Stock Market Flashing A Buy Signal?

Since the first trading session in May we have seen the stock market sell off. The old saying “sell in May and go away” was dead on again this year. Here we are 7 weeks later with the stock market continuing to lose ground. This extended sell off has everyone all worked up that this is the beginning of another market collapse.

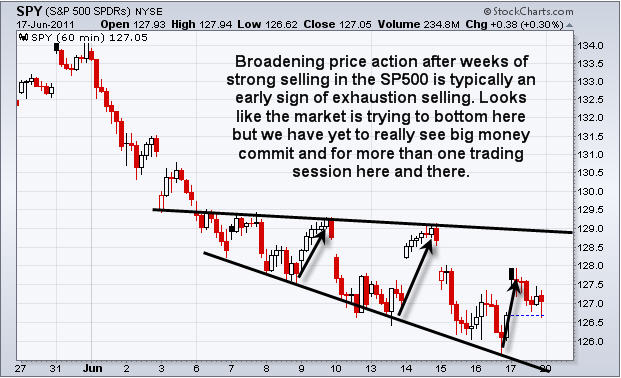

Let’s take a quick look at the SP500 hourly chart covering the month of June.

As you can see, price is still falling but every couple of trading sessions we get some big money players nibbling on stocks accumulating shares and running the market higher. This type of price action is typically an early signal that the market is trying to bottom.

There are two key ingredients for a higher stock market and both have been missing from the mix for a couple months. The two key sectors which have a significant weighting in terms of the broader market are the financial and technology stocks.

Let’s take a look at the financial sector:

As you can see on the bottom of this chart, financials started to lag the market in late January. Ever since then this sector has been in a strong downtrend pulling the broad market averages lower with it. The good news is that this sector has just reached a major support zone and is looking ripe for a bounce and possible rally.

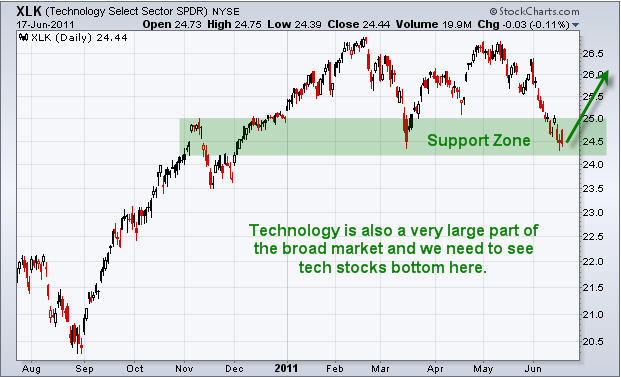

The other main ingredient to a higher stock market is the technology sector.

Looking at the technology sector:

Here we can see technology stocks have been pulling back for several weeks. Tech stocks are now trading down at a major support zone and they look oversold. A bounce from this level is very likely in the coming week.

Weekend Trading Conclusion:

In short, I continue to feel the market is trying to bottom here and we are at the tipping point when things get volatile and choppy just before we get a trend reversal in the S&P 500. Keep an eye on the short term charts of financials and technology sectors. Once they start making higher highs and higher lows on the 60 minute charts I believe it will be the start of a nice bounce and possible rally.

Get my free weekly technical analysis on sectors here: http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen