Is This A Sign of a Market Top or Buying Opportunity?

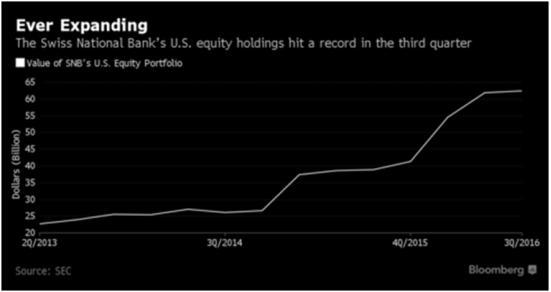

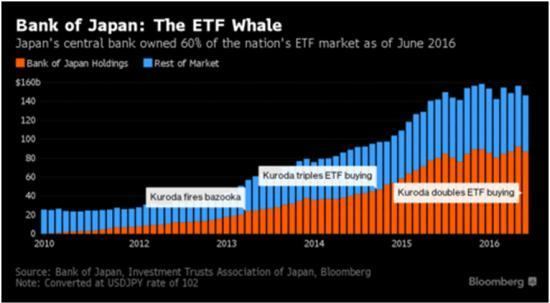

The Japanese and Swiss Central Banks have turned themselves into one of its market’s biggest “investors”. The Swiss National Bank is a huge holder of U.S. blue chip stocks like Apple and Microsoft. The FED has been “elevating” the U.S. stock market, indirectly, by buying bonds!

If the stock market crashes, the FED will bail out investors like Japan and Switzerland in the next market downturn? – http://libertystreeteconomics.newyorkfed.org/2012/07/the-puzzling-pre-fomc-announcement-drift.html.

The FED could lift large cap stocks possibly pushing prices to levels that history would consider totally insane!

Currently the SPX is experiencing a period of consolidation. Do NOT short this market! The momentum oscillators are now RESETTING for the next move up!

These oscillators are extremely helpful in trending markets. According to Traders Almanac, the month of April is the best month for the Dow Jones with an average gain of 1.9% since 1950, p. 38.

Market bubbles are rarer than you think and very hard to recognize until it is too late. Many economists have long debated whether bubbles can be identified and then stopped, before they burst and cause widespread damage like the crisis of 2007-2008.

Investors are always questioning if it possible to avoid being pulled into a bubble at the top. All investors can avoid declines like the 80% drop experienced by the NASDAQ 100 index of technology stocks between March 2000 and August 2002 just by viewing my daily morning video reports, for by following the direction of the momentum stock trades over at ATP.

The latest Sentiment Surveys disclosed:

Small investors tend to trade on emotions rather than logic or expertise which is why they are considered the dumb money. Finally succumbing to the lure of apparently easy money and pouring their savings into the stock market. This dumb money flowed into exchange traded funds (ETFs) which offers exposure to all sectors and broad market indexes. BlackRock Inc. reports Investors poured $62.9 billion into exchange-traded funds in February of 2017: (https://www.wsj.com/articles/etfs-race-to-fastest-yearly-start-ever-based-on-inflows-blackrock-data-show-1488499476).

The NAAIM survey, (http://www.naaim.org/programs/naaim-exposure-index/), of active investment managers, is showing the least exposure to stocks in months. Active Managers, which is considered the smart money have been stepping cutting back their exposure from “Risk On”

The four other times they pulled back after spending months heavily exposed to stocks, the SPX took off to the upside. They did maintain high exposure to stocks since November of 2016, which was the right move. Now, they have started to reduce their positions and are below 80% net exposure for the first time in months. Investment manager exposure is dipping after months of being extremely exposed.

The stock market tends to swing from one extreme to the opposite extreme as human emotions swing from greed to fear and back again! The CNN Money Fear & Greed Index indicates FEAR at 30 on Friday March 24th, 2017, signaling its lowest level of investor confidence since November of 2016 before the election:(http://money.cnn.com/data/fear-and-greed/). Our metrics are reflecting that optimism is declining after recording extreme optimism, but has reached neutral territory.

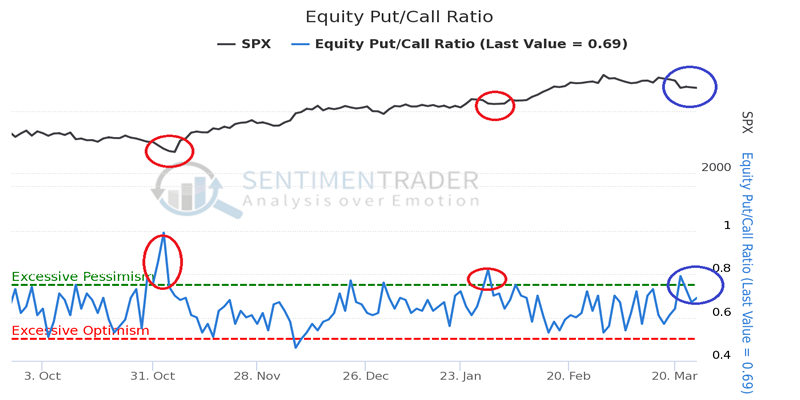

The total put/call ratio is the volume of puts divided by the volume of calls traded on individual equities on the Chicago Board Options Exchange. The chart below indicates that the “sweet spots” to BUY is when this indicator reaches EXCESSIVE PESSIMISM which are marketed by the red circles.

Individual investors feel comfortable with the rate hike by the FEDS as positive. The speed and the extent of the post-election rally and the prevailing level of valuations remain a point of concern The potential impact that President Trump could have on the domestic and global economy continues to cause uncertainty among some investors, while encouraging the majority.

How to Play Wall Street for Profits

We use a combination of traditional technical analysis tools, Elliot Wave Counts and investor sentiment! This makes for Killer Trades with oversized Profits!

There are ways to take advantage of these fast-moving markets to earn a steady income or grow your trading account. That is through our Momentum Reversal Method (MRM). The key tenants of my trading are waiting for the right trigger/event and getting in early. We find this is one of the most difficult aspects for traders to understand and master, and why we do best and share with followers of our trade alerts.

Recent Trading Results Include:

UGAZ 74%

ERX 7.7%

NUGT 112%

URA 2.7%

Our most current active trades are in FOLD and CARB which both are ready to soar with the next market upswing!

Get Trade Alerts in Real-Time at: www.ActiveTradingPartners.com

John Winston & Chris Vermeulen