Phantom Blips On The Chart – Don’t Lose Focus & Free Silver Round Giveaway!

Recent news seems to have everyone concerned about Italy, global debts, Europe and the potential for a debt contagion exploding into the markets. Yet, our research into price activity says this market is just getting started with an upside swing that could be massive. Take a few minutes to review our current research to see why we believe the extended level of fear in the markets is related to the recent February price rotation and a generally accepted erroneous Elliot Wave Count.

We, the research team at Technical Traders Ltd., pride ourselves at sticking to our proprietary research and waiting for price to tell us if our analysis is correct or not. Because of this, our research can sometimes directly opposite to the other analysts out there. The tricky part of trying to predict the future is that we won’t know if we are correct until the market does what it does in the future. Still, we believe that price is critical to understanding the markets dynamics at play as well as a core understanding of economic fundamentals as related to capital, debt, expectations and degrees of risk. Keeping this in mind, let’s get to the charts to show you what we are seeing in the markets right now.

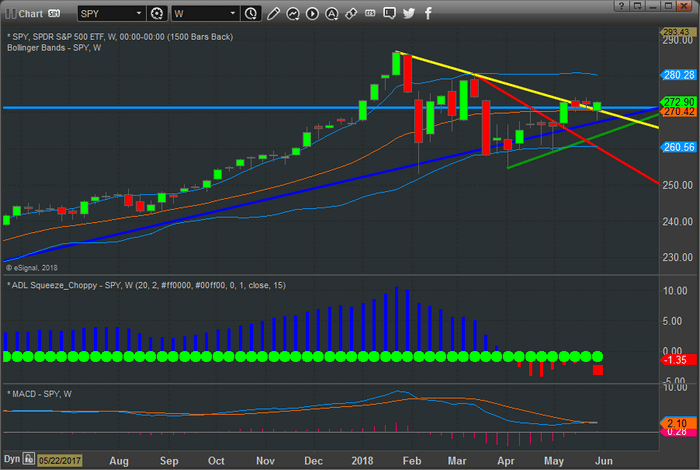

This Weekly SPY chart clearly shows the recent upside price breakout of the RED and YELLOW price downtrend ranges. Additionally, even though Italy sent shock waves through the markets yesterday, the price recovery today pushed the closing price to well above the key support level near $270. Pay close attention to the GREEN upward price sloping line near recent lows. Unless this level if breached/broken, there is no reason for great concern of any downside price move.

This next chart, the Weekly TRAN (Transportation Index), paints an even clearer picture of the recent price advance. Weekly, the price lows since the February market lows, have been advancing to higher and higher levels. The most recent unique low, near $10,100, is the current Fibonacci Key Price Low and as long as the current price does not rotate lower to test that level, we have nothing to worry about in terms of downside price activity. Yes, price rotation could continue within this range ($10,000 to $11,000), but that unique low price is the key to the support that is holding the markets together and driving price higher.

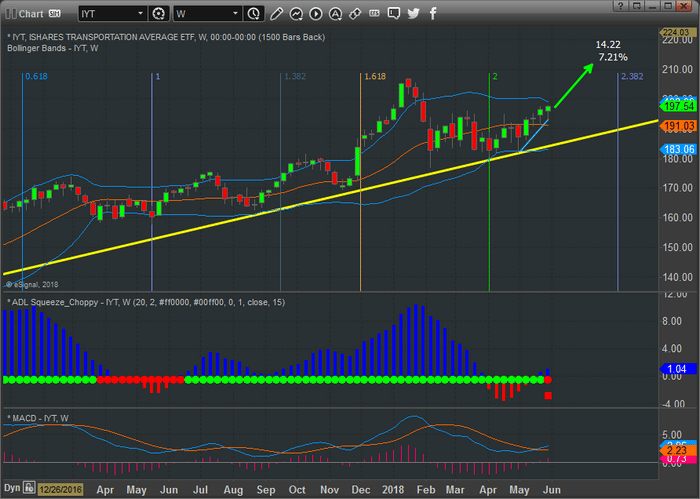

This last chart is a Weekly IYT ETF. It is very similar to the Transportation Index chart, but still shows a very clear upward sloping price channel and a more recent upward sloping price advance near the right side of this chart. Pay attention to the MACD levels on each of these charts. In each instance the MACD has rotated into a bullish indication with the potential for an even greater price advance setting up.

In our opinion, the concern in the market regarding global debt is warranted. We will post a more detailed research report on this issue in the near future for all our followers. Yet we believe the fundamentals of the US market is strong and we believe the “completed wave 5 Elliot Wave” analysis that is being proposed by many analysts is erroneous. We issued our research on this issue a little over a week ago and we are waiting to see if price breaks to new all-time highs to confirm our analysis.

Please don’t get caught off-guard with regards to this price rotation and what it means to the markets. A massive price expansion pattern is setting up in the US markets that may drive prices much higher all the way through 2019 and possibly further. We believe many of the major analysts have missed this pattern and we have positioned our loyal members to take advantage of this move in the future.

Visit www.TheTechnicalTraders.com to learn how we can help you stay ahead of this market and stay on the right side of price trends. You owe it to yourself to learn how we can deliver superior research and trading signals to help you find profits and better manage your trades.