A financial system stability assessment report, from the International Monetary Fund (IMF), on one bank in Europe identified Deutsche Bank AG (NYSE: DB), as the TOP bank that poses the greatest systemic risk to the global financial system. Systemic risk was identified as a major contributing factor in the ‘financial crisis’ of 2008. This is essentially the risk of contagion by the failure of one firm leading to failures throughout its’ industry.

On February 24th I talked about DB (Deutsche Bank) as the next major bank to fail. Since then price has plunged 31% and its likely headed much lower yet.

IMF: The Top Bank That Poses Global Financial Risk Is DEUTSCHE BANK!

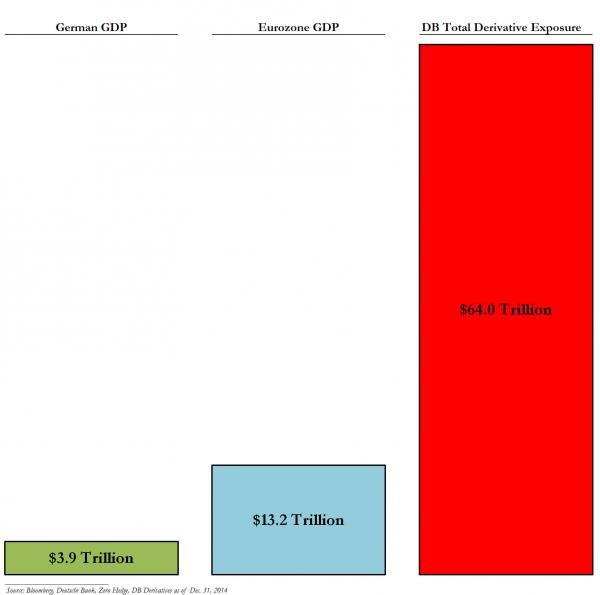

Deutsche Bank’s $75 Trillion In Derivatives Is 20 Times Greater Than German GDP!

Deutsche Bank was historically one of the most respected banks in the world. Today, it is increasingly the subject of reports that it was on the verge of collapse which was primarily due to a massive exposure to derivatives estimated at $50 to $70 trillion. The bank has struggled continuously since the 2008 financial crisis, and its’ stock price, as of late July 2016, stood at a new seven-year low of just $14.57 per share which is less than 10% of its’ peak price, in 2007, before the ‘financial crisis’.

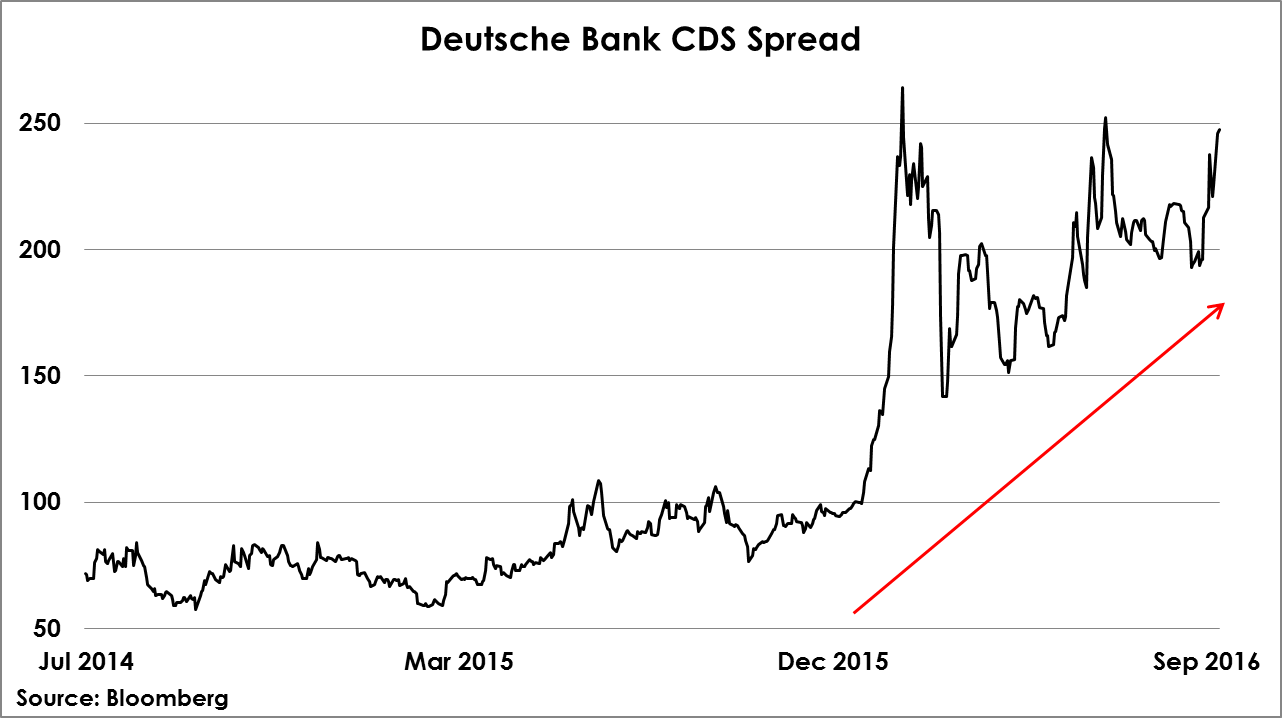

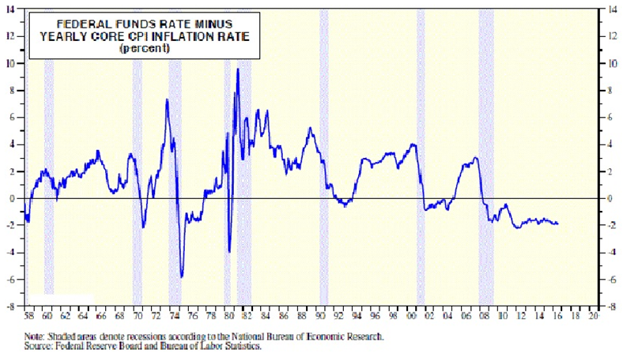

The bank’s CDS spread shot up to recent highs (a CDS is a measure of risk – higher is bad) and its’ share price hit 33 year lows. DB has been struggling in Europe’s negative interest rate environment. Negative interest rates have been crushing European and Japanese banks. Deutsche Bank’s CEO John Cryan told analysts that banks will increase fees and take other measures which will be passed on to customers.

The bank was hit with a $2.5 billion fine in October 2015 for its’ involvement in the LIBOR scandal regarding interest rate rigging. In January 2016, it announced a record loss of more than $6 billion for 2015 which is a stunning reversal from a 2014 profit of $1.6 billion. In my past articles, I issued a warning that Deutsche Bank was massively leveraged and that its’ problems were most probably insurmountable. In June 2016, the Fed announced that Deutsche Bank had failed its’ stress test for the second year in a row. The bank was also hit by the BREXIT decision seeing as it derived nearly 20% of its’ revenues from the United Kingdom.

Does Deutsche Bank Have Similarities to Lehman?

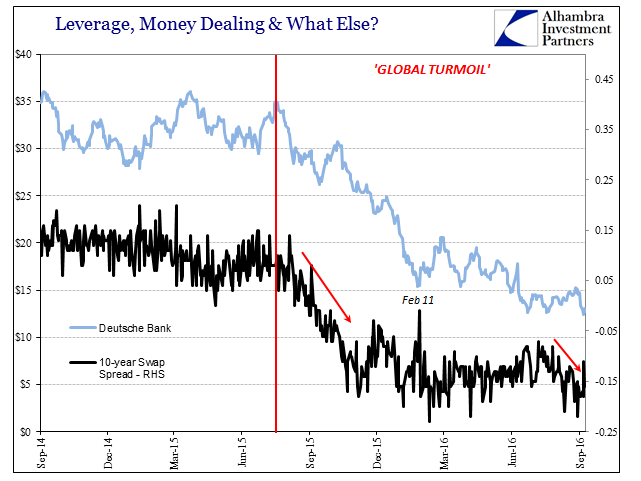

The biggest problem that Deutsche Bank faces is excessive leverage on its’ balance sheet. It faces insurmountable challenges from poor-performing core businesses and a lack of capital. I believe that the company ultimately must raise more equity capital to solve its’ leverage problems. Deutsche Bank’s valuation highlights the market’s pessimism. As of June 15th, 2016, the bank traded at 27% of tangible book value, which means that the company is worth less than its’ liquidation value.

In 2008, failures at Lehman Brothers and American International Group Inc. (NYSE: AIG) led to a run on banks and imperiled the financial system. Similarly, a failure at Deutsche Bank will have catastrophic consequences for the banking system during 2016.

The U.S. Department of Justice (DOJ) has ordered Deutsche Bank AG (DB) to pay $14 billion in order to settle claims of miss-selling mortgage-backed securities. Deutsche Bank said it would fight a $14 billion demand by the U.S. Department of Justice to settle claims that it miss-sold mortgage-backed securities which raises questions about the future of Germany’s largest lender.

The bank’s market value is about $18 billion. A pending fine of $14 billion is not a good sign. The bank, which is already battling multiple legal cases, has only around $6 billion in its’ litigation reserves. Therefore, paying a $14 billion fine would seriously impact the capital structure of the bank. It is important to note that Deutsche Bank has already been struggling in terms of profitability.

The Destruction Of An Illusion:

Last Monday, September 26th, 2016, their stock crashed yet again; down another 6%. Its’ bonds have slumped, while the cost of credit default ‘swaps’ are essentially a way of hedging against a collapse. It all has a very 2008 deja vu feeling to it.

Markets should be bracing themselves for the worst outcome. The European ‘debt crisis’ will create long-term systemic risks for ALL banks. Shares in all European banks continue to lag while at the same time U.S. indexes are making all-time highs!

Deutsche Bank has struggled in Europe’s negative interest rate environment and very recently the German Chancellor Angela Merkel has ruled out a government rescue of the bank. Deutsche Bank has the second largest ‘derivative’ book in the world while behind JP Morgan and that is indeed a serious concern. If the viability of Deutsche Bank is put in jeopardy, many other Euro banks will go under, as well, which would induce “global turmoil” reminiscent of 2008. The IMF has highlighted Deutsche Bank as the most important net contributor to ‘systemic risk’. Once confidence is lost, a bank is in big trouble. If Deutsche Bank does go under, it will most likely take Merkel with it and quite possibly the euro as well!

This is Your Biggest Buying Opportunity Of Your Life!

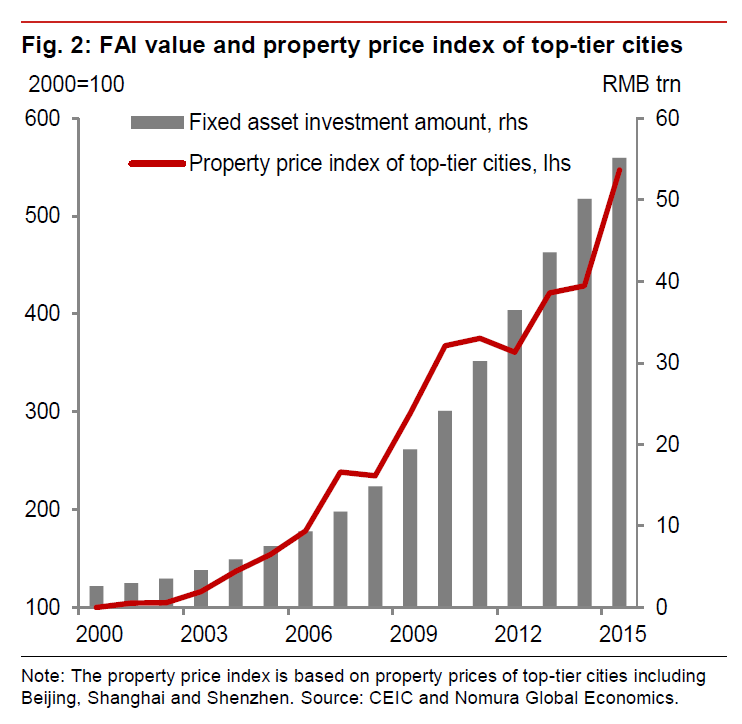

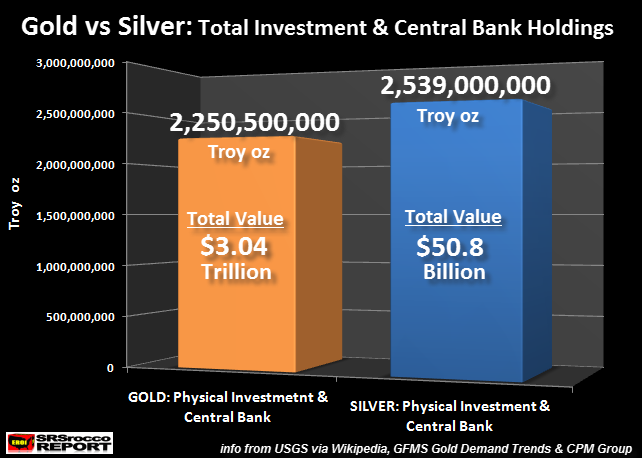

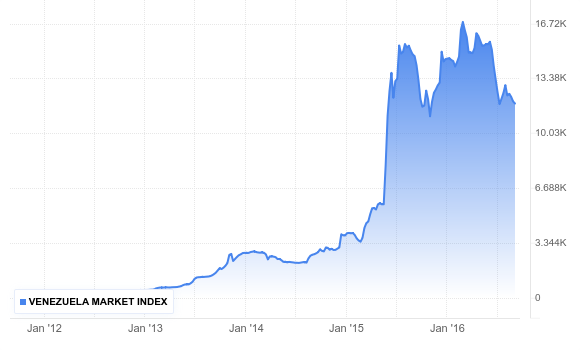

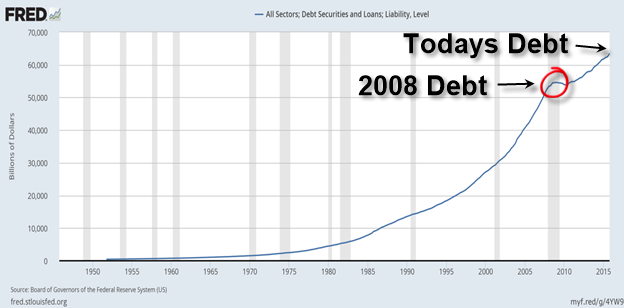

The difficulty in identifying asset bubbles is directly related to credit expansion. The problem is not the asset bubbles, whether they be in stocks, housing, or student loans. This is merely a symptom of a deeper condition. The real threat is the underlying credit expansion by easy monetary policies that has created these asset bubble problems in the first place.

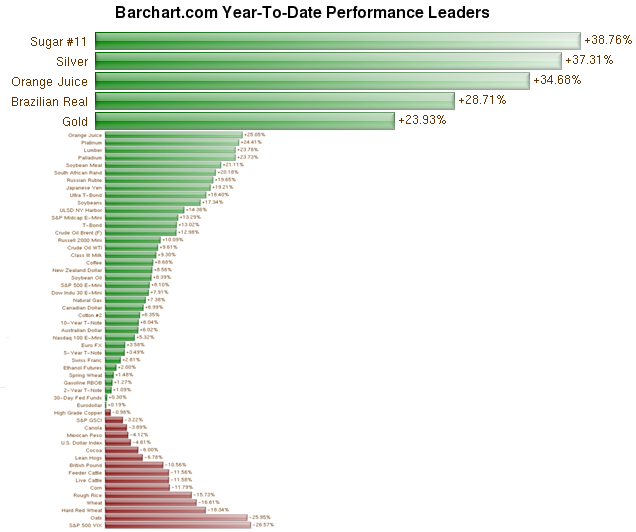

Every crisis also brings an opportunity with it, hence, lets’ make the best use of the opportunity before the price of gold and silver blows through the roof. It is better to invest now and see our investments multiply, instead of waiting for the crisis to start, as, by then, more than half of the rally would be behind us.

Follow my trades and long-term investment position at www.TheGoldAndOilGuy.com

Chris Vermeulen