The current economic landscape is changing by the day and rarely for the better. This is from the standpoint of the middle and lower classes.

As negative rates become increasingly part of the new normal, more depositors are swept up by the creeping confiscation of their savings. I expect that the other part of the “cash trap” endgame, the actual elimination of large currency bills, will also soon accelerate. First in Europe where the ECB recently put an end to the printing of €500 bills and soon after everywhere else.

The point is that Central Banks and the FED knows this prolonged period of ZIRP (Zero Interest Rate Policy) is not only highly “irregular”, but that it is harming a healthy environment for investment and economic growth. Yet, they are paralyzed with “fear”.

Perhaps what they do not realize is that it is going to happen anyway. You cannot get back to “normalization” without incentives to save and invest. Sure, when rates go up, there will be a giant sucking sound, like the undertow of the sea after it washes to shore and then goes back out. But in time, as investors and savers get rewarded for saving their monies, they will eventually start investing those savings and that will bring the economy back after the “Great Reset”.

After this “Great Reset” all investors will see exceptional values if they have some monies, (gold), saved to capitalize on these. Right now? Everybody is afraid to take the risk with assets being so high, and savings so low. Even bankers are afraid, much like political leaders to make the necessary changes.

Investors of all levels of experience are attracted to gold as a solid, tangible and long-term “store of value” that historically has moved independently of other assets. My analysis shows that gold will be implemented to protect ‘global purchasing power’ and minimize losses during our upcoming periods of ‘market shock’. It serves as a high-quality, liquid asset to be used when selling other assets would cause losses.

Listen to Recent Phone Call and Gold Forecast – Click Here

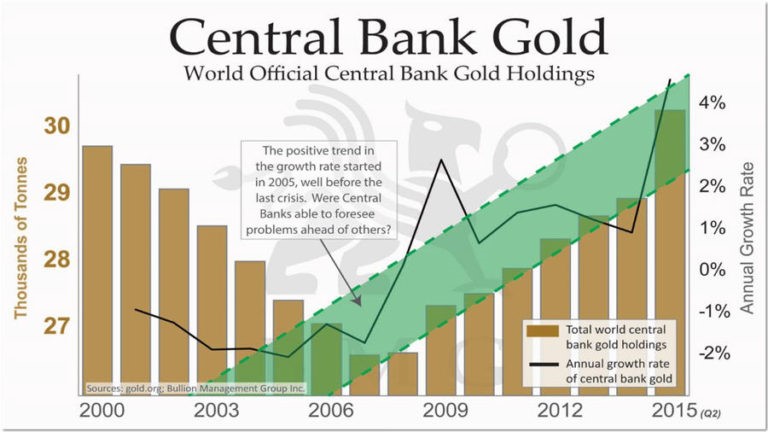

Central Banks of the world’s largest long-term investment portfolios use gold to mitigate portfolio risk in this manner and have been net buyers of gold since 2010.

Investors should make use of golds’ lack of ‘correlation’ with other assets which makes it the best hedge against currency risk. Though we are in for a period of great financial turmoil, investors can safeguard themselves by investing smartly in gold. Do not be left behind and see your dollar assets lose value. Invest in gold!

Gold is the only asset which will increase value:

In todays’ negative interest rate environment, one should definitely be more concerned about the “return of one’s money, than the return on one’s money”. Considering the threat of negative interest rates, it is obvious why people are rediscovering the value of holding gold.

Gold tends to perform well in declining or negative real interest-rate environments. The deeper Central Banks move into negative rate territory, the more gold is going to be supported, as the cost of carry disappears. High real rates are bad for gold but negative real rates are quite good for it!

Gold is the only asset class, which will maintain its value during times of ‘financial crisis’. It has done so previously in the past and I observed its performance during the beginning of the year, in which its status affirms it as the preferred safe haven.

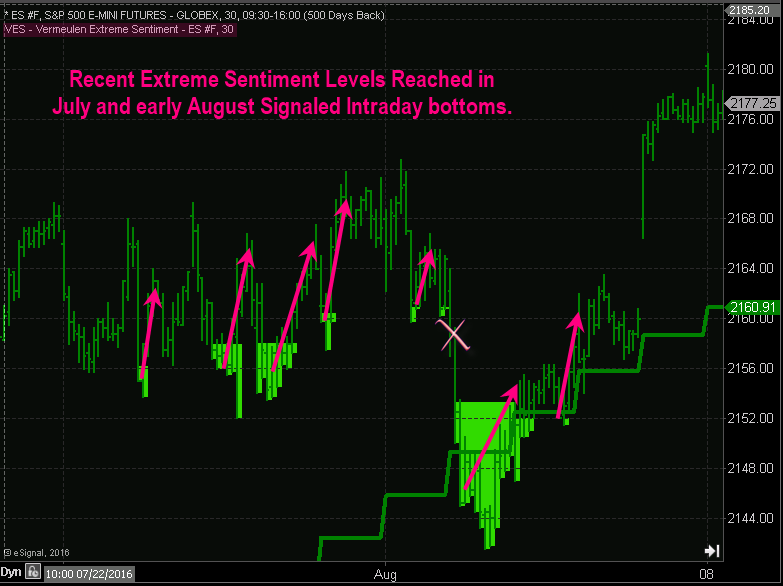

There will be times during this ‘crisis’ when different assets classes will be in focus. I will continue to guide you as to the best profit making assets, during this period of time. If you are holding any stocks, this current rally is the last chance to liquidate your holdings; gold will give one an excellent buying opportunity within a few weeks of time and should be used to purchase this for the long-term period.

Unfortunately, I foresee very difficult economic times ahead for all. Therefore, it is best to be prepared and take proactive measures, in advance, so as to avoid the pain rather than regret it later!

Follow both my swing trades and long-term investment positions at www.TheGoldAndOilGuy.com

Chris Vermeulen