

(SOURCE: ZILLOW.COM)

CURRENT SAN FRANCISCO FORECLOSURE MAP

(SOURCE: ZILLOW.COM)

CURRENT NEW YORK FORECLOSURE MAP (SOURCE: ZILLOW.COM)

Many of you may remember my Crunching Numbers article from just a week ago where I attempted to model what I believe would be the likely outcome of US GDP over the next 5+ years? Well, it now appears others are following up with their own predictions for US GDP. Based on some of the expectations within this Bloomberg article, my predictions pale in comparison to these comments. Source: https://www.bloomberg.com

Now, let’s try to be realistic about how this entire process is likely to take place. We know the economy will find a base (at some point) and attempt to recover from this virus event. The question is what does that base look like and where is the bottom?

We won’t really know where the bottom is in the global markets until most of the unknowns have been processed, most of the collateral damage has been identified and processed, and consumers realize the bottom is in sight. At that point, there is a real chance that the global markets will begin a recovery process that may eventually push to new all-time highs.

What we’re concerned about right now is the Q1 and Q2 economic activity and how that relates to consumer markets, credit markets, existing business enterprises and the potential collateral damage to hard assets like homes, commercial real estate and other foundations of wealth. We believe the first few dominos of this event will be the collapse of jobs, earnings, and consumer spending. The longer the global stays in a mostly shutdown economic environment, the greater the risks these critical numbers will implode – possibly taking with it the rest of the economy.

We believe the suspension of Foreclosures for a potential 12 month period may not reduce the total number of foreclosures across the US, we believe it may compound the problem. The suspension effort is designed to help people stay in their homes if their incomes become threatened or lost. But the reality is that a Foreclosure suspension will simply start to build larger and larger numbers of properties in foreclosure (waiting for the suspension to be lifted) while home prices potentially collapse.

We’ll dig into more data in Part III of this article and attempt to illustrate the data we believe will point to a clearer picture of how all of this may unfold in the near future.

As a technical analysis and trader since 1997, I have been through a few bull/bear market cycles. I believe I have a good pulse on the market and timing key turning points for short-term swing traders.

Visit my ETF Wealth Building Newsletter and if you like what I offer, and ride my coattails as I navigate these financial markets and build wealth while others lose nearly everything they own during the next financial crisis.

Chris Vermeulen

www.TheTechnicalTraders.com