The US stock market continues to grind higher but is doing so with eroding market internals. As the market indexes rise we see fewer stocks moving up to support the move. It’s a matter of time before a large correction occurs.

It seems everyone is calling for a market top, and many have done so for the past 3 years. But the key to success is to follow the market, not predict market tops or bottoms. We follow price trends and trade alongside. We do have a bearish tone looking forward the next 1-2 years for stocks, but we are not calling a market top, nor are we shorting the market in anticipation. Instead, we actively trade the markets smaller trends which occur on a regular basis (weekly and monthly) through active buying, and shorting these smaller trends.

The month of July has been an incredible month for the new and improved automated trading system as you saw from the Results posted recently. The frustrating part is that it takes some time for us to move and integrate this improved system into our platform for our users. While the system is trading incredibly well during one of the toughest market conditions we have experienced in years, we are excited that our users will have these trades executed in their accounts starting September 1st.

Adding to this excitement is the fact that stocks typically fall 3-7 times faster than they rise, which means we can make more money, and make it faster during a falling market then we do from a rising market. Once the major trend turns down (likely later this year) we will be off to the races with out-sized trading gains once again.

Over the next couple months we should start to see the US equities market top, and start its first major correction. Once it start we trade the market in a way that should generate gains as the stock market falls in value.

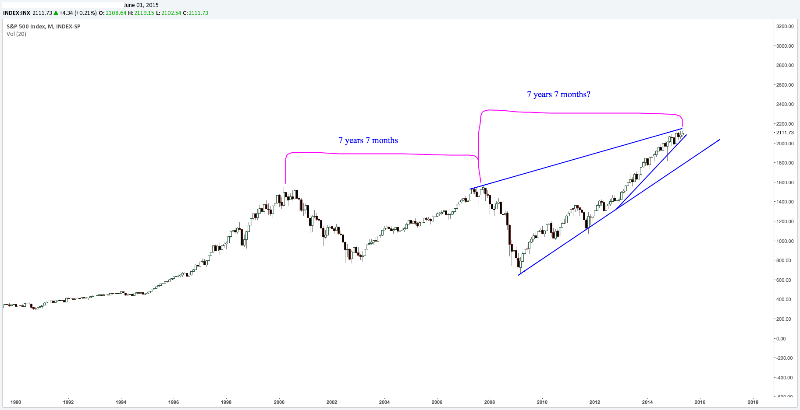

S&P 500 Monthly Chart – 7 Year Cycle

The SP500 index (US Stock Market) continues to be in and Uptrend.

The major trend line on the chart below must be broken in a big way before a full blown bear market will be confirmed. This is still months away at best. The AlgoTrades INNER-Market Analysis will get us positioned when the time is right and enable us to profit as the stock market loses value.

Your long term equity investments can continue to be held at this point. Speculative and momentum stocks (Russell 2K) continue to show weakness. Large cap stocks will likely be in favor as the safe haven “blue chip” stocks, but when the market is ready to roll over, all stocks will fall.

I do fear a global economic collapse is possible which I talk about in our GoldAndOilGuy Trading Newsletter. But at this time, we do not need to change our trading approach and investment capital. But when certain events start to happen in the USA and abroad we will need re-allocate some of our investment capital, but again, we will keep you updated on this also when the time is right.

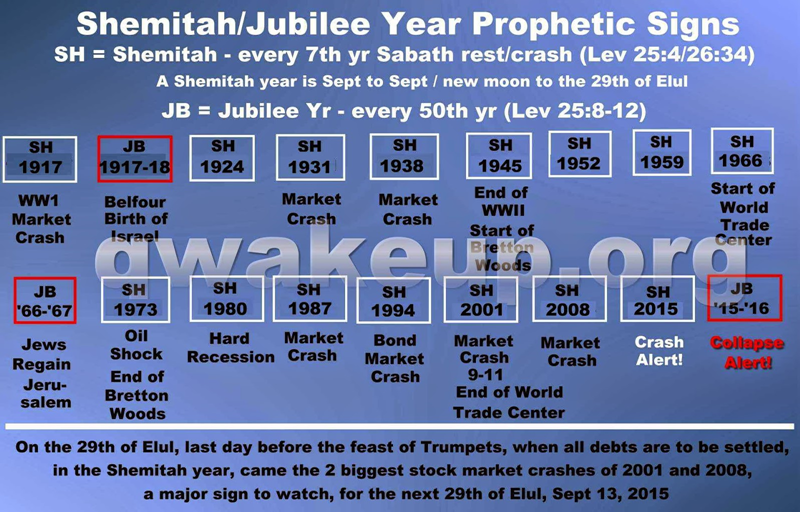

S&P 500 Quarterly Chart – BIGGER PICTURE

This chart I feel provides a great perspective on the overall market trend and price patterns. This is the 70 year prospective. I hope something like this unfolds. Fingers crossed to a nominal 12 month correction/bear market. This will build a new base for the next super cycle.

US Dollar has now reached the upper resistance trend line… we could see weakness in the dollar going forward… Keep in mind this is a quarterly chart, lower prices may still be a few months away.

Factory Orders Scream Recession/Correction

This has never happened outside of recession… Year-over-year, factory orders dropped 6.3% (adjusted) but 8% non-adjusted, the most since the financial crisis. Against expectations of a 0.5% drop MoM, manufacturers saw new orders tumble 1.0% and previous months were revised dramatically lower. Factory orders has now missed 10 of the last 11 months. Factory Orders have fallen for 9 of the last 10 months…

Source: ZeroHedge

Also, the New York Stock Exchange and SP500 indexes are losing momentum.

The SP500 index has been trading sideways the over the last 6 months. It has not provided many trades for our automated trading system (AlgoTrades).

NYSE BIG BOARD STOCKS – Breaking Down

Stock Market Rises with Fewer Stocks – RED FLAG

Since mid 2014 the US stock market has become move volatile. Fewer stocks participating in the markets move up. This can be seen by comparing the percent of stocks trading above their 200 day moving average and the S&P 500 index.

Once the stock market comes to a complete stall it will drop violently. While I am not calling a top yet, understand each month we are getting closer and I believe the stock market is in a stage 3 topping process.

INNER-Investor Monthly Conclusion:

The New York Stock Exchange, S&P 500, and Dow Jones forming a bearish rising wedge which they appear to have broken down from. This could be the start of a bear market but until the price action truly confirms this the major trend remains up. The last quarter of 2015 will likely provide great opportunities for the active trader. BECOME AN ALGOTRADES USER TODAY – CLICK HERE

OTHER TRADING EDUCATIONAL MATERIALS

…No B.S., No Kidding or Exaggeration. WE GUARANTEE IT!

Steaming Video Course: Click Here

Not yet read my book? I highly recommend you do this as it walks you through the key indicators/analysis used so you understand how the AlgoTrades system can make you money on auto-pilot.

Digital Book Download: Click Here

It is more critical than ever in our history to hedge against an economic collapse, especially this year.

Seven experts from around the world agree with this impending collapse and you will have a once-in-a-lifetime opportunity to profit from chaos.

Digital Book Download: Click Here