Recently, quite a bit of news has been originating from Malaysia, China and other areas of South East Asia. Much of it is concerns with multi-billion dollar projects and excessive corruption and graft. Malaysia is taking the lead with this issue so far with the new Mahathir administration. Yet, we believe these issues are far-reaching and could result in quite a bit of market turmoil over the next few months – possibly much longer.

What is at risk is the exposure of “cooked books” across much of China, India and likely throughout the globe with infrastructure and real estate projects that were designed to boost numbers while hiding real economic concerns. You may remember we alerted our members and the general public to this concern in March 2018 – nearly 4 months ago in this blog post. If you have not read our multi-part research post regarding how China has set itself up for a massive economic collapse, please take a minute to read all of our earlier research.

How has this Ponzi scheme been setup to play out for so long? Our assumption is that it goes something like this. In late 2009/early 2010, China was feeling the crunch of the global credit market crisis and made an attempt to push easy credit out to internal and external infrastructure projects in an attempt to keep the manufacturing and export sectors in China clicking right along. The objective was to keep building, while the capability was available and the supply was plentiful. The only thing China needed to do was to make it easy for capital (loans) to be acquired for builders and buyers.

Much like what happened throughout most of the world, China took advantage of an already steady economy to avoid any contraction in real economic output by creating capital out of thin air and allowing their banking institutions to loan capital for massive projects. This fueled a huge wave of investment and speculation throughout most of Asia – including external projects like those in Malaysia, Africa, India and many other countries. What we are learning, though, is that the projects may have been much more nefarious than we originally thought.

For example, the 1MDB investigation in Malaysia has shown that graft, corruption, nepotism and a host of other issues are raising many questions as to how and where multiple hundreds of billions of dollars vanished? It appears one component of the 1MDB and other project were a commitment for the infrastructure project materials to be purchased from Chinese manufacturers and the payment schedule for said materials were set to be transmitted well before these materials were actually delivered. In other words, China made a capital commitment to loan a portion of capital for an international project with the commitment being to purchase materials from Chinese manufacturers where the host country would also have a capital repayment agreement as their joint partnership in this project. The problem was that China never really delivered on the materials and the host country, in some cases, has already paid for 80%+ of the project costs. This is a classic “I’ll gladly pay you in advance for materials and work that I may never EVER see”.

In terms of how this type of deal cooks the books, think of it like this. China just “booked” a $400 billion project where China must contribute 10~15% of the capital costs and the host country contributes the rest. This results in a “sale” of $400 billion on the books with additional sales going out to manufacturers and suppliers. As the host country begins payments for this project, China can quickly recover actual costs because they have not delivered much in terms of raw materials or actual building materials for this project. Meanwhile they are bilking the host country out of hundreds of millions or billions on a “phantom project” that may never be completed.

It all seems to work well for the books because as long as no one actually finds out what is happening, China is selling “vapor projects” to other nations and booking profits for simply making a commitment – a shell game with billions, possibly trillions, at risk.

At the end of the day, China shows multiple massive infrastructure projects and this boosts their GDP, employment, and manufacturing data while covering the raw material and labor costs by sucking real revenues from host nations. As long as the host nation does not lose faith in the deal or ask too many questions, no one is the wiser and China can keep playing their shell game.

We believe all of this started to change in early 2018 when the Chinese consumer sentiment started to change and when President Trump began to disrupt the “global think” in terms of trade, multi-national deals, and future economic expectations. As soon as the curtain was pulled back and questions started being asked, China came under real pressure as consumers, nations, and corporations began to question the ongoing financial and economic capabilities of China suspecting that it had over-extended itself, it’s credit capacity and cooked the books with phantom projects, income, and economic output. The real threat comes when the shadow banking system in China collapses as well as the investment grade debt, corporate debt, and project liabilities become too great for collapsing revenue. This is when the collapse will accelerate beyond anyone’s imagination.

Right now, we believe we are in the early stages of a discovery process that could roil the markets a bit over the next 2~6+ months. Once consumers in China get an idea of what is actually transpiring (if they ever really find out), they will move into protection mode and prices will decline in a massive asset bubble collapse. Global debt issues will likely be resolved by the legal systems in place in various countries and a series of defaults will likely take place. When one of my partners was doing business in SE Asia, he quickly learned that most Chinese businessmen keep three sets of books; one for partners – showing a big loss, one for the government – showing enough of a loss to not pay too much in taxes, and the last (real) set of books that shows the real profit or loss.

We believe the fallout from all of this could drop the Chinese economic credibility to new lows and could result in a massive wave of legal and financial woes as the Chinese credit, banking, manufacturing and asset markets collapse because of this. It will start small with the Chinese government trying to inject billions into the economy to shore up failing enterprises and banks. But once the total scope of this shell game is exposed, we believe it could disrupt nearly all of the Asian and partner nations economies and could land many foreign and domestic state and business officials behind bars or worse. This is the kind of thing the ends very badly for some people.

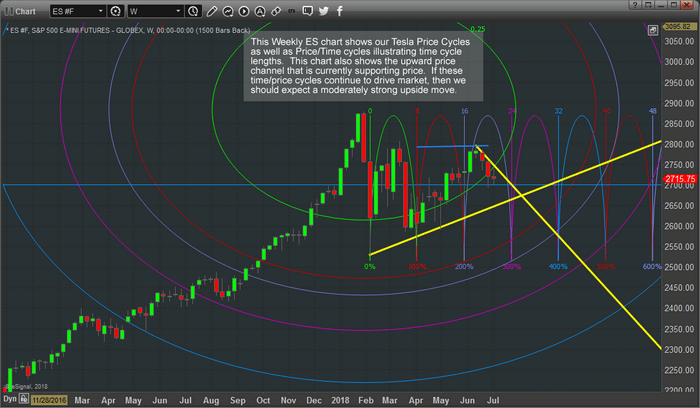

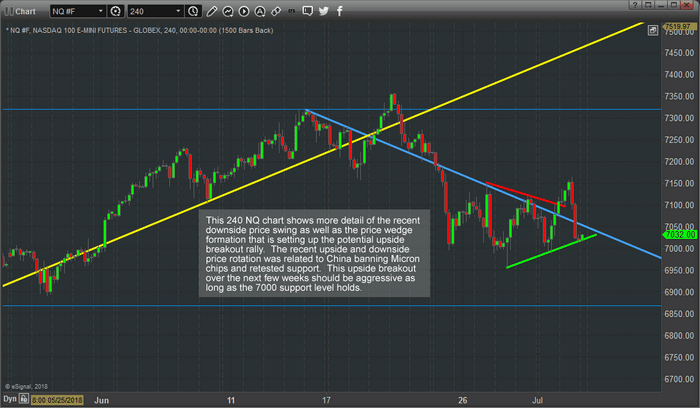

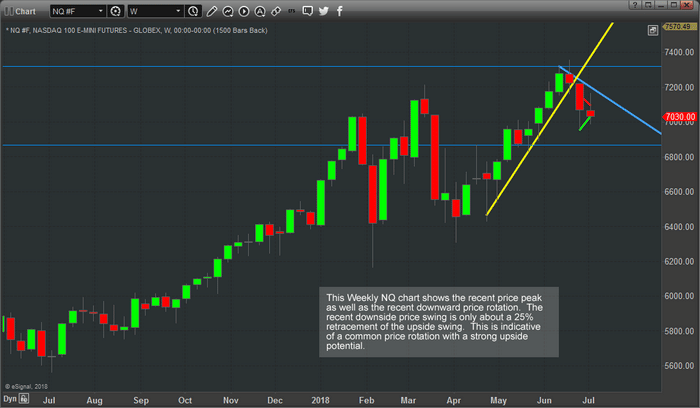

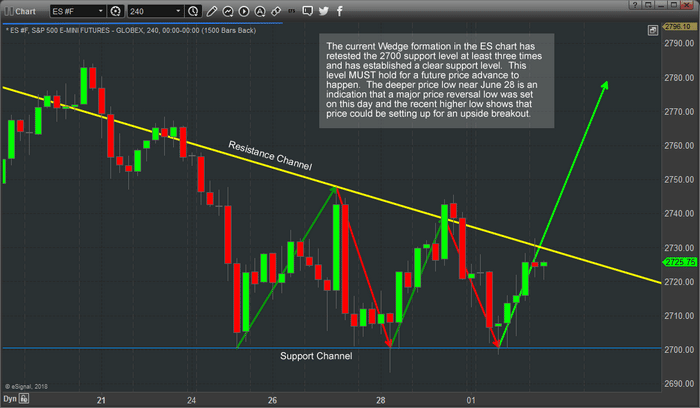

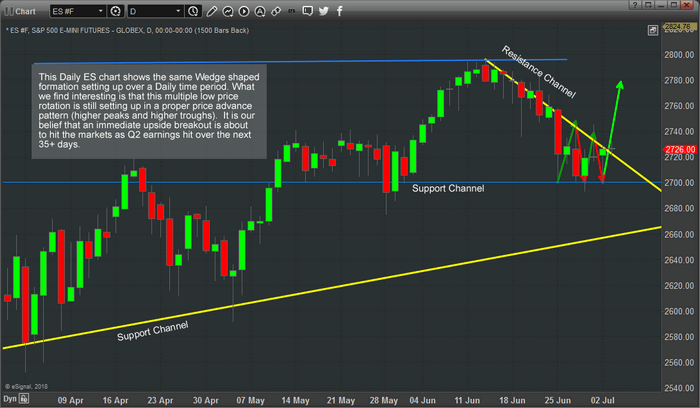

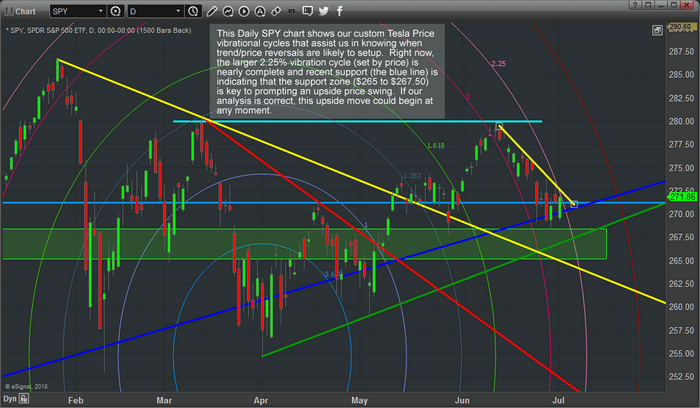

We have been paying very close attention to the unfolding events in China and SE Asia. We believe, for now, the US Equities markets seem immune to most of this, yet we believe we will soon start to see some credit issues spill over as trade issues and corporate liability repayments may soon begin to falter. Be prepared for an unknown or unforeseen event to unfold very quickly over the next 6+ months. We are not suggesting that investors or traders prepare for an immediate collapse in the global markets, but we are suggesting that the Chinese Dragon economy could very quickly unravel into a Chinese Gecko with little to really support pricing and valuations.

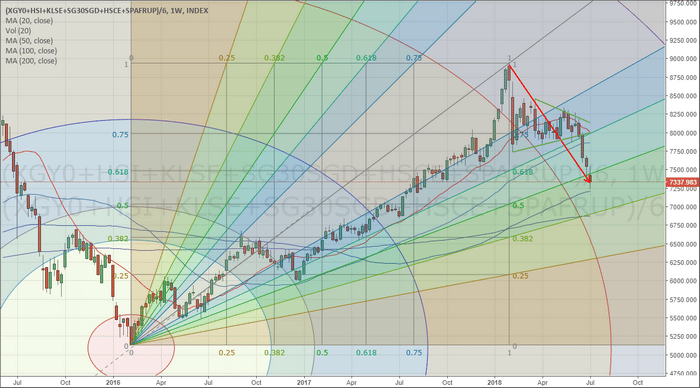

Our Custom China/Asia index has already retraced more than 38.2% from a recent price peak. As of right now, we are not calling this a collapse because we have yet to cross critical price levels to the downside. A move below the 50% retracement level, for us, would raise some additional concerns.

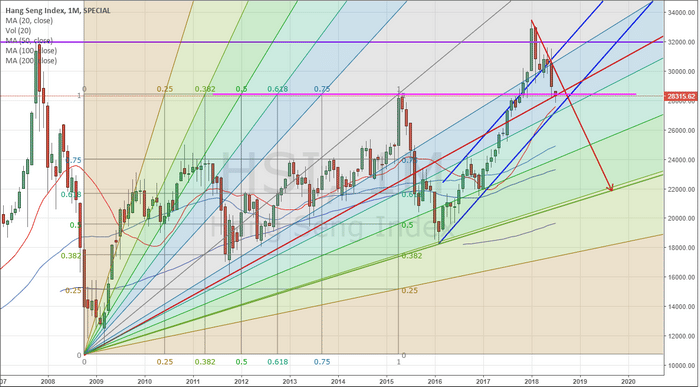

The Hang Seng Index has recently rotated above long-term resistance and collapsed back to the 2015 peak (support). You can see from our BLUE price trend channel that support could still hold near these lows, possibly prompting a further upside rally. Yet, we are watching these support/price channel levels because any break of the MAGENTA support line in conjunction with a breach of the price channel would be an ominous technical trigger that bottom has fallen out of the Chinese equity market – and possibly resulting in a massive asset valuation crisis.

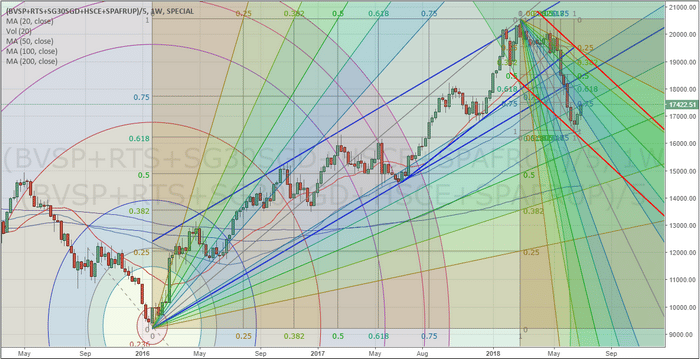

Lastly, our BRICs custom index chart is showing a much deeper price correction that has already established a new downside price channel (in RED). This is one of the bigger concerns that we have in regards to this Chinese debt/liability fallout. China may be able to absorb some, or most, of the crisis by nationalizing companies and increasing capital through central bank activities. But what happens to the other foreign nations that are left holding the empty bag of these failed infrastructure projects? They could be out hundreds of billions with nothing to show for it except a “Chinese IOU”. This Chinese shell game to “cook the books” could result in a global crisis involving some of the weakest and most vulnerable nations on the planet. Yes, the BRICs emerging markets could be taking a wild ride in the near future if the fallout from all of this extends as we believe it could.

Our opinions at this point is that China is in a very fragile position; protect itself from complete disgrace and economic collapse by going “all-in” with central bank and currency manipulation while delaying or canceling projects in an attempt to gain control of this mess; or orchestrate a planned and organized economic crisis event that exposes the shenanigans that have been ongoing for a decade or more while attempting to “save face” and maintain some level of credibility throughout the world. Remember, one of the most important aspects of the Chinese culture is “Asian face”. The term implies that one never disrespect or disgrace a leader or person of power. It is, in some ways, the most disgusting and horrid thing that can happen to anyone – to lose honor and respect in front of one’s peers.

China is stuck between the proverbial “rock and a hard place”. The only option they have at the moment is the “controlled/planned economic crisis event” (to the best of their abilities) while praying that nothing massive hits the news wires which could cause further damage to their fragile footing. If something (think Malaysia/Mahathir and neighboring countries) does hit the news wires to further erode China’s plans – it could result in an all-out collapse of the Chinese economy. Something that has really not been seen in well over 500 years (prior to the Qing Dynasty: 1644-1912).

We are advising our clients with regards to this unfolding event and continue to dedicate a large number of resources toward protecting our clients from unexpected and unknown issues. We have developed a unique set of trade positions that we believe assist our clients in executing successful future trading strategies as well as executing a protected style of trading based on our research and objective analysis. Our job is to deliver success for our clients and to keep them aware of the market turns and risks as we find and execute successful trades.

Visit www.TheTechnicalTraders.com to learn how we can help you create success, stay ahead of these market moves and deliver greater success for you as these incredible opportunities unfold over the next 6~24+ months.