Gold has a “clear presence” to play in a world dominated with ‘global economic uncertainty”

My analysis shows that gold will be implemented to protect ‘global purchasing power’ and minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used when selling other assets would cause losses. Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk in this manner and have been net buyers of gold since 2010.

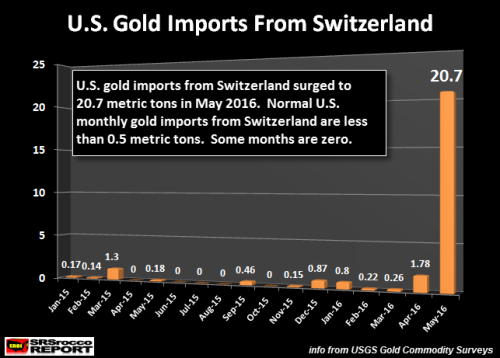

Investors should make use of gold’s lack of ‘correlation’ with other assets which makes it the best hedge against currency risk. There was a huge trend change in U.S. gold investment last May 2016. Switzerland is now a major source of U.S. gold exports. The tables turned back in May 2016 as the Swiss exported a record amount of gold to the United States. There has been a huge increase in gold flows into the Global Gold ETFs & Funds. Something seriously changed in May 2016 as the Swiss exported more gold to the U.S. in one month than they have every year for several decades.

Though we are in for a period of great financial turmoil, investors can safeguard themselves by investing smartly in gold. Do not be left behind and see your dollar assets lose value. Invest in gold!

It is in these conditions gold is the only investment that will appreciate in time.

The world including Russia, Syria, Libya, North Korea, the South China Sea, Venezuela and social discord from Europe to the U.S., it is difficult to make the case for any good news. Gold will continue to perform its role as a “safe haven” in these times of crisis which appear to be never ending. The metals surge of as much as 8.1 percent on the day of the “Brexit” vote last month is an indicator that its’ luster of safety is undimmed in the current market. There’s little to be gained from arguing whether such beliefs are right or wrong: “The market can stay irrational longer than you can stay solvent”.

The list of prominent hedge fund managers backing gold is lengthening. Paul Singer, of Elliott Management Corporation, is the latest name to lend his support. It is likely that more investment institutions will turn to gold as the logical way to countervail the effects of many years of quantitative easing.

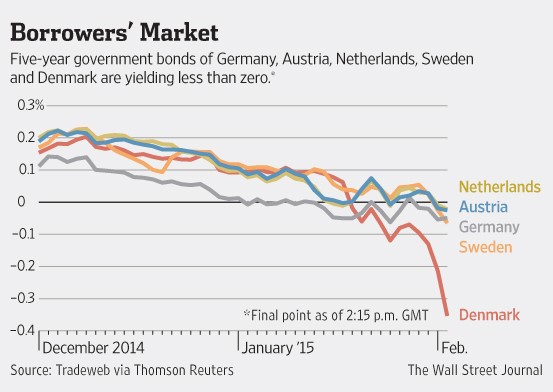

“It’s a glaring warning sign of deflation. We’ve never really had deflationary fears throughout such a widespread part of the world before,” said Phil Camporeale, a multi-asset specialist at JPMorgan Asset Management.

These accommodative Global Central Bank policies has lead to monetary easing policies that have been adopted globally. It is not so much that the U.S. Dollar has become strong the last few weeks. The “systemic” uncertainty of the recent “Brexit” vote in the U.K. resulted in the U.S. Dollar became a “safe haven”.

The FED is doing everything in its power to prevent a rise in the dollar. They are willing to “orchestrate” any scenario where the stock market continues to soar and people will feel a “wealth effect” from new stock market highs and fight the argument that the economy is “contracting”. The FED is getting everything it wants in this regard and will continue to do so. The number one priority of the FED is “debasing” the U.S. Dollar. Gold can rise even if the dollar continues to rise

Investors of all levels of experience are attracted to gold as a solid, tangible and long-term “store of value” that historically moved independently of other assets classes

Golds’ importance even in today’s environment was clearly visible during the massive rally during the start of the year, when all other asset classes were tanking. Investors piled on gold on a scare of a likely financial crisis in the world.

Investors should make use of Gold’s lack of ‘correlation’ with other assets which makes it the best hedge against currency risk.

Though we are in for a period of great financial turmoil, investors can safeguard themselves by investing smartly in gold. Don’t be left behind and see your dollar assets lose value. Invest in gold.

It is in these conditions that one of the best investments is gold.

Talk of further “unconventional” monetary policies globally has increased. Japan has reached the limit of what negative interest rates and quantitative easing have achieved. The Bank of Japan may adopt a policy of so-called “Helicopter Money”.

Dr Loretta Mester, President of the Federal Reserve Bank of Cleveland and a member of the rate-setting Federal Open Market Committee (FOMC), signalled direct payments to households and businesses to stoke spending was an option Central Banks might look at in addition to interest rate cuts and quantitative easing.

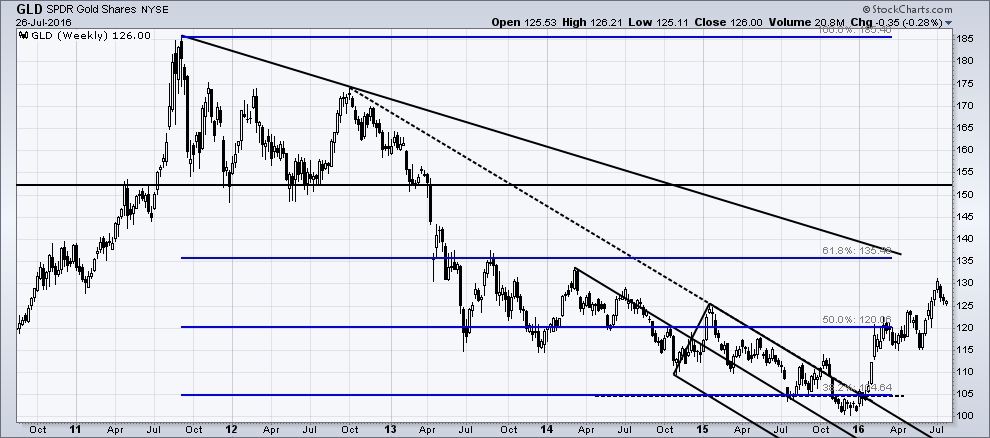

However, back in April 2016, if you have followed my recommendation, you would have maintained that once gold crossed the $1190/oz. levels, it was destined to go higher. Above the downtrend line, which acted as a resistance from 2013 and onwards, the trend altered and it appears to be extremely highly unlikely that it will reverse downwards, at all!

However, the head and shoulder formation tested my resolve to buy into gold, as it is a most reliable bearish pattern, but, once a bearish pattern fails, it becomes very bullish which is what has happened in this case. I was quick to alert my subscribers to buy as soon as the pattern was triggered.

“We’re always assessing tools that we could use,” Dr Mester said in response to a question about the potential use of “Helicopter Money”. However, Dr Mester signalled that in the event of another shock or economic downturn that most likely option would be more quantitative easing-style money printing.

Global Government Bond rates are negative:

Global rates are at zero too negative, money will continue to chase gold and U.S. Treasuries for the higher yield. This will continue to push yields lower as the global economy continues to slow. What would cause this to reverse? It would require either an “economic rebound” or a complete “loss of faith” in the U.S. to pay its debts such as a collapse of the U.S. Government.

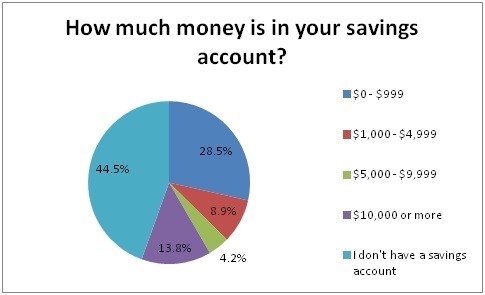

Addicted to debt:

The total amount of government bonds in the world that have negative yields are currently $13 trillion, according to Bank of America Merrill Lynch. Given that there were almost zero negative-yielding bonds just two years ago, the rise is “incredible”. Do not be surprised to see $15 trillion to $20 trillion worth of negative-yielding government debt by the end of this year. The yield on short-term government include Switzerland, Belgium, Denmark, France, Germany, Japan, and the Netherlands which are all sub-zero. Even short duration U.S. bond rates are barely above zero. Bonds are not fixed-income assets anymore now as fixed-outgoings once were ones. Investors are currently buying them for their ‘capital appreciation’ rather than their ‘coupon payments’.

Gold is currently in a correction. In this upcoming August of 2016, gold is set to surge much higher and surprise ALL. As you can see from the chart below, I am targeting 135 level on GLD.

Global Central Banks have yet to ‘manufacture’ inflation!

This trend will continue to grow for now, until, just like in 2008, the bubble bursts in “cataclysmic fashion. ”

The Central Banks are manipulating the fabric of price-time by reversing the flow of time via negative interest rates. Therefore, the global financial system no longer possesses the “productive capacity” to generate any income to sustain current equity asset values.

My own economic outlook is “invaluable” and is a must have if one wishes not only to save their wealth to profit themselves handsomely from this current “gloomy” crisis that is only worsening behind the scenes. There are many ways to survive, protect, and grow one’s financial position in this prolonged economic downturn.

The end of the Great “Keynesian” Experiment is upon us. Follow my lead as we navigate through the various financial markets using cycle price forecasting, technical analysis, my secret pre-market price spike intraday trend indicator for accurate swing trades and long term ETF investment positions. Copy what I do in both of my portfolios – Active Trading & Long Term Investing at www.TheGoldAndOilGuy.com

Chris Vermeulen