A financial revolution is now taking place and I want to tell you the story. It has rather large implications for interest rates, the stock market, gold and real estate.

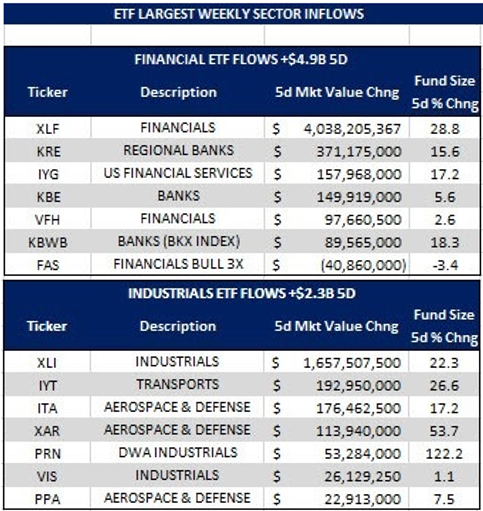

The only reasons for the DOW JONES sharp gains, post-election, is due to the fact its’ index leans toward financial and industrial stocks, (as seen in the chart below), more than the SPX and Nasdaq Indexes. Those two sectors have outstripped most of the market since Election Day.

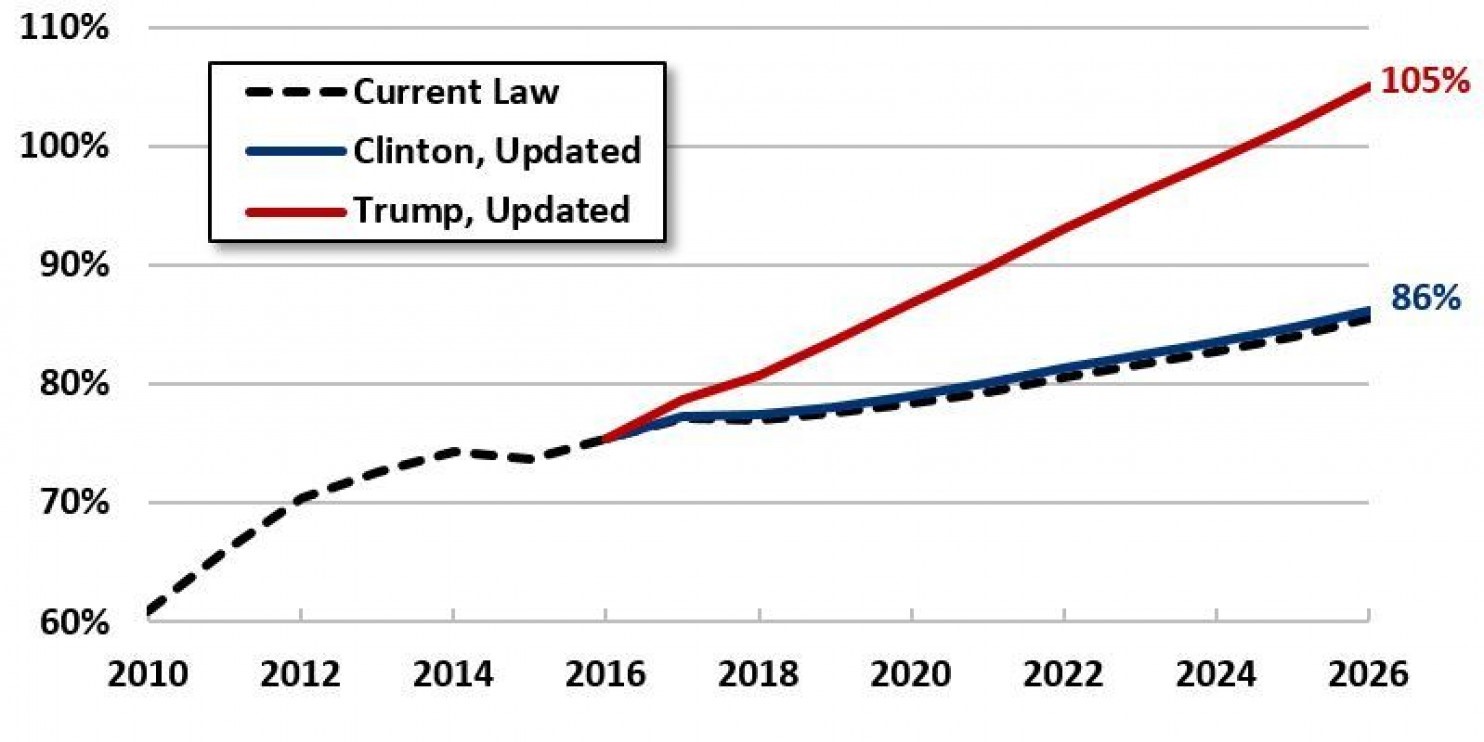

Trump’s economics policies include: substantial tax cuts, spending at least $300 billion on infrastructure, increasing defense spending and shaking up major trade deals.

President-elect Trump plans to change the status quo not only in Washington D.C. politics, but for global financial markets, as well. On Monday, December 19th, 2016, the members of the Electoral College will gather in all 50 state capitals to cast their votes for president. It is then, and only then, that the next president of the United States will be elected.

All the proposed infrastructure spending is expected to put upwards pressure on “demand-pull” inflation which would be a catalyst for tighter monetary policy.

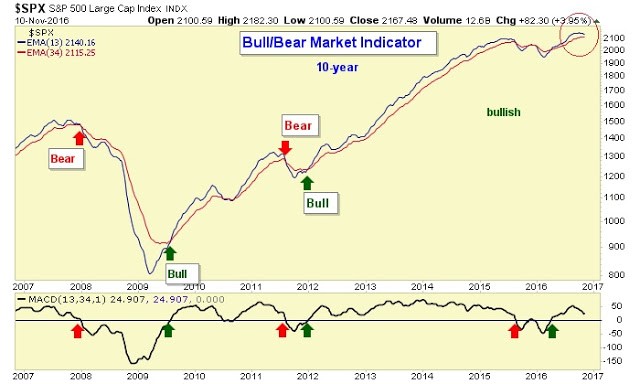

Regardless of the U.S. negative economic data, I believe that the U.S. equity markets are destined to trend higher now.

‘Hot money’ is supporting the market. The FED will not stop supporting this market because it promotes the illusion of a healthy economy.

Stocks should continue to rise for the remainder of 2016 with the belief that Trump’s stimulus package will boost company profits and growth. Last week, investors returned into investing of equities. This was evidenced by the massive Equity ETF flows, last week, of $31 billion. You should follow my trading plan as it is presented daily by video. You cannot afford NOT to be part of my cutting edge daily “cycle analysis”!

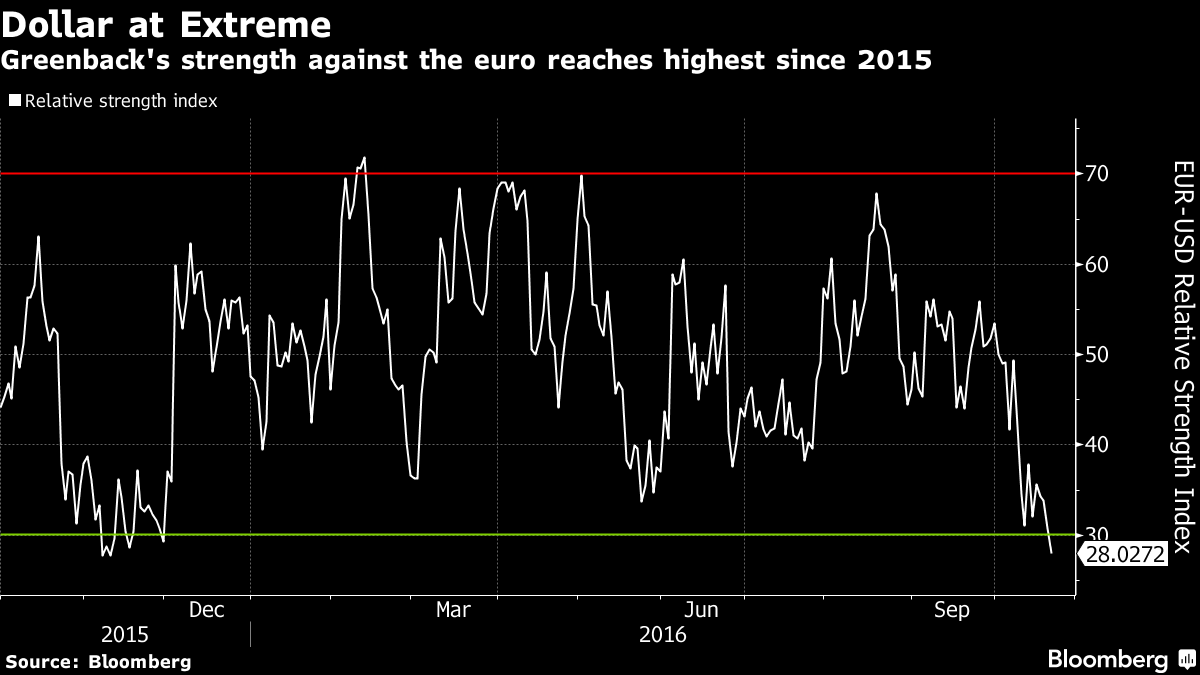

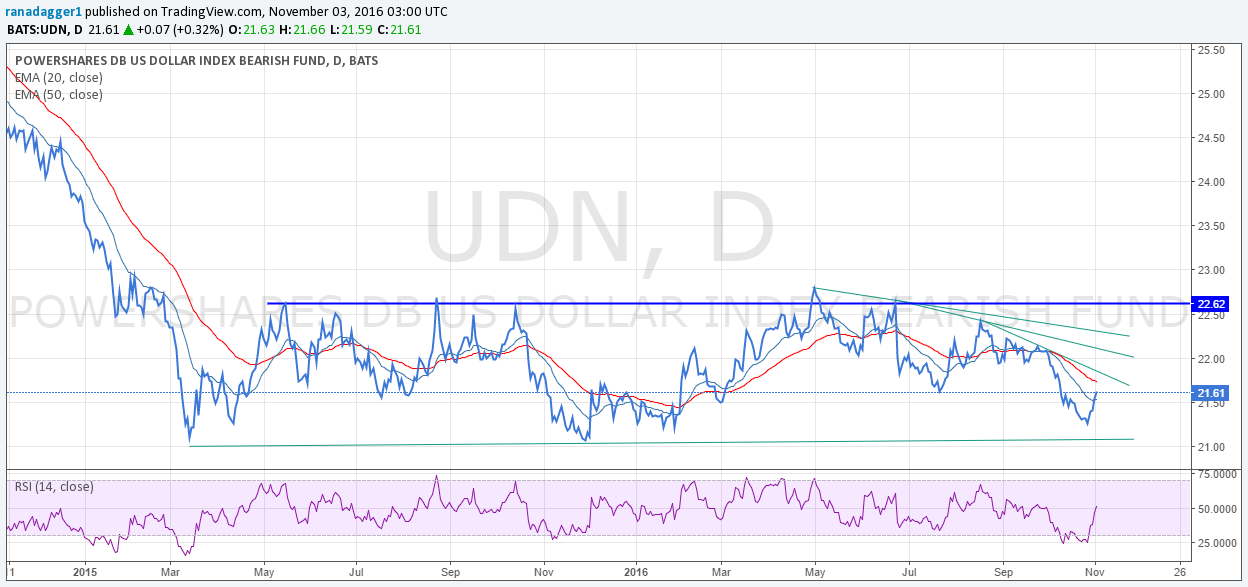

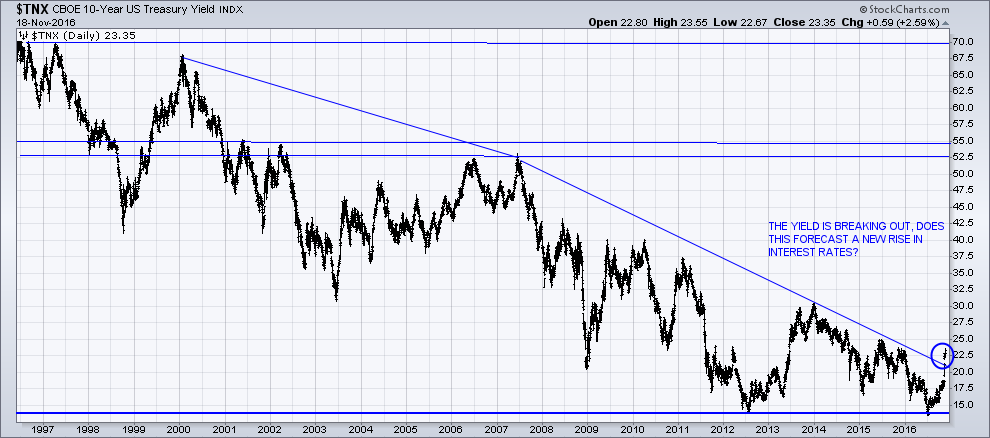

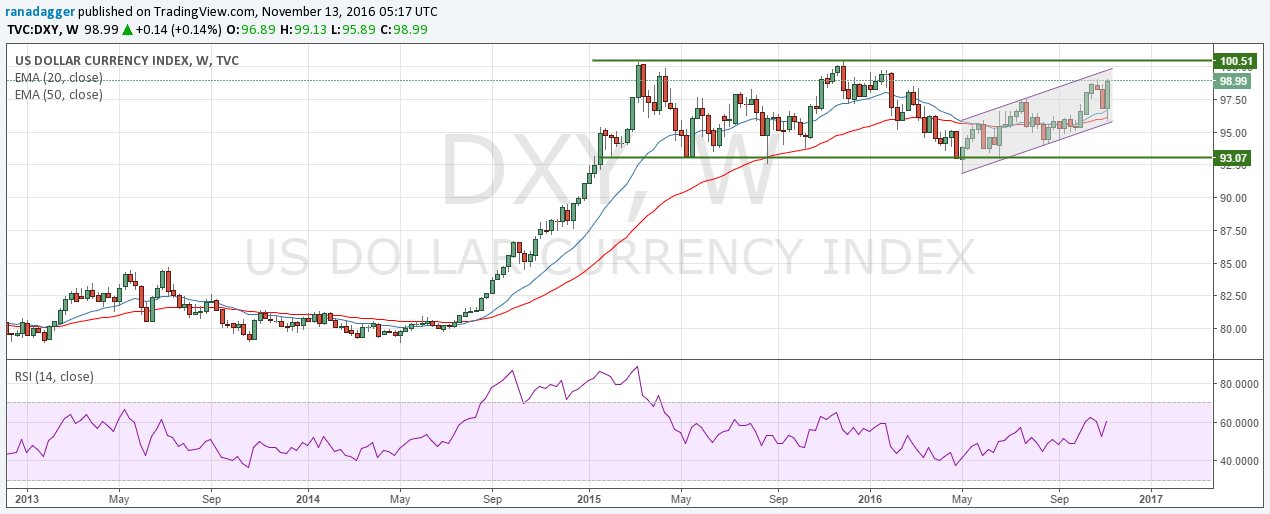

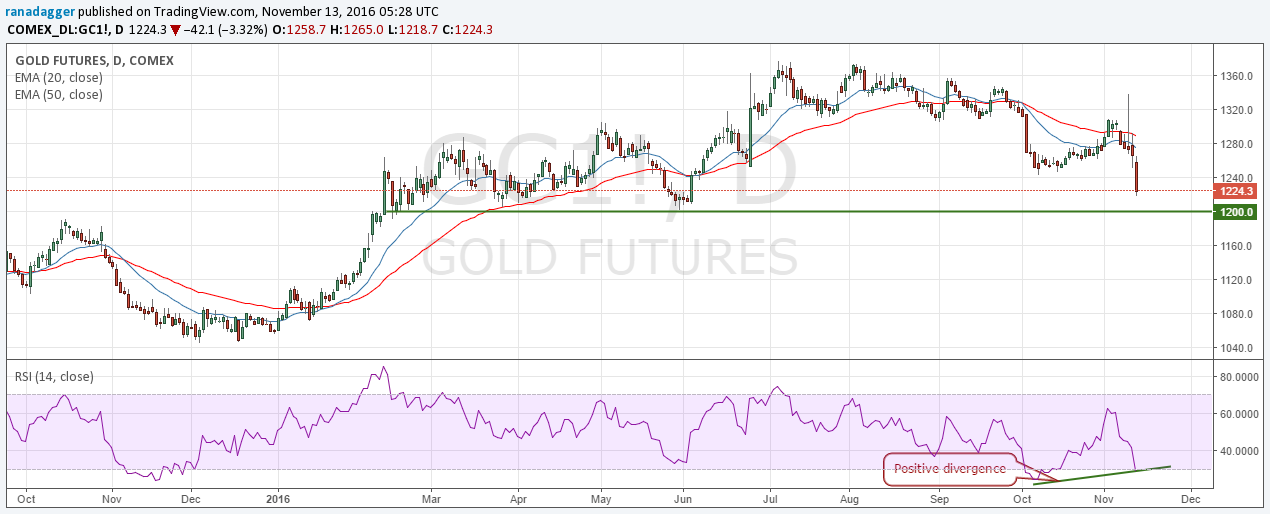

Institutional investors have been caught on the wrong side of all market ‘asset classes’. The rate on the 10-Year U.S. Treasury Yield ($TNX) surged (as can be seen in the chart below), thereby, increasing interest rates in the United States. On November 9th, 2016, the first day after the Presidential election, yields rose.

Global bonds yields, around the world, remained at record lows and with no real prospect of them rising much, if at all. When Japans’ Ten Year Yields climbed above 0, the BOJ promptly intervened with its’ unlimited bond buying program. The ECB President Draghi signaled that its’ QE program will continue. Global investors will want to invest their money in U.S. Treasury securities. There has been a huge sell-off on international bond markets in response to the rising higher yields (bond prices fall as interest rates rise).

The Revolution:

Our historically low-interest rate environment that we have experienced for too many years is soon coming to an end! It came about following the global ‘financial crisis’.

All the markets have shifted radically and with longer-term interest rates spiking higher, along with copper, iron ore, nickel, and shipping costs. The world is preparing for a large infrastructure project in the world’s largest economy.

If, and when, President- elect Trump attempts to patch up our current financial and economic system, he will struggle to be successful. If Donald J.Trump truly wants to fix the economy, he must reshape the Federal Reserve: (http://www.globalresearch.ca/trump-prepares-to-take-over-the-federal-reserve/5557824). The Federal Reserve Banks consider themselves to be private corporations with private funding.

Our current financial system is not working. The powerful forces on Wall Street restructured our financial system over a century ago. The Federal Reserve was created on December 23rd, 1913. This Central Bank (http://www.nytimes.com/2016/11/13/business/economy/trump-the-fed-yellen-gets-ready-for-reckoning.html?_r=1) has turned the U.S. dollar into a debt-based currency that continuously is inflated creating an endless debt spiral from which we cannot recover from!

The Bottom Line:

Being on the right side of all the financial markets are discussed in my daily videos telling you where you need to be in these markets to take the opportunities that are presented. Today, there are unique trading setups in which you can make HUGE profits in.

Follow my lead at www.TheGoldAndOilGuy.com where I trade ETF’s and recently close UNG for a quick 2.6% profit and GDX for another 5% profit in a couple days.

If you prefer more lucrative potential profits like these recent trades: EDZ 20.7%, NUGT 11%, UGAZ 36%, VUZI 25% then join us at www.ActiveTradingPartners.com

Chris Vermeulen

(

(